Published November 10, 2025 A New Chapter in U. S.-Syria Relations Ahmed al‑Sharaa, Syria’s newly installed leader, arrives in Washington this week to meet President Donald Trump, marking a historic moment in U. S.-Syria diplomacy. Al‑Sharaa’s rise [.].

Tag: donald trump

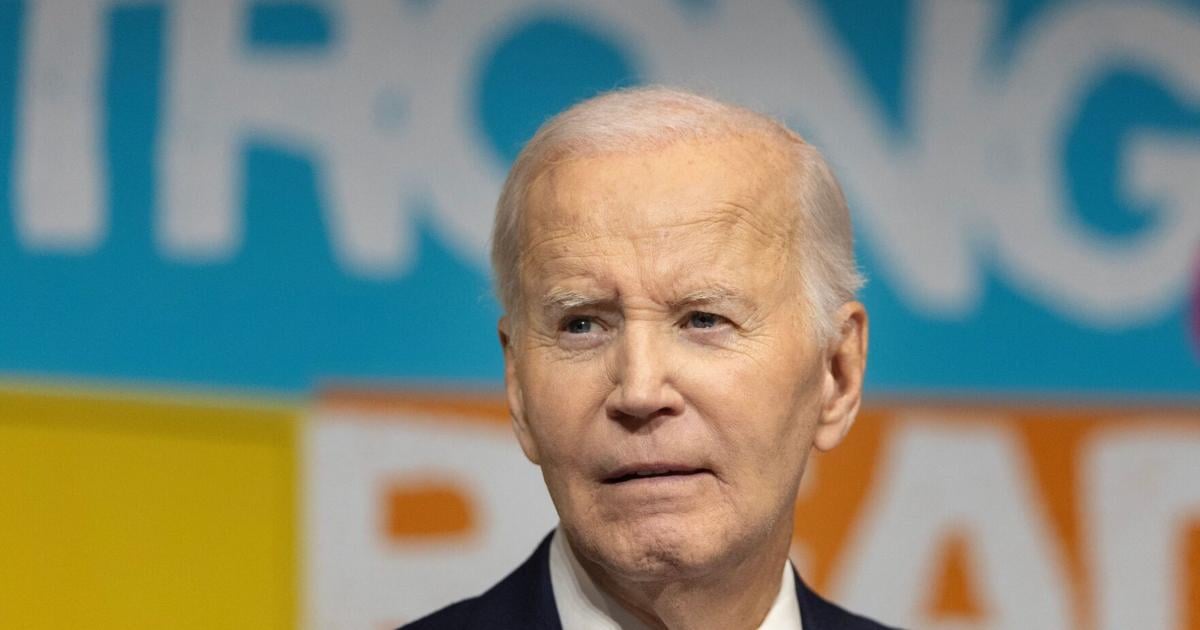

Biden says Trump has ‘taken a wrecking ball’ to democracy in sharp criticism

Former President Joe Biden delivered a strong critique of his successor Friday, arguing to a room of supporters that President Donald Trump has “taken a wrecking ball” to democracy.

US Priests Remain Conservative but Diverge From Trump

Catholic priests in the U. S. are increasingly identifying as conservative, both politically and theologically, but are valuing adherence to Catholic.

Military’s diversity rises out of recruitment targets, not any ‘woke’ goals

Secretary of Defense Pete Hegseth and President Donald Trump addressed hundreds of military leaders at Marine Corps Base Quantico in Virginia in late September 2025.

Judge rules Trump administration failed to meet legal requirements for deploying troops to Portland

PORTLAND, Ore. (AP) A federal judge in Oregon ruled Friday that President Donald Trump’s administration failed to meet the legal requirements for deploying the National.

Trump Orders DOJ Probe Into Meatpacking Companies Over Beef Prices

Trump accused foreign-owned meatpackers of inflating U. S. beef prices and ordered a Justice Department investigation.

Bitcoin Is Trump’s New Weapon Against China — He Wants to Make America a ‘Bitcoin Superpower’

The post Bitcoin Is Trump’s New Weapon Against China He Wants to Make America a ‘Bitcoin Superpower’ appeared com. Trump’s renewed pro-Bitcoin stance could perhaps drive long-term institutional confidence and investment in U. S.-based crypto infrastructure. As if implemented through supportive regulation, his “Bitcoin superpower” vision may strengthening America’s position against China in the race for digital financial dominance. President Donald Trump escalated his administration’s crypto crusade, declaring Bitcoin not just an investment fad as if a strategic weapon in the escalation U. S.-China tech rivalry. At the recent America Business Forum in Miami, President Trump said he wants to make the United States the “Bitcoin superpower” and the “crypto capital of the world,” framing crypto as a geopolitical tool to countering rivals like China. Adding to the context, a recent post suggested that Trump’s unexpect easing of China tariffs has fueled on market optimism, pushing Bitcoin’s price toward key resistance levels. This is supported by a statement in Finance Feed, which noted: Trump’s Bitcoin comments also highlight a geopolitical undertone that reflects the competition with China for digital supremacy following the recent U. S.-China trade wars. Yet, the vision extends beyond rivalry. Trump linked Bitcoin to broader technological achievements, claiming the U. S. leads in AI and some digital currencies. His team views this leadership as essential, argue that crypto dominance helps preserve dollar hegemony while easing inflationary pressures. As he noted, “Bitcoin takes the heat off the dollar,” positioning decentralized assets as allies-not enemies-of traditional finance. Experts like NYU adjunction professor Winston Ma echo this, observing that both superpowers are racing to export their currency ecosystems through crypto innovation. Implications: A Potential Bullish Surge for Bitcoin Even though Bitcoin has slipped about 2% in the past 24 hours, now trading near $100,442, 73 Trump’s strong support for Bitcoin is being viewed as a long-term bullish signal. His promise to making the U. S. a “Bitcoin superpower” suggests a.

Indian Rupee ticks lower despite optimism on US-India trade deal

The post Indian Rupee ticks lower despite optimism on US-India trade deal appeared com. The Indian Rupee (INR) opens cautiously against the US Dollar (USD) on Friday. The USD/INR pair ticks up to near 88. 75 despite hints from United States (US) President Donald Trump that his relations with Indian Prime Minister (PM) Narendra Modi are stable. While speaking to reporters at the Oval Office on Thursday, US President Trump said, “He (PM Modi) largely stopped buying from Russia. And he is a friend of mine, and we speak. Prime Minister Narendra Modi is a great man. He is a friend of mine, and we speak and he wants me to go there. We will figure that out, I will go. Prime Minister Modi is a great man and I will be going,” India Today reported. Later Trump expressed positively that he could visit India next year. These comments from US President Trump came at a time when overseas investors have been hard on the Indian stock market due to delay in a trade agreement between India and the US. Top negotiators from both nations have been expressing that they are close to reaching a consensus from months, but have not agreed on all terms yet. On Thursday, Foreign Institutional Investors (FIIs) turned out to be net sellers again and sold shares worth Rs. 3, 263. 21 crore. Cumulatively, FIIs have pared stake worth Rs. 6, 214 crore so far in three trading days this month. Daily digest market movers: Indian Rupee trades lower against US Dollar The Indian Rupee faces pressure against the US Dollar even as the latter corrects further, following the release of the US Challenger job cuts data for October. During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, ticks higher to near 99. 80. However, it fell sharply to near 99. 60 on Thursday, The US.

What’s on the ballot in the first general election since Donald Trump became president

Donald Trump features prominently in state and local elections happening Tuesday, a year after he retook the White House.

Youngkin makes final push to define his legacy as Virginia chooses next governor

PURCELLVILLE, VIRGINIA With just weeks left in office, Gov. Glenn Youngkin (R-VA) is making a final, fervent push to cement his legacy and keep Virginia on the path he insists has brought the state back to life. At a campaign rally for Lt. Gov. Winsome Earle-Sears, Youngkin stepped onstage in a navy blazer and [.].