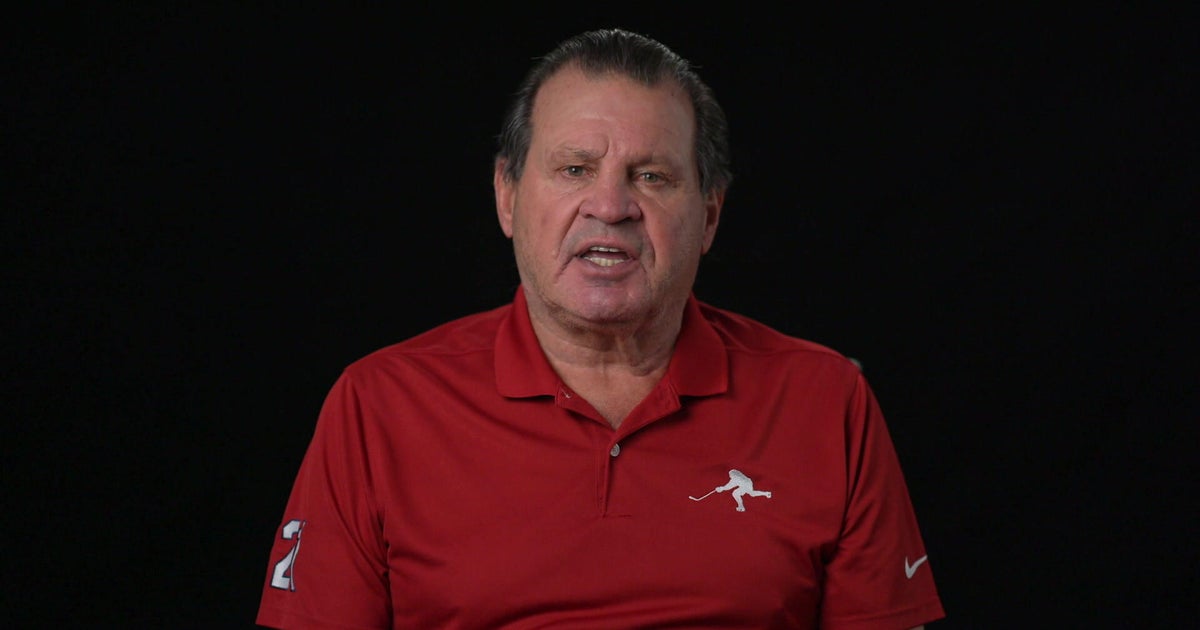

Mike Eruzione, captain of the 1980 U. S. Olympic hockey team, led a squad of amateurs against the Soviet Union-and scored the game-winning goal. He reflects on the lessons of that “Miracle on Ice.”.

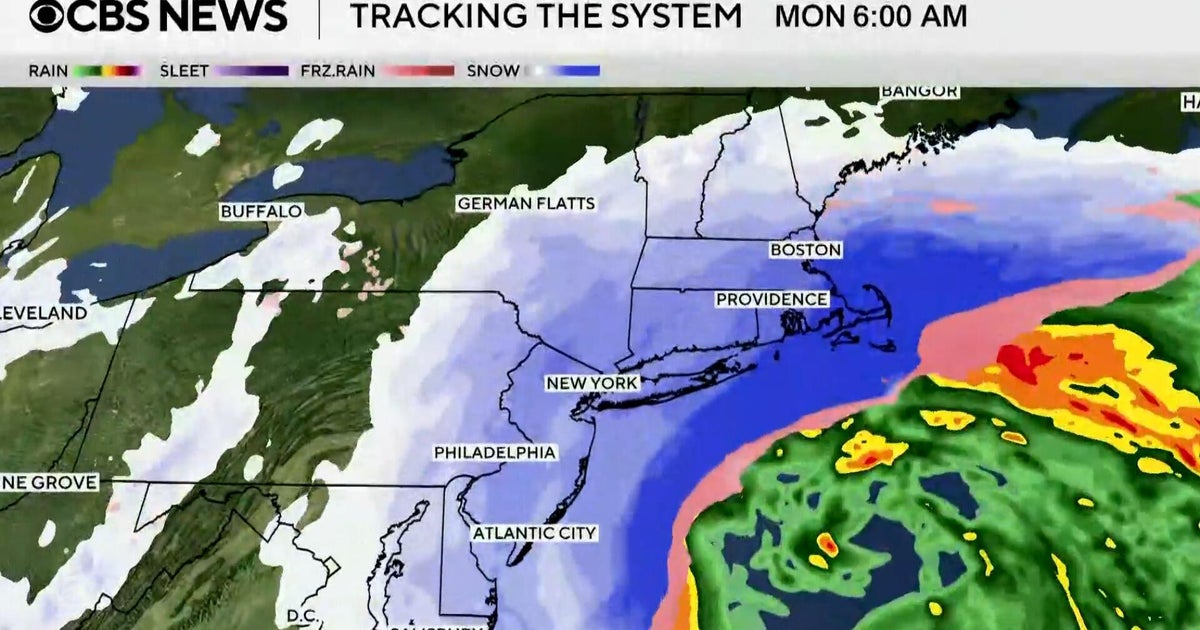

Massive snowstorm hits East Coast: What to know

A massive winter storm has begun to impact the East Coast, with heavy snow, brutal wind and dangerous flooding expected for several states. Shanelle Kaul, Andrew Kozak and Jason Allen have the latest.

UCLA to play 2026 football season at Rose Bowl as lawsuit continues

UCLA coach Bob Chesney and the Bruins will play the 2026 football season at the Rose Bowl while litigation continues over the school’s right to move to SoFi Stadium.

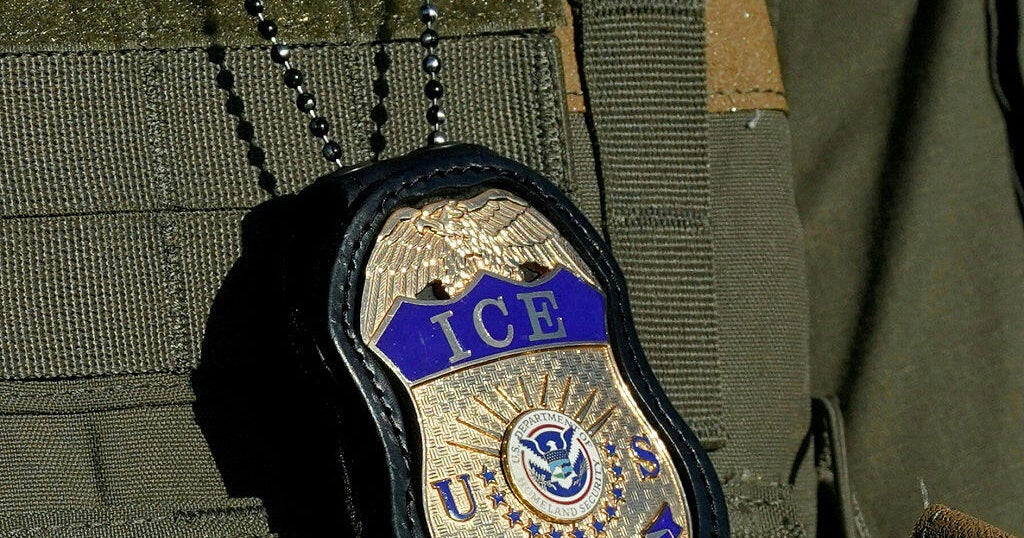

Records show ICE agent fatally shot U.S. citizen nearly a year ago in Texas

Ruben Ray Martinez was fatally shot in South Padre Island, Texas, in March 2025. ICE’s involvement in the shooting was not disclosed until more than 11 months after the shooting.

“Jersey Shore” star Nicole “Snooki” Polizzi reveals she has cervical cancer

“Jersey Shore” star Nicole “Snooki” Polizzi said in a TikTok video that her results at a post-op appointment for a cone biopsy showed stage 1 cervical cancer.

Man’s cat sanctuary naps still helping rescue expand years after they first went viral

A retired teacher started volunteering to take care of cats at a sanctuary, but his mission quickly evolved to napping with them. Steve Hartman checks in seven years later about the viral moments have allowed them to help even more cats over the years.

Former Patriots QB Brian Hoyer shares family tragedy with ‘sudden’ death of sister-in-law

“If you can find it in your heart to help us help him and his girls through this unimaginable season, we would be forever grateful.” The post Former Patriots QB Brian Hoyer shares family tragedy with ‘sudden’ death of sister-in-law appeared first on Boston. com.

Tour company says guides on deadly ski trip were avalanche trained

At least eight skiers have been found dead, and one is still missing after an avalanche the size of a football field struck in California’s Sierra Mountains on Tuesday. CBS News chief correspondent Matt Gutman has the latest.

Adam Schefter maps out potential price for Patriots in Maxx Crosby trade

“I was told that the Raiders don’t want to trade him and that if they even contemplated it, it would take a Micah Parsons-type package.” The post Adam Schefter maps out potential price for Patriots in Maxx Crosby trade appeared first on Boston. com.

New, dramatic testimony in Colin Gray’s second-degree murder trial

There was new dramatic testimony in the trial of Colin Gray, the father accused of purchasing the rifle his son used to kill four people at his Georgia high school in 2024. Skyler Henry has more.