The post PEING, XRP & ETH Market Outlook appeared com. Crypto Presales Explore XRP price prediction with PEING and Ethereum. Discover utility, community growth, and why early movers dominate crypto trends. XRP price prediction talk is heating up again as analysts point toward a possible climb to $5. 50. Charts are shifting, sentiment is building, and traders are scanning every move for early positioning. Ethereum joins the conversation with renewed upside interest, creating a setup where both majors are starting to attract fresh attention from market watchers. While these predictions gain momentum, early movers are already locking onto Apeing (PEING). The project is pulling in participants who want an edge before the next wave forms. Its rising whitelist activity signals a clear trend in 2025. Those who secure their spot early often catch the biggest upside when the broader market finally reacts. Apeing (PEING): The Meme Coin Built for Early Movers Apeing is not your typical meme coin. Its foundation revolves around instinctive, community-first action rather than overanalyzing charts. The team prioritizes security, ensuring the presale and token mechanics are fully audited. This approach creates a safe entry point while keeping the energy of early adoption intact. Apeing thrives on culture and engagement, integrating utility features that reward participation and loyalty. Its roadmap emphasizes real-world application, from gamified rewards to community-driven governance. Early adopters gain unique advantages. Whitelist participants are the first to access tokens at discounted rates, benefiting from strategic early entry before the wider market catches on. Apeing’s distribution model encourages a balance between immediate momentum and long-term sustainability, reinforcing the trend that those who act first often capture outsized returns. Why Apeing (PEING) Leaves Other Projects in the Dust Apeing (PEING) is getting all the hype because of its culture, utility, and community-first design. While many projects rely on hype or complex tokenomics, Apeing emphasizes security through audits.

Tag: sustainability

STRK Holds Breakout Zone As Buyers React To $3M Spot Inflows

The post STRK Holds Breakout Zone As Buyers React To $3M Spot Inflows appeared com. Starknet trades near $0. 216 as the breakout from the nine-month $0. 12-$0. 19 range faces its first major retest. Coinglass data shows $3. 06M in inflows, the strongest accumulation spike in months, signaling renewed demand after the breakout. $0. 20 remains the critical support, with a break above $0. 235-$0. 245 needed to confirm continuation toward $0. 27 and $0. 30. Starknet price today trades near $0. 216 after a clean breakout above the multi-month consolidation range that held the market between $0. 12 and $0. 19 for almost nine months. The move places immediate pressure on buyers to maintain control as the token pulls back toward the top of the broken range while spot flows show one of the strongest positive prints of the quarter. 19 resistance that capped every rally from March through October. The candle structure turned positive once price reclaimed the 20 and 50 EMAs at $0. 163 and $0. 144, followed by a push above the 100 and 200 EMAs near $0. 139 and $0. 164. The first rejection near $0. 24 triggered a controlled pullback. Price is now retesting the breakout level at $0. 20 to $0. 195. This zone acted as the upper boundary of the consolidation range and now represents the immediate support buyers must defend. Supertrend has flipped bullish at $0. 117, confirming momentum remains with buyers as long as the market stays above the previous demand band. Starknet spent nearly nine months trading inside a narrow horizontal channel. Breaking out of that structure often leads to extended directional movement if the retest holds. Starknet recorded a positive $3. 06 million net inflow on November 19,.

Funding Radar: Belmont Forum invests in ocean research

Photo credits: zverge / BigStock The Belmont Forum, a partnership of funding agencies, international scientific councils and regional consortia supporting global environmental change research, is investing in transdisciplinary projects that tackle pressing global ocean challenges.

Why Are Stocks Down Today?

TLDR Stock markets dropped sharply Friday with Nasdaq falling 2%, S&P 500 down 1. 1%, and Dow losing 400 points on November 7, 2025 AI stocks including Nvidia, AMD, and Qualcomm declined as investors worry about tech sector overvaluation October recorded the highest layoff numbers in more than 20 years, signaling labor market weakness U. S. government [.] The post Why Are Stocks Down Today? appeared first on Blockonomi.

Watch the 2025 Tesla (TSLA) Annual Meeting of Shareholders here

Watch the 2025 Tesla (TSLA) Annual Meeting of Shareholders here

“Revolutionary AI Platform by Simple Provides Live CO₂e Data for Businesses and Institutions through Invoice Monitoring”

Swedish-Austrian Technology Company Launches Breakthrough AI Platform for Real-Time CO₂e Emissions Calculation Vienna / Gothenburg / Osaka.

DIY or bust: West Philly’s self-made Halloween celebrations

While Halloween has become a widespread commercial success in the U. S., with the National Retail Federation estimating that Americans will spend more than $13 billion on Halloween festivities in 2025, [.] The post DIY or bust: West Philly’s self-made Halloween celebrations appeared first on Billy Penn at WHYY.

Whales Just Flipped the Script – Dumping $BTC and $AVAX to Join MoonBull, the Best Crypto Presale to Buy in October

What if the next crypto breakout is already gaining traction while most investors are still watching from the sidelines? The [.] The post Whales Just Flipped the Script Dumping TC and VAX to Join MoonBull, the Best Crypto Presale to Buy in October appeared first on Coindoo.

PepePawn ($PEPA) Price Prediction Turns Flat While Coldware ($COLD) Rises — BlockchainFX ($BFX) Now Leads the Top Crypto Projects of 2025

PepePawn (EPA) and Coldware (OLD) might be making noise in the crypto market this October 2025, but one name is [.] The post PepePawn (EPA) Price Prediction Turns Flat While Coldware (OLD) Rises BlockchainFX (FX) Now Leads the Top Crypto Projects of 2025 appeared first on Coindoo.

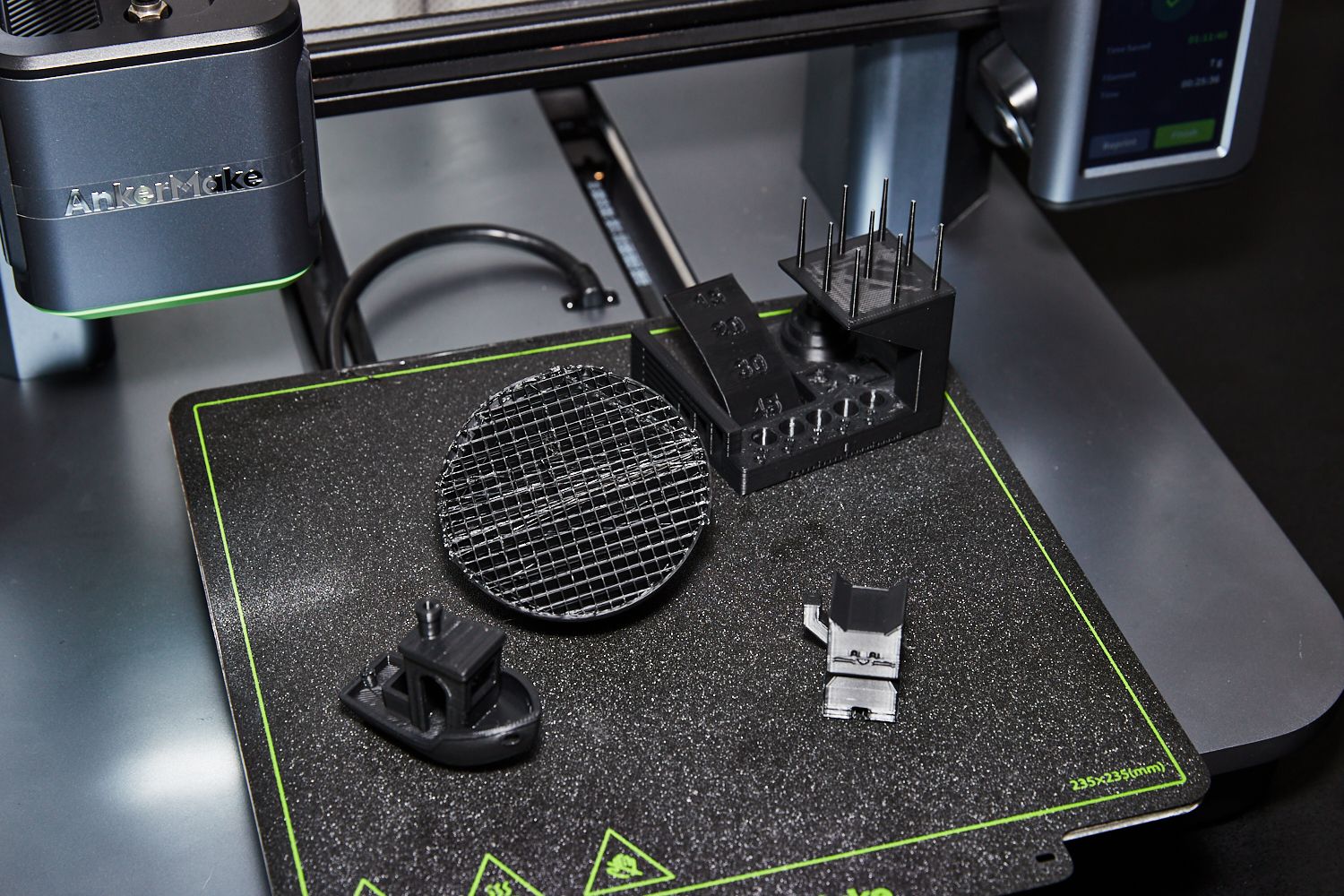

The Best 3D Printers for Beginners and Enthusiasts

The Best 3D Printers for Beginners and Enthusiasts