Google has become something of a fixture in digital infrastructure in the Pacific. In late 2023, Canberra announced a joint project with the US, Google and Vocus, an Australian digital infrastructure firm, to deliver the A$80 million South Pacific Connect initiative. The object: to link Fiji and French Polynesia to Australia and North America, with [.] The post Google on Christmas Island: Data Centres and Imminent Militarisation first appeared on Dissident Voice.

Tag: infrastructure

Coinbase Reportedly Ends $2 Billion Acquisition Talks with Stablecoin Firm BVNK

The post Coinbase Reportedly Ends $2 Billicom. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Coinbase has ended negotiations to acquire UK-based stablecoin infrastructure firm BVNK, valued at around $2 billion, according to a Fortune report. The decision was mutual after initial advanced talks involving both Coinbase and Mastercard. Coinbase scraps BVNK acquisition: Mutual agreement halts $2B deal discussions. The UK fintech BVNK specializes in stablecoin payment infrastructure for global businesses. Both Coinbase and Mastercard had entered exclusive talks with BVNK before the negotiations concluded without a deal, as per sources cited in the Fortune report. Coinbase BVNK acquisition plans end abruptly in $2B deal talks. Explore the implications for stablecoin growth and crypto infrastructure. Stay updated on key developments. What Happened to Coinbase’s Acquisition Plans for BVNK? Coinbase BVNK acquisition discussions have concluded without a deal, as the American cryptocurrency exchange mutually agreed with the UK-based stablecoin firm BVNK to halt negotiations. The proposed transaction was valued at approximately $2 billion, according to sources familiar with the matter reported by Fortune on Tuesday. This development follows advanced talks that also involved Mastercard, highlighting competitive interest in BVNK’s stablecoin infrastructure capabilities. COINOTAG recommends •.

Startale launches ‘super app’ for Sonieum blockchain

The post Startale launches ‘super app’ for Sonieum blockchain appeared com. Startale Group has unveiled a super app designed to serve as the an all-in-one platform for the Soneium ecosytem. The app will facilitate TGEs, airdrops and rewards for Soneium. Summary Startale has launched its Ethereum Layer-2 “super app” that serves as the main consumer platform for Sony’s blockchain, Soneium. The app enables user participation in Soneium airdrops, loyalty rewards, and token generation events while removing Web3 friction through Account Abstraction, gas-free transactions, and seed phrase-free wallet management. According to a press release sent to crypto. news, the company launched the app on Ethereum’s Layer2 infrastructure with support from the Ethereum Foundation. The self-proclaimed “super app” is meant to become an entry point to attract consumers to Sony’s Ethereum Layer2 network, Soneium. The app will serve as the official consumer layer for the Sony’s blockchain, which has generated more than 380 million transactions across over 5. 1 million wallets. Soneium-native projects will be launching airdrops, loyalty rewards and other on-chain experiences directly through the Startale App. Users will be able to take part in Soneium token generation events and enjoy priority for ecosystem airdrops and reward systems through the app. The platform also provides a solution to traditional Web3 friction through the Account Abstraction infrastructure, which is a blockchain technology that allows smart contracts to act as user accounts instead of being limited to just externally owned accounts. In addition, the app also removes the use of seed phrases, allows for gas-free experiences and simplifies wallet management by eliminating the need to manage multiple wallets while taking part in events in the Sonieum ecosystem. Startale App also supports Mini Apps, which means that builders can build directly on Soneium without needing to deploy third-party websites. CEO of Startale Group, Sota Watanabe said that the app is designed to remove “the final barrier” to.

Building Thermal Insulation Market Future Growth Driven by Energy Policies

The global building thermal insulation market was valued at USD 26. 9 billion in 2024 and is projected to reach USD 37. 8 billion by 2030, growing [read full press release.].

Jack Dorsey announces that Bitcoin-to-Bitcoin payments are now live

The post Jack Dorsey announces that Bitcoin-to-Bitcoin payments are now live appeared com. Former Twitter (now X) CEO and present CEO of Block Inc., Jack Dorsey, has announced that Bitcoin-to-Bitcoin payments are now live. The company will enable over 4 million merchants with its Square payment system to accept Bitcoin as payment. Dorsey announced the update on X. He stated, “Our sellers can now receive BTC to BTC, BTC to fiat, fiat to BTC, or fiat to fiat [.] we have one in CashApp, all merchants (not just Square) worldwide that accept bitcoin.” Now, traders worldwide can choose their preferred settlement method without added complexity. Traders go live with Bitcoin payments Dorsey first confirmed that his company was actively working on integrating Bitcoin payments for merchants on April 3rd. He wrote, “not a simple flip, but we are doing it.” The company provided more details on the project last month, promising that it would go live today. It’s here. Starting today, over 4 million Square sellers can accept Bitcoin at checkout. Zero fees until 2027. Instant settlement. Global freedom. The switch is flipped and this is only the start.@Square | @block | #Bitcoin ⚡️ pic. twitter. com/q03dpLxdz7 Jacob Szymik (@JacobSzymik) November 10, 2025 The launch provides access to instant settlement with no fees until 2027. Thereafter, the company shall levy a nominal fee of 1%. This is significantly lower than the typical credit card rates, which can range from 2. 5% to 3. 5%. The feature is accessible to traders from the Square dashboard to activate. Buys are executed on the Bitcoin blockchain, making transactions transparent and traceable. BTC and Fiat money are both supported on the platform. Block is also using the Lightning Network. It is a scaling solution of Bitcoin, which transacts almost instantly with low charges. This allows traders not only to get Bitcoin directly, but they can also use auto-conversion to US dollars as a more.

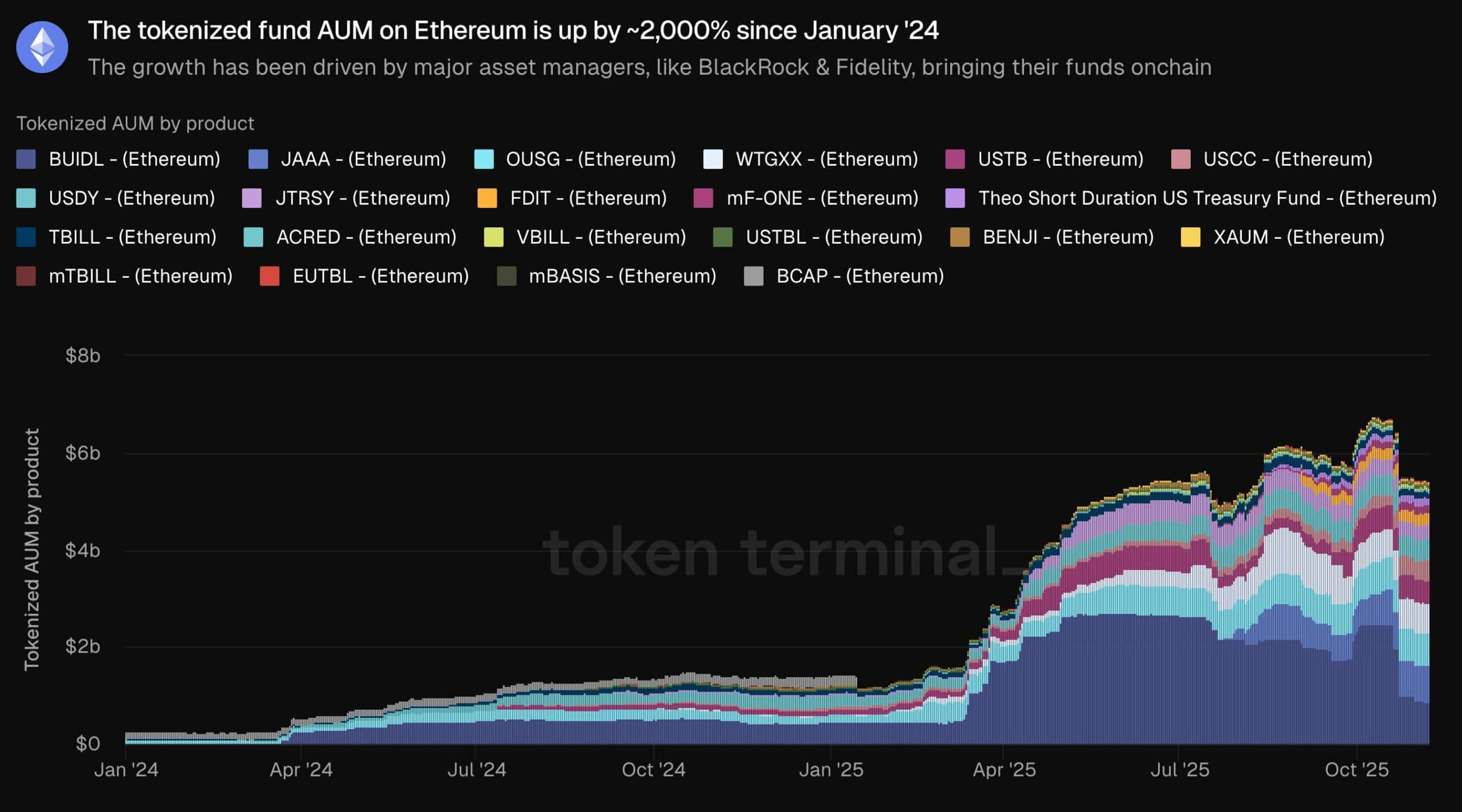

Ethereum On-Chain Surge via PYUSD and Tokenized Funds May Face Price Headwinds Below $3,500

com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Ethereum’s on-chain growth in 2025 is fueled by surging stablecoin activity and tokenized asset adoption. PayPal’s PYUSD stablecoin reached $18. 6 billion in transfer volume, while tokenized funds saw a 2, 000% increase since early 2024, driven by institutions like BlackRock and Fidelity. PayPal’s PYUSD stablecoin volume hits $18. 6 billion, boosting Ethereum’s payment infrastructure. Tokenized funds on Ethereum surge 2, 000% year-over-year, signaling mainstream financial integration. Despite on-chain momentum, ETH price hovers below $3,500 with neutral derivatives indicators. Ethereum on-chain growth in 2025 accelerates with PYUSD’s $18. 6B milestone and tokenized funds boom. Explore how these trends shape ETH’s future-stay ahead in crypto finance today. What is Driving Ethereum’s On-Chain Growth in 2025? Ethereum on-chain growth in 2025 is primarily propelled by the rapid expansion of stablecoin usage and real-world asset tokenization. Institutions are increasingly leveraging Ethereum’s network for efficient, secure transactions, with PayPal’s PYUSD stablecoin achieving $18. 6 billion in transfer volume. This shift marks a pivotal moment as traditional finance converges with blockchain technology. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior traders, research‑backed setups,.

Hodler’s Digest, Nov. 2 – 8 – Cointelegraph Magazine

The post Hodler’s Digest, Nov. 2 8 Cointelegraph Magazine appeared com. Top Stories of The Week Ripple rejects IPO plans despite SEC case victory: Here’s why Ripple, the US blockchain company behind the XRP cryptocurrency, will not pursue an initial public offering following the conclusion of its years-long legal battle with the US Securities and Exchange Commission. Ripple president Monica Long said the company has no plans or timeline for an IPO, according to a Bloomberg report on Wednesday. “We’re in a fortunate position where we’ve been able to be very well capitalized and fund all of our organic growth, inorganic growth, strategic partnerships, anything we want to do,“ Long said. Ripple’s decision to forgo an IPO ends years of speculation, after multiple executives had hinted at one. The company was hit with a $1. 3 billion SEC lawsuit in late 2020. Bitcoin bull run hasn’t started yet: Jan3’s Samson Mow Samson Mow, the CEO and founder of Bitcoin technology infrastructure company Jan3, argues the Bitcoin bull run is yet to begin, as Bitcoin fell to just under $100, 000 earlier this week. “The Bitcoin bull run hasn’t started yet. We’re just marginally outperforming inflation at this price range,” he said on Wednesday. Bitcoin and the broader cryptocurrency market continued to slump this week, with analysts attributing the decline to trade tensions between the US and China, as well as other macroeconomic factors. Bitcoin selling intensified on Tuesday, and CoinGecko data shows the price dipped to $99,607 on Wednesday. However, Mow, in a series of bullish X posts, predicted the market still has plenty of upside on the horizon as Bitcoin continues to outperform the US inflation rate of 3%. FBI can’t be blamed for wiping hard drive with $345M BTC, say judges A man convicted of identity theft, who claims his hard drive with over 3, 400 Bitcoin was seized and wiped by.

Binance Joins Sei Network as Validator, Institutional Trust Meets High-Speed Blockchain

@Binance has officially joined @SeiNetwork as a validator, marking a major step forward for the fastest Layer-1 blockchain. The move strengthens Sei’s network security and reliability while adding Binance’s operational scale and institutional-grade protection. For a blockchain designed for global finance, this partnership is more than symbolic, it’s a statement. The world’s largest crypto exchange [.].

Bitcoin Is Trump’s New Weapon Against China — He Wants to Make America a ‘Bitcoin Superpower’

The post Bitcoin Is Trump’s New Weapon Against China He Wants to Make America a ‘Bitcoin Superpower’ appeared com. Trump’s renewed pro-Bitcoin stance could perhaps drive long-term institutional confidence and investment in U. S.-based crypto infrastructure. As if implemented through supportive regulation, his “Bitcoin superpower” vision may strengthening America’s position against China in the race for digital financial dominance. President Donald Trump escalated his administration’s crypto crusade, declaring Bitcoin not just an investment fad as if a strategic weapon in the escalation U. S.-China tech rivalry. At the recent America Business Forum in Miami, President Trump said he wants to make the United States the “Bitcoin superpower” and the “crypto capital of the world,” framing crypto as a geopolitical tool to countering rivals like China. Adding to the context, a recent post suggested that Trump’s unexpect easing of China tariffs has fueled on market optimism, pushing Bitcoin’s price toward key resistance levels. This is supported by a statement in Finance Feed, which noted: Trump’s Bitcoin comments also highlight a geopolitical undertone that reflects the competition with China for digital supremacy following the recent U. S.-China trade wars. Yet, the vision extends beyond rivalry. Trump linked Bitcoin to broader technological achievements, claiming the U. S. leads in AI and some digital currencies. His team views this leadership as essential, argue that crypto dominance helps preserve dollar hegemony while easing inflationary pressures. As he noted, “Bitcoin takes the heat off the dollar,” positioning decentralized assets as allies-not enemies-of traditional finance. Experts like NYU adjunction professor Winston Ma echo this, observing that both superpowers are racing to export their currency ecosystems through crypto innovation. Implications: A Potential Bullish Surge for Bitcoin Even though Bitcoin has slipped about 2% in the past 24 hours, now trading near $100,442, 73 Trump’s strong support for Bitcoin is being viewed as a long-term bullish signal. His promise to making the U. S. a “Bitcoin superpower” suggests a.

KuCoin Institutional and Cactus Custody Partner to Strengthen Institutional Asset Security and Trading Access

The post KuCocom. KuCoin Institutional, the institutional division of global crypto exchange KuCoin, has entered a strategic partnership with Cactus Custody, the digital asset custody arm of Matrixport, which currently safeguards billions of dollars in assets. The collaboration brings Cactus Custody’s Off-Exchange Settlement (OES) solution, known as Cactus Oasis, to KuCoin’s platform. This integration allows institutional and qualified clients to trade across KuCoin’s spot, margin, options, and perpetual futures markets without the need to pre-fund their exchange wallets. Instead, client assets remain securely stored within Cactus Custody’s regulated custody infrastructure until execution, ensuring segregation and enhanced protection. The custody framework includes advanced security features such as multi-signature wallets, cold storage mechanisms, and ISO-certified protocols. This setup enables institutions to optimize capital efficiency and access liquidity while adhering to strict custody and compliance standards. “At Cactus Custody, we are committed to advancing security standards and digital asset operations, working closely with industry partners to enhance client asset safety and seamless market access. Our latest offering, Cactus Oasis, combines institutional-grade security with integrated operational efficiency. By launching on KuCoin, we continue to broaden institutional clients’ access to trading venues and further strengthen client trust,” said Wendy Jiang, General Manager at Cactus Custody. The partnership aligns with KuCoin’s broader initiative to scale institutional services, following the recent introduction of its $2 Billion Trust Project. The collaboration expands trading and custody options for institutional clients, offering greater choice in how assets are managed and safeguarded through third-party partners. “Our partnership with Cactus Custody represents a pivotal step in building a safer and more efficient digital asset ecosystem for institutions,” said Tika Lum, Head of Global Business Development at KuCoin Institutional. “The launch of KuCoin Institutional and our integration with Cactus reaffirm our commitment to providing institutions with the highest standards of liquidity, infrastructure, and.