PayPal’s PYUSD Stablecoin Volume Hits $18.6 Billion, Boosting Ethereum’s Payment Infrastructure

Ethereum’s on-chain ecosystem has seen remarkable growth in 2025, propelled by the rapid expansion of stablecoin usage and real-world asset tokenization. PayPal’s PYUSD stablecoin recently achieved a significant milestone, crossing $18.6 billion in transfer volume. This surge is a strong indicator of mainstream financial integration within the blockchain space, signaling Ethereum’s growing role as a foundational layer for modern digital finance.

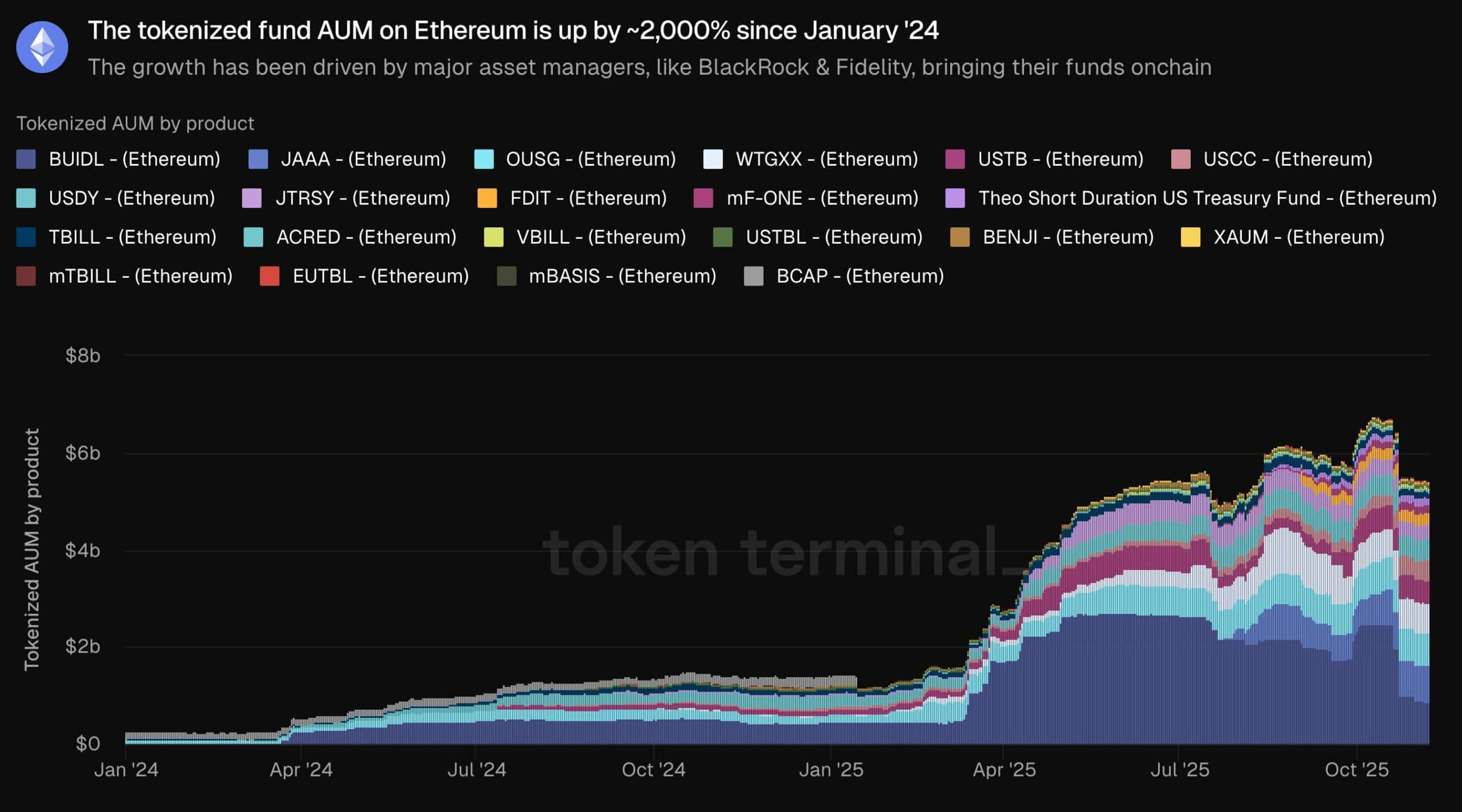

Tokenized funds on Ethereum have experienced a staggering 2,000% year-over-year increase, underscoring the shift toward institutional adoption and the digitization of traditional assets. Despite these impressive on-chain developments, Ethereum’s native token (ETH) price currently trades below the $3,500 mark, showing neutral momentum across derivatives markets.

What is Driving Ethereum’s On-Chain Growth in 2025?

Ethereum’s expansion in 2025 is mainly driven by two core factors: stablecoin adoption and real-world asset (RWA) tokenization. Institutions increasingly leverage Ethereum for efficient and secure transactions, with PayPal’s PYUSD leading the charge in stablecoin usage.

Achieving $18.6 billion in transfer volume, PYUSD exemplifies how traditional finance players are converging with blockchain technology. This transition highlights Ethereum’s growing importance for everyday financial activities and cross-border payments.

How Has PayPal’s PYUSD Contributed to This Momentum?

PayPal’s PYUSD stablecoin has become a key catalyst within Ethereum’s ecosystem. Its $18.6 billion total transfer volume by late 2025 demonstrates increasing acceptance of on-chain payments. On-chain analytics point to PYUSD’s role in enabling seamless cross-border transfers and enhanced merchant adoption, significantly reducing dependence on legacy banking rails.

Blockchain research firm Chainalysis reports a 150% year-to-date increase in daily active addresses involved in PYUSD transactions. This growth aligns with Ethereum’s scalability improvements following the Dencun upgrade, which brings lower fees and faster settlement times. These enhancements have attracted institutional players seeking efficiency and reliability.

As noted in Deloitte’s blockchain insights, PYUSD’s stable peg at $1 has reinforced user trust. Consequently, Ethereum’s overall total value locked (TVL) surpassed $100 billion in 2025, marking a milestone in the network’s evolution.

How Are Tokenized Funds Accelerating Ethereum’s Adoption?

Beyond stablecoins, tokenized funds are fueling Ethereum’s on-chain expansion. Assets under management (AUM) in tokenized funds have surged nearly 2,000% since January 2024. Industry heavyweights like BlackRock and Fidelity have introduced on-chain versions of their treasury funds, bringing billions of traditional assets onto Ethereum’s blockchain.

This tokenization trend offers several advantages: fractional ownership, 24/7 trading availability, and enhanced transparency. These features are transforming the way investors access fixed-income and other financial products.

Early 2025 marked a clear inflection point when tokenized real-world assets began outpacing decentralized finance (DeFi) protocols in transaction volume. A Boston Consulting Group report highlights that tokenized funds now manage over $10 billion on Ethereum, a sharp increase from $500 million a year earlier.

This growth not only validates Ethereum as a foundational platform for institutional finance but also emphasizes its competitive edge in settlement speed — with transaction finality measured in seconds compared to days on traditional networks. Moreover, Ethereum’s proof-of-stake consensus mechanism appeals to ESG-conscious investors thanks to its energy efficiency.

What’s the Current State of ETH Price Amid This On-Chain Surge?

Despite the booming on-chain activity, ETH’s price remains range-bound, fluctuating below $3,500 as of late 2025. Technical indicators show consolidation, with the token trading under the 9-day exponential moving average (EMA).

The Relative Strength Index (RSI) stands at 37.7, indicating subdued buying pressure, while the Chaikin Money Flow (CMF) reading of -0.10 points to ongoing capital outflows. Derivatives data further reveal a dip in open interest to $17.6 billion alongside near-neutral funding rates at 0.0098%.

This subdued momentum suggests ETH may continue trading sideways unless a breakout above $3,500 sparks renewed bullish sentiment. Market participants should watch how on-chain developments translate into price action in the coming months.

Frequently Asked Questions

What factors are key to Ethereum on-chain growth in 2025?

Ethereum’s on-chain growth is primarily driven by stablecoin adoption, exemplified by PYUSD’s $18.6 billion transfer volume, and the rapid expansion of tokenized real-world assets (RWAs), growing nearly 2,000%. Institutional participation from firms like BlackRock solidifies Ethereum’s utility, with total value locked surpassing $100 billion, according to Chainalysis.

Is ETH price poised for a breakout due to on-chain activity?

Although on-chain metrics indicate strong ecosystem growth, ETH price remains range-bound below $3,500 with neutral derivatives signals and low open interest. While a breakout is possible if momentum builds, current subdued volumes call for cautious optimism among investors.

Key Takeaways

- Stablecoin Surge: PayPal’s PYUSD reaching $18.6 billion in transfers demonstrates Ethereum’s rising role in efficient payments.

- Tokenization Boom: A 2,000% increase in tokenized funds since 2024, driven by firms like BlackRock and Fidelity, confirms growing institutional adoption.

- Price Caution: ETH trades below $3,500 amid weak momentum; monitoring for breakout signals is essential to gauge future trends.

Conclusion

Ethereum’s on-chain growth in 2025, highlighted by PYUSD’s milestone and the explosive rise of tokenized funds, positions the network as a key bridge between traditional finance and decentralized digital assets. As institutional involvement deepens, Ethereum’s ecosystem benefits from enhanced resilience, scalability, and innovation.

Investors and stakeholders should stay informed about the interplay between on-chain activity and price dynamics to seize emerging opportunities within this evolving crypto finance landscape.