A heavy dose of Decatur’s run game led the Eagles to their third area title in four seasons under coach Steve Huff. Led by the Eagles’ senior running back duo of Jake Milligan and Jamari Fletcher, Decatur (8-3) rushed for 388 yards and six touchdowns en route to a 49-21 win over Paris in the 4A Division I second-round bout [.] The post Decatur outruns Paris in area-round win first appeared on Wise County Messenger.

Year: 2025

How did Alabama football’s backup QBs perform vs. Eastern Illinois?

How did Alabama football’s backup QBs perform vs. Eastern Illinois?

Rosters set for East Texas Volleyball All-Star Games

The second annual East Texas Volleyball All-Star Games are set for Sunday, Dec. 7 at Spring Hill’s Panther Gymnasium. The day will feature a small school match at 3 p. m. and a big school match at 5 p. m.. Proceeds from the event will help provide Christmas for needy families in East Texas. Coaches for the [.].

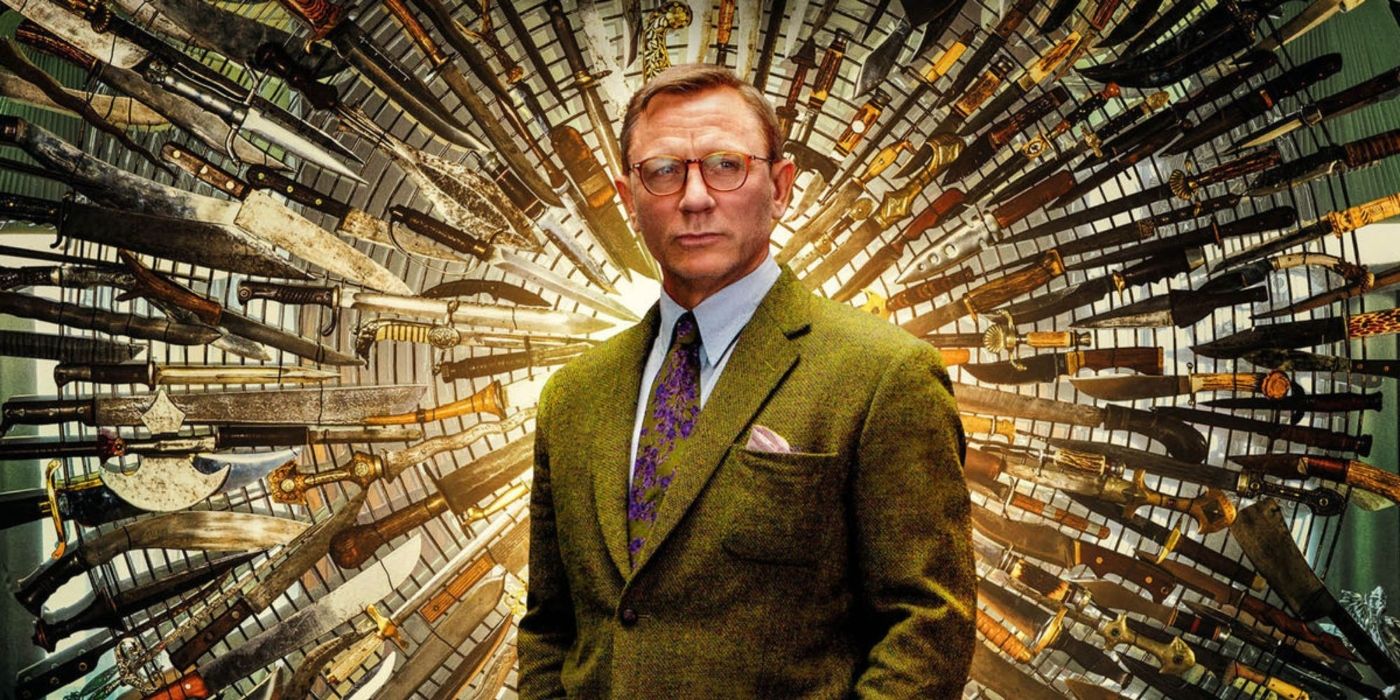

10 Cozy Movies To Watch After Thanksgiving Dinner

After you finish your Thanksgiving feast, we recommend cozy movies to watch, including The Sound of Music, Knives Out, and Howl’s Moving Castle.

Tampa Bay Buccaneers at Rams: Who has the edge?

What’s at stake, who’s better, key matchup, TV info, fantasy sleeper and prediction for Sunday evening’s showdown at SoFi Stadium.

Callum McGregor shifts Celtic mood with injury time magic to break battling St Mirren – 5 talking points

Callum McGregor shifts Celtic mood with injury time magic to break battling St Mirren – 5 talking points

JD Vance Drops Truth Bombs on Canada

Yesterday, I wrote about the fact that Canada is being overrun by migrants. Almost half of all births are now to foreign-born mothers (42% currently, and rising), and one-third of the overall population is foreign-born. One of the many terrible consequences of the liberal policies that have resulted in this replacement of the native population is stagnating economic growth. Migration, of course, is not the only cause of this stagnation. Energy policies, housing policies, and all sorts of government meddling in the economy are at fault as well, but it is undeniable that replacing a high-trust first-world citizenry with people.

Greene’s Exit Deals A Blow to G.O.P., Putting Rifts on Display

Representative Marjorie Taylor Greene’s sudden resignation underscored the fragility of the G.O.P. majority, and exposed deep discontent on the right going into the midterm elections.

Eagles Get Good News on Key Starter Ahead of Cowboys Game

Ahead of a big-time NFC East showdown, the Philadelphia Eagles got some positive injury news. Starting C Cam Jurgens, who left last week’s game against the Lions with a concussion, is cleared to play on Sunday against the Cowboys after being a full participant in practice on Friday. He carries no injury designation heading into [.] The post Eagles Get Good News on Key Starter Ahead of Cowboys Game appeared first on Heavy Sports.

3I/ATLAS: Harvard’s Avi Loeb Debunks Calamity Fears Over Pre‑Christmas Earth Flyby

Harvard astrophysicist Avi Loeb explains why interstellar comet 3I/ATLAS is unlikely to spell doomsday for Earth, even as he urges NASA to hunt for mini‑probes and other potential technological signatures.