After his win over Belal Muhammad at UFC Qatar, Ian Garry now believes he is owed a title fight against Islam Makhachev.

Year: 2025

UMass comes up short against Green Bay

Paradise turned to purgatory on Saturday for the Massachusetts men’s basketball team as it lost its second consecutive game at the Paradise Jam. Matched up in the losers’ bracket against Green Bay on Saturday, UMass (3-3) suffered a remarkably stagnant first half offensively before gaining some life in the second, but was out-executed down the stretch for a 79-75 loss.

Season still alive: Bobcats fight off ULM in 31-14 win

The scoreboard read 31-14 in favor of the Bobcats over the Warhawks, but this game was bigger than that. This game was about keeping the season alive. With six losses already on the season, including a.

Traffic stop in Hesperia uncovers stolen gun and suspected meth, deputies say

A late-night traffic stop in Hesperia led to the arrest of a 35-year-old Boron man after deputies say they found a stolen handgun, ammunition and suspected methamphetamine inside his vehicle. According to deputies, the stop occurred shortly after 1 a.m. on Nov. 17 at the intersection of Bear Valley Road and Eleventh Avenue, when Deputy […]

Can You Make Stuffing Ahead Of Time For Thanksgiving?

Can You Make Stuffing Ahead Of Time For Thanksgiving?

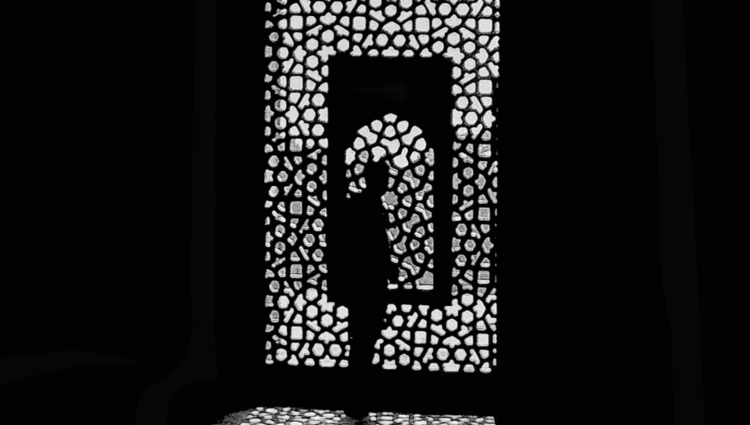

From Light to Darkness

Without any human help, it was my own desperate need to find God that enabled me to persevere in the Dark Night in which I found myself when first fervour left me flat. However, in case I give the impression that first fervour is of little consequence and can easily be bypassed, this is not [.].

Men’s basketball: Gophers’ free-throw struggles prove costly against San Francisco

Men’s basketball: Gophers’ free-throw struggles prove costly against San Francisco

Miley Cyrus celebrates her birthday – see her transformation over the years as she turns 33

We revisit the Flowers singer’s most unforgettable fashion moments from early country-music carpets to the polished, high-fashion looks of today.

South Florida scores 27 unanswered points to roll past UAB

South Florida scores 27 unanswered points to roll past UAB

How politicians have reacted to Marjorie Taylor Greene’s resignation news

Rep. Marjorie Taylor Greene’s shocking announcement that she is leaving Congress in January is still reverberating in Washington and beyond. The news, delivered Friday in a lengthy statement, appears to have caught some people off guard — including President Trump, whose feud with the Georgia Republican and the beef’s rippling effects played a role in…