The Steam Machine will fail if Valve repeats this Steam Deck mistake

Year: 2025

PIAA football schedule including Northwestern Lehigh, Southern Lehigh

Here is the PIAA football schedule for Week 15 including Northwestern Lehigh, Southern Lehigh, the last two District 11 teams alive.

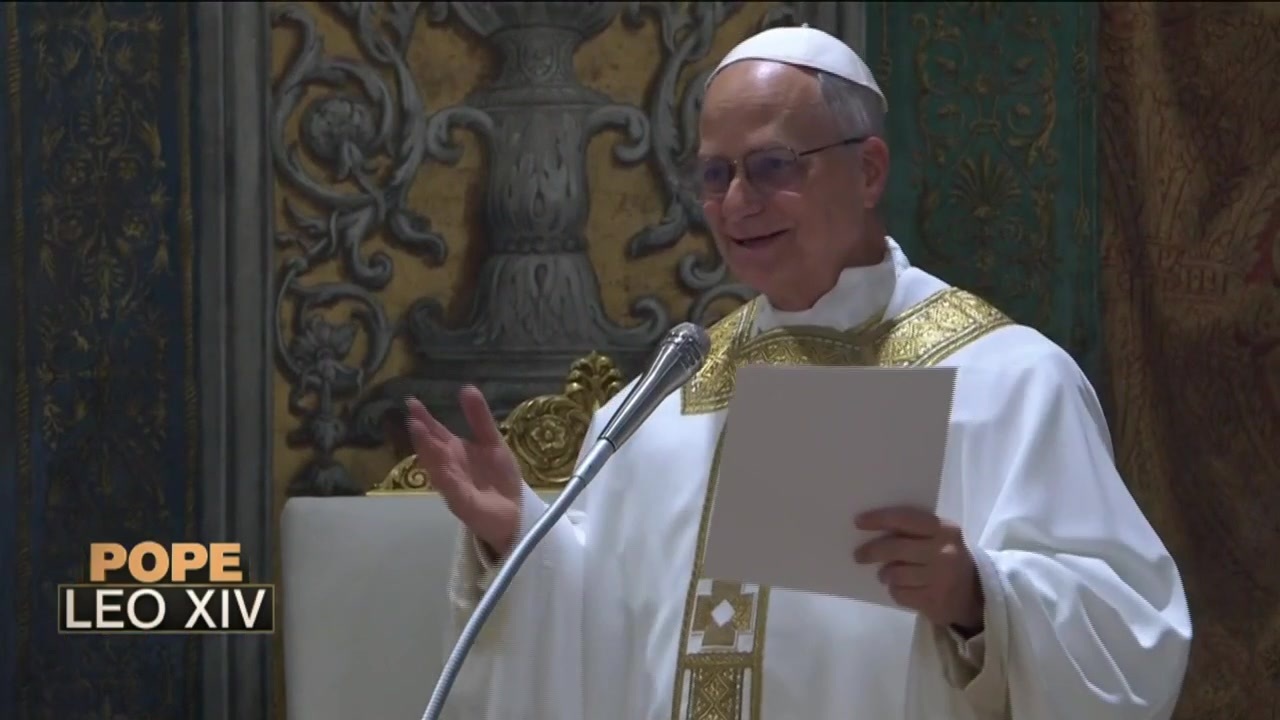

Pope calls on kidnappers in Nigeria to free 265 students and teachers after 50 pupils escape

ABUJA, Nigeria (AP) Fifty of the 303 schoolchildren abducted from a Catholic school in north-central Nigeria’s Niger state have escaped captivity and are now with their families, the.

Braves Acquire 3-Year Veteran Outfielder After Phillies Stint: Report

The Atlanta Braves needed outfield depth, but their newest signing brings very minimal major league experience.

Yankees Slugger Projected To Sign 6-Year, $162M Deal After Bounce-Back Year

The New York Yankees, New York Mets, and Los Angeles Dodgers are seemingly the top teams in the Cody Bellinger sweepstakes.

‘Predator: Badlands’ Conquers One of the Greatest Dystopian Thrillers Ever Made at the Box Office

Predator: Badlands is still roaring at the box office, now taking down Hugo Weaving’s dystopian masterpiece ahead of its 20th anniversary.

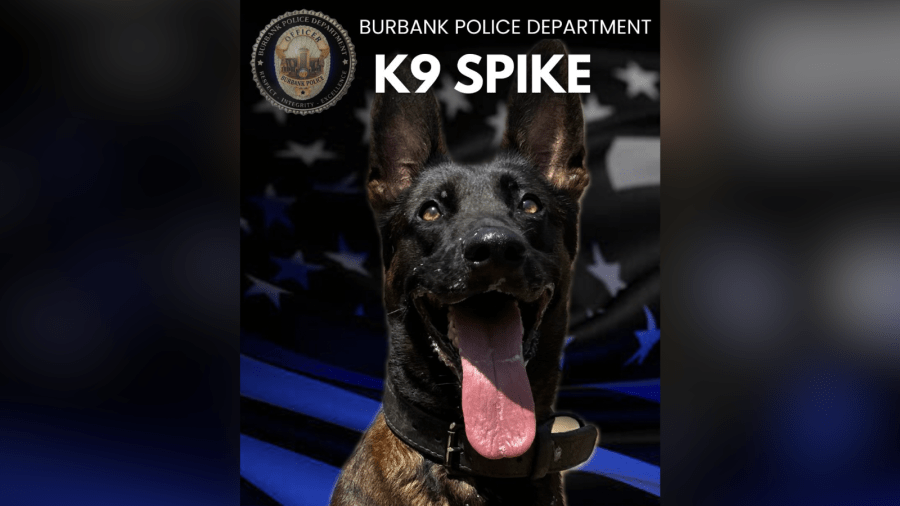

Burbank Police Department K9 officer shot, killed on 5 Freeway

A K9 officer with the Burbank Police Department was shot and killed on the 5 Freeway by a suspect who is now also dead, according to police. The Burbank Police Department originally stated that, around 6:40 p.m. Saturday, units were conducting a traffic stop on the 5 Freeway near the Buena Vista Street off-ramp when […]

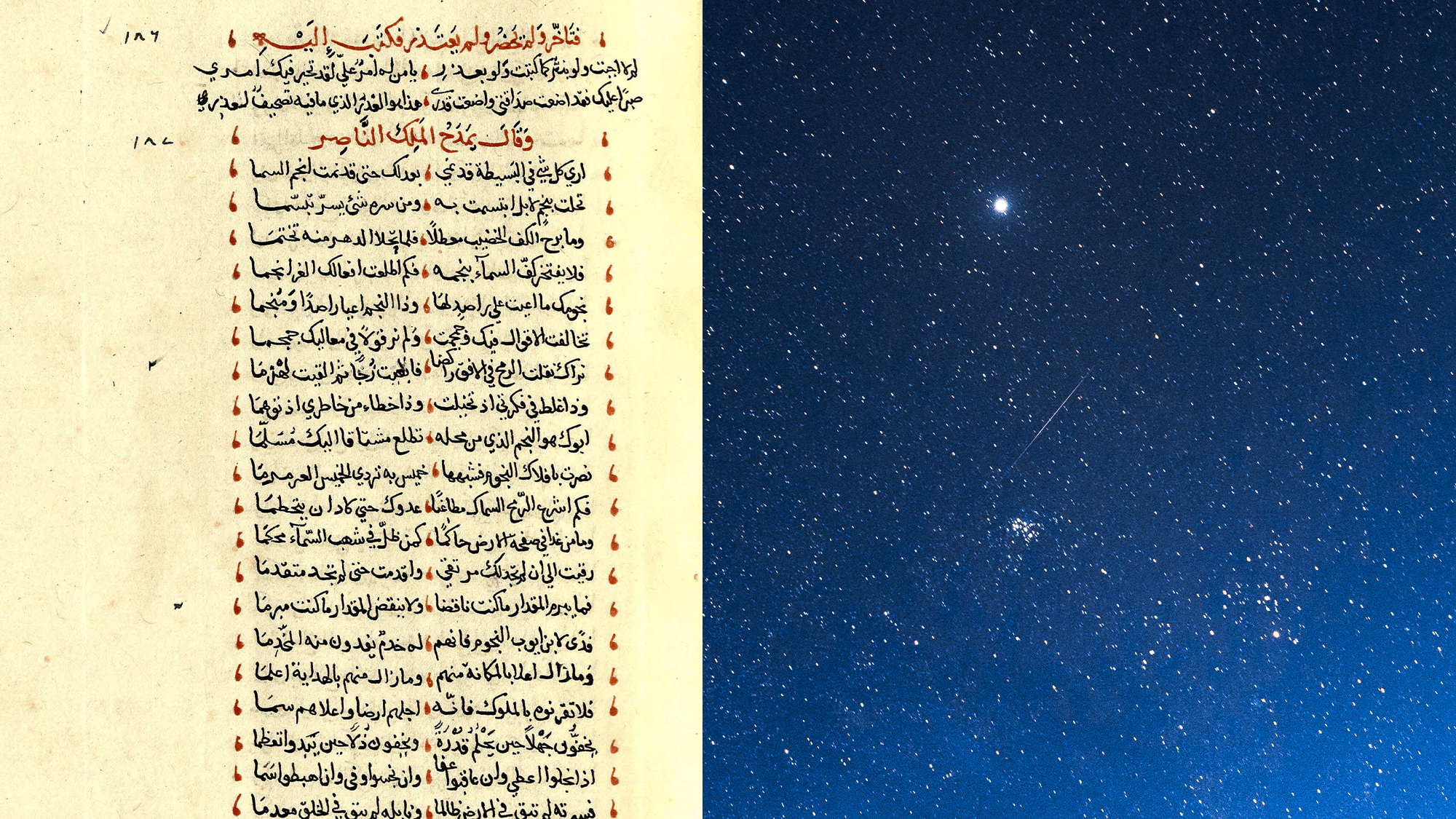

Medieval Arabic texts help researchers track down explosive star deaths

In 1181, Egyptian, Chinese, and Japanese scholars documented a cosmic explosion. The post Medieval Arabic texts help researchers track down explosive star deaths appeared first on Popular Science.

Hundreds flock to Seaside for annual Turkey Trot

Want to prepare your body for the annual Thanksgiving feast? Flock to downtown Seaside. The annual Seaside Turkey Trot is back and once again hundreds of people from all over the United States will descend to downtown Seaside for the family fun event. Some may be wearing turkey costumes, while others might be drinking coffee [.].

Wicked: For Good Producer Addresses the Film’s Core Themes

Wicked: For Good producer Marc Platt discusses how the film’s core theme feels relevant to modern audiences.