TLDR Testnet 1 processed high transaction volume with almost zero failures. Mainnet version v23 is confirmed and expected to launch soon. Fast-track KYC now enables early wallet activation for new users. Pi Network pilots decentralized AI training through OpenMind nodes. Over 50 million users may soon see Pi Network enter its next phase as Testnet [.] The post Pi Network Prepares for Mainnet After Testnet 1 Shows High Stability appeared first on CoinCentral.

Category: general

Smurfit Westrock: Some AI Resistance In An Economic Bellwether

Smurfit Westrock: Some AI Resistance In An Economic Bellwether

Aaron Rodgers Criticizes Steelers Offense After ‘Bad Ball’ Against Chargers

Pittsburgh Steelers quarterback Aaron Rodgers was very critical of himself and the offense after the team’s 25-10 loss to the Los Angeles Chargers. The post Aaron Rodgers Criticizes Steelers Offense After ‘Bad Ball’ Against Chargers appeared first on Heavy Sports.

What to Stream: ‘Freakier Friday,’ NF, ‘Landman,’ ‘Palm Royale’ and Black Ops 7

Jamie Lee Curtis and Lindsay Lohan re-teaming as the body-swapping mother and daughter duo in “Freakier Friday” and albums from 5 Seconds of Summer and the rapper NF are some of the new television, films, music and games headed to a device near you. Also among the streaming offerings worth your time this week, as.

Monday November 10th – Open Thread

Our Father, who art in heaven, hallowed be thy Name. Thy kingdom come. THY WILL BE DONE, on earth as it is in heaven. Give us this day our daily bread. And forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but DELIVER US FROM EVIL. [.] The post Monday November 10th Open Thread appeared first on The Last Refuge.

Trump Stimulus Check Could Trigger New Crypto Bull Run

The post Trump Stimulus Check Could Trigger New Crypto Bull Run appeared first S. President Donald Trump said Americans could receive direct cash payments funded by tariff revenue. The announcement came through Trump’s Truth Social post, where he claimed the U. S. is bringing in “trillions of dollars” from tariffs. According to him, this money will be used to reduce the.

Mike Tirico, Cris Collinsworth talk UC Bearcats past of Mike Tomlin, Rick and Jesse Minter

Mike Tirico and Cris Collinsworth discussed the Sunday Night Football reunion between the Steelers’ Mike Tomlin and Chargers’ Rick and Jesse Minter.

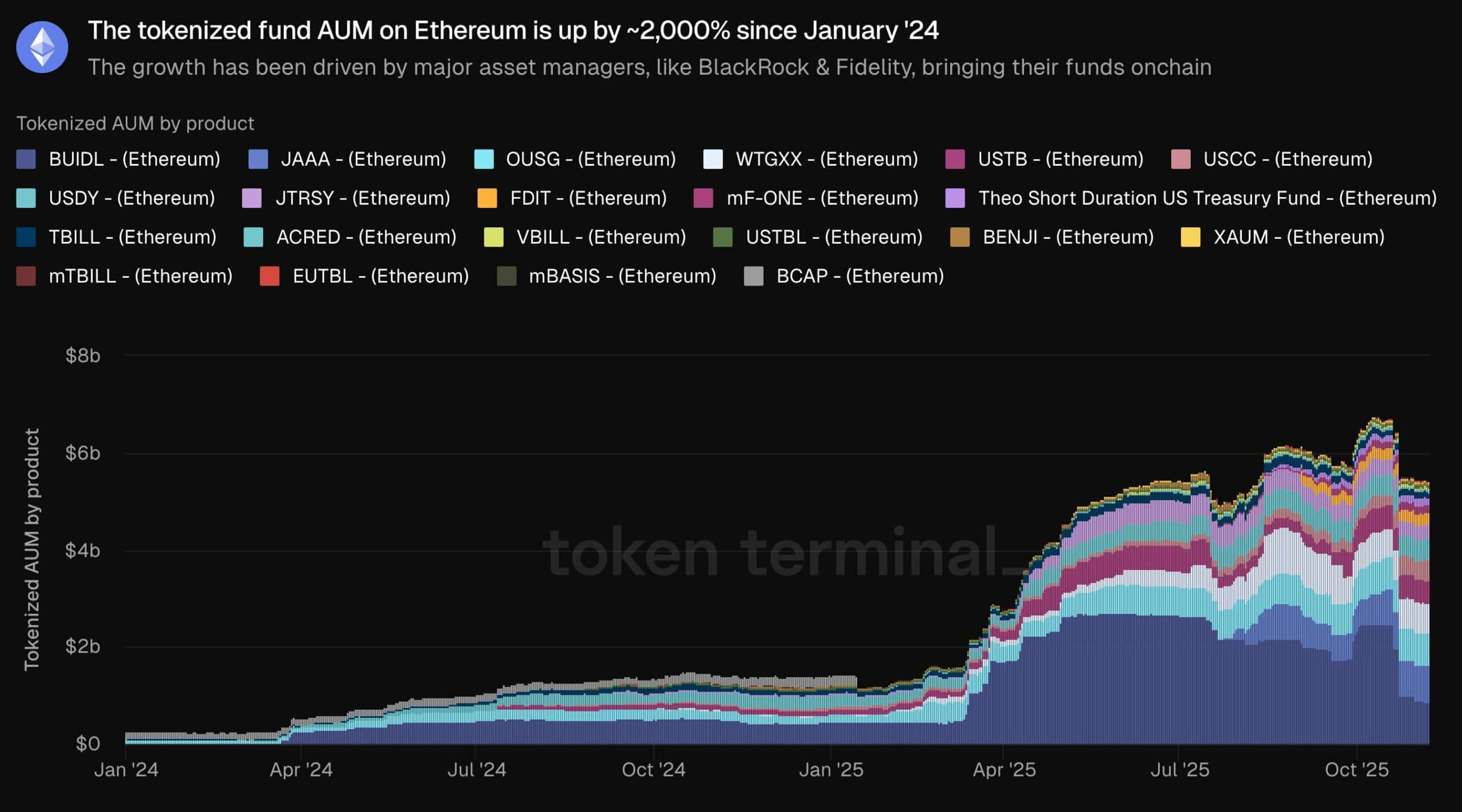

Ethereum On-Chain Surge via PYUSD and Tokenized Funds May Face Price Headwinds Below $3,500

com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Ethereum’s on-chain growth in 2025 is fueled by surging stablecoin activity and tokenized asset adoption. PayPal’s PYUSD stablecoin reached $18. 6 billion in transfer volume, while tokenized funds saw a 2, 000% increase since early 2024, driven by institutions like BlackRock and Fidelity. PayPal’s PYUSD stablecoin volume hits $18. 6 billion, boosting Ethereum’s payment infrastructure. Tokenized funds on Ethereum surge 2, 000% year-over-year, signaling mainstream financial integration. Despite on-chain momentum, ETH price hovers below $3,500 with neutral derivatives indicators. Ethereum on-chain growth in 2025 accelerates with PYUSD’s $18. 6B milestone and tokenized funds boom. Explore how these trends shape ETH’s future-stay ahead in crypto finance today. What is Driving Ethereum’s On-Chain Growth in 2025? Ethereum on-chain growth in 2025 is primarily propelled by the rapid expansion of stablecoin usage and real-world asset tokenization. Institutions are increasingly leveraging Ethereum’s network for efficient, secure transactions, with PayPal’s PYUSD stablecoin achieving $18. 6 billion in transfer volume. This shift marks a pivotal moment as traditional finance converges with blockchain technology. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior traders, research‑backed setups,.

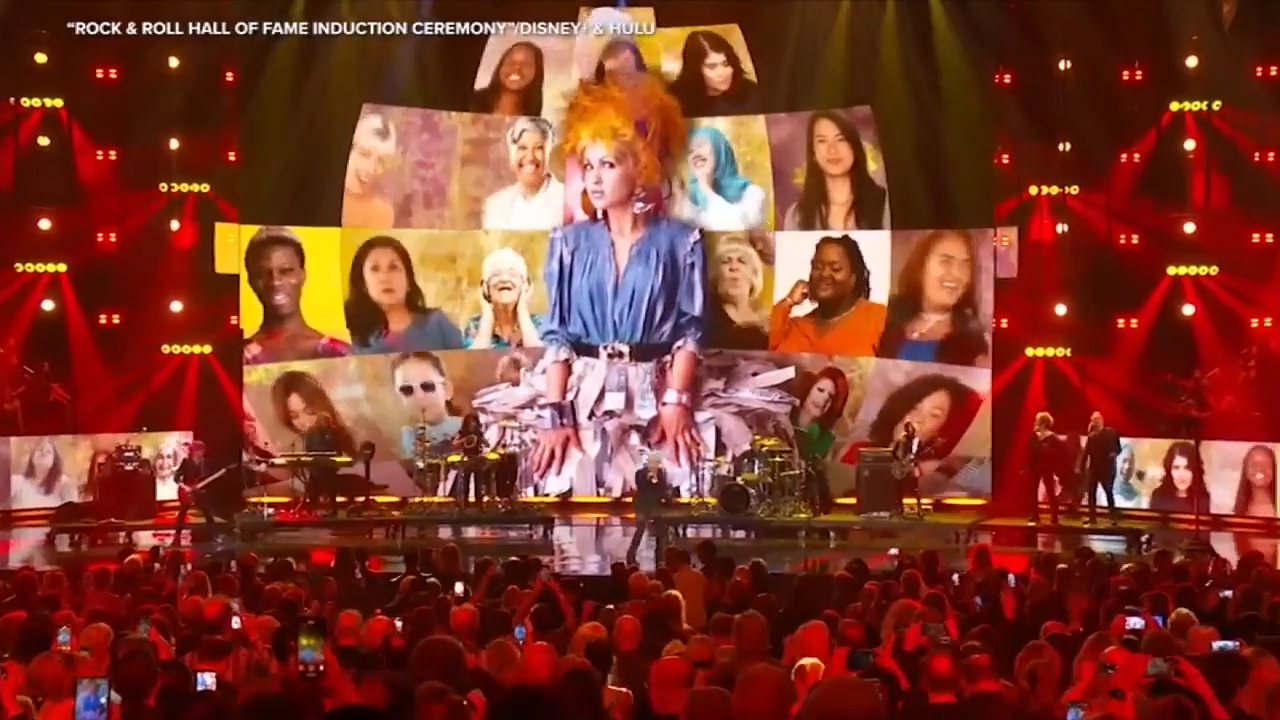

A look at the Rock & Roll Hall of Fame 2025 inductees and how they were honored

LOS ANGELES (AP) The Rock & Roll Hall of Fame has inducted its 2025 class of music giants. The ceremony held Saturday at Los Angeles’.