Since 1971, in the Nixonian monetary era, the American government has enjoyed a power derived from the pure fiat paper money that its central bank can print in unlimited quantities to finance the government’s deficits. Simply put, politicians naturally like to keep passing out money to stay in office. It’s convenient, politicians reckon, to have a compliant central bank to buy government bonds with printed money, especially if Congress is spending more than taxes bring in.

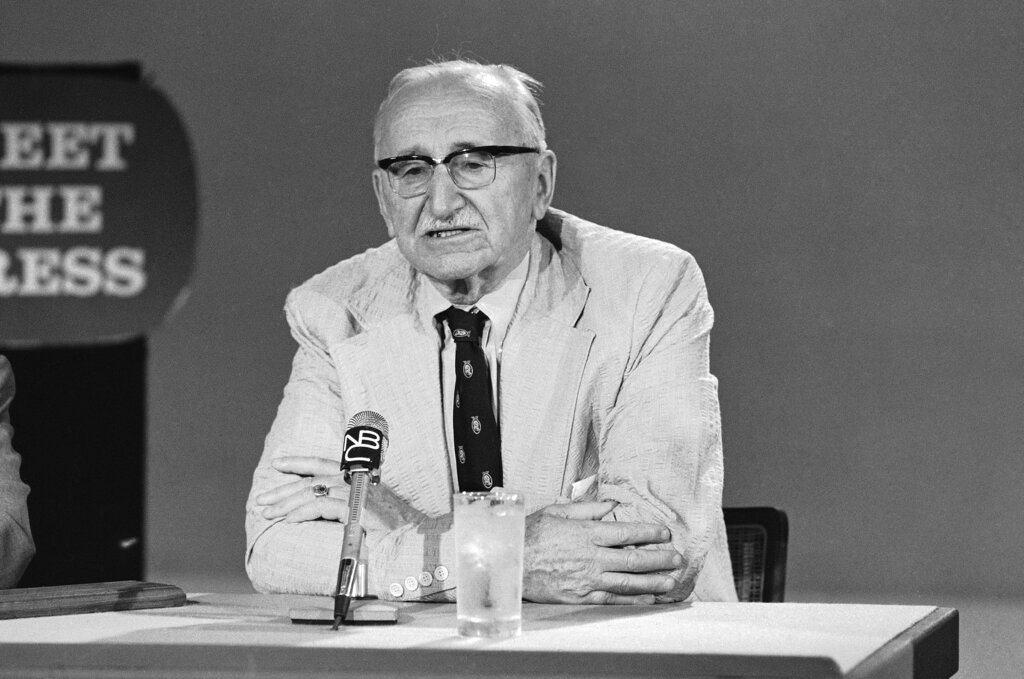

Of course, this scheme depreciates the currency, taking away the people’s purchasing power and the value of their savings and wages. As Friedrich Hayek observed in his essay “Choice in Currency,”

> “Practically all governments of history have used their exclusive power to issue money in order to defraud and plunder the people.”

Hayek argued that the essential problem is that the government’s central bank has an “exclusive power” to print money, or in other words, a monopoly on money, so it can impose its depreciating currency on the people. He suggested that since there is no hope of reforming the central bank, instead we should focus on taking away its monopoly.

Thus:

> “Let us deprive governments [and] their monetary authorities of all power to protect their money against competition.”

Then,

> “if people were free to refuse any money they distrusted and to prefer money in which they had confidence, [there] could be no stronger inducement to governments to ensure the stability of their money.”

In other words, let choice in currency and competition among currencies discipline the government and its central bank. If they produce an inferior money, that money would lose out to the better one supplied by someone else. This was an innovative application of classic market logic to the problem of money, one notably consistent with a free society.

Hayek concluded,

> “I hope it will not be too long before complete freedom to deal in any money one likes will be regarded as the essential mark of a free country.”

A recent introduction to Hayek’s thought observes that this essay “is enormously popular among advocates of cryptocurrencies.” Hayek, in any event, was not most concerned with competition for the government’s fiat currency by other fiat currencies, whether those of other governments or private currencies. He was really thinking of gold.

> “It seems not unlikely,” he suggested, “that gold would ultimately reassert its place as the universal prize if people were given complete freedom to decide.”

Hayek’s essay originated shortly after the American government at long last lifted its oppressive 1933 prohibition of Americans owning any gold, which it had made into a criminal offense. All Americans were prohibited by their government from protecting themselves with gold from the ongoing depreciation of their currency by the Federal Reserve.

That may seem amazing to us now, but it clearly shows how far even a democratic government will go to protect the monopoly of its own fiat currency.

The chief American negotiator at the 1944 Bretton Woods Conference, Harry Dexter White, claimed that for international use,

> “the United States dollar and gold are synonymous,”

as Benn Steil reports in *The Battle of Bretton Woods.* We are a long way from there.

With the value of a thousand American dollars currently at about one-quarter of an ounce of gold, as compared to the old Bretton Woods price of 28.6 ounces, the value of the dollar has depreciated by 99 percent against gold.

White’s view did not hold up, and neither did the confident assertions of this *Financial Times* editorial from 2004:

> “The barbarous relic is crumbling to dust,” the FT’s editors wrote. “For central banks and governments to hold it as a reserve asset is a betrayal of the public. Given the pointlessness of holding gold, gold is on its way out as an investment and as a reserve asset.”

Today, in contrast, many central banks are buying gold and increasing the allocation to gold in their reserves, and the unrealized profit of the U.S. Treasury on its gold has reached about $1 trillion.

The Fed, meanwhile, owns no gold, and adding together its operating and mark-to-market losses has a total loss of around $1 trillion.

The international market for central bank reserves cannot be monopolized like a domestic currency can. Perhaps in this central bank market, we are now seeing Hayek’s scenario of choice and competition in currencies actually playing out. Gold seems to be winning this round.

https://www.nysun.com/article/hayeks-last-hurrah-so-to-speak-a-choice-in-currency-emerges-among-central-banks