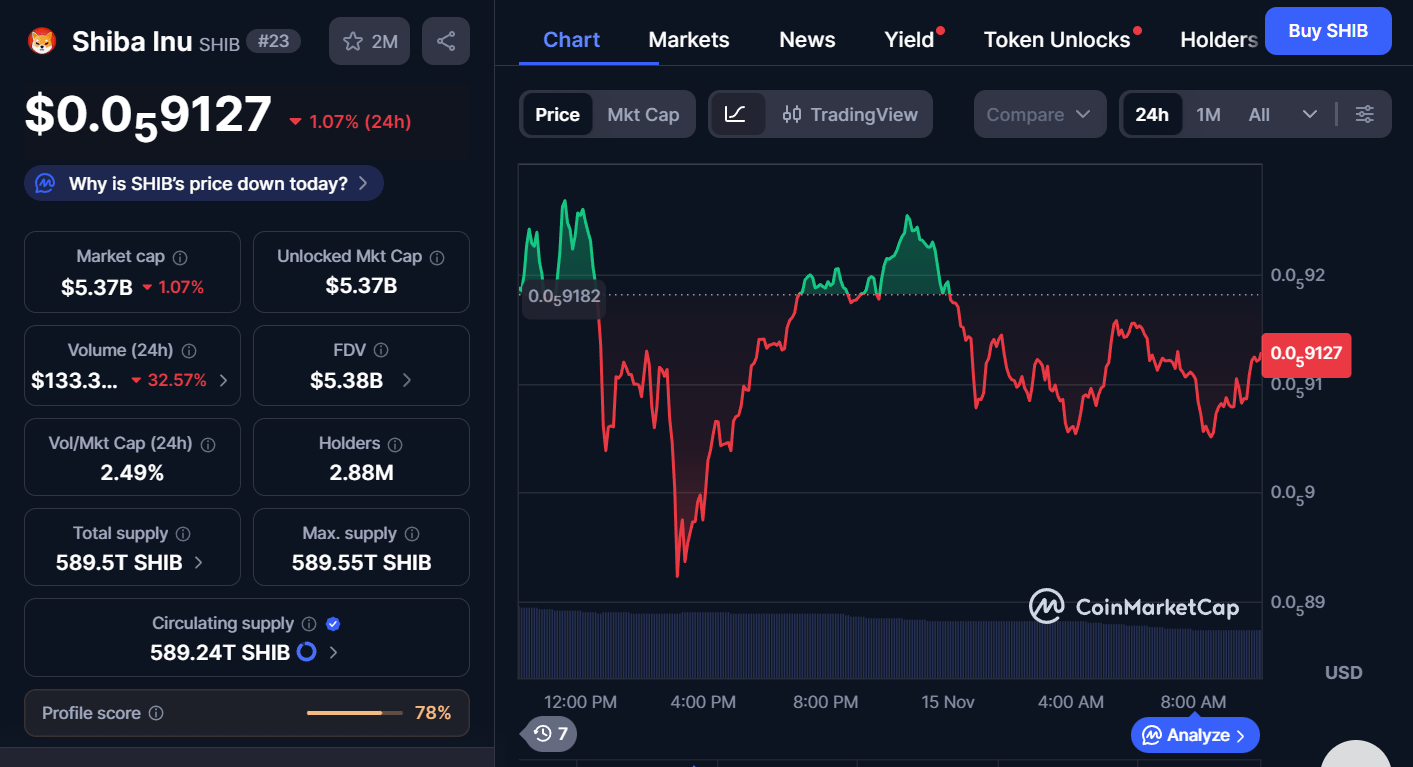

The post Latest Shiba Inu News: New Meme Coin Presale Goes Viral Set To Rival SHIB appeared com. Shiba Inu news just got a serious twist as Layer Brett bursts onto the scene with a viral pre-launch and its own Ethereum Layer 2 plans. While SHIB trades like a giant, LBRETT is setting up as the quicker rival, with faster transactions, big staking yields and a public testnet coming for holders hunting fresh upside in this high-volatility meme market cycle. Shiba inu cools off as price dips and trading interest fades Based on the most recent statistics, Shiba Inu (SHIB) is trading at 0. 000059127, which implies that it has gone down by 1. 07 in the past 24 hours. Nevertheless, SHIB has a large market cap of 5. 37 billion and a strong base of holders amounting to 2. 88 million holders. Moreover, the volume of trading has dropped by more than 32%, which is an indicator of less market activity and possibly a lack of conviction by investors. 00005912 and $0. 00005982. The short-run sentiment of SHIB is bearish as evidenced by the steady downwards highs that are signs of selling pressure. In this uncertain situation, many investors are looking for better options in the meme coin industry and Layer Brett keeps coming up as a strong rival for Shiba Inu for its current market standing. How Layer Brett’s is giving competition to Shiba Inu SHIB has a high overall reach into the meme coin market, but LBRETT is rapidly gaining momentum through a private funding event that has raised more than 4. 4 million USDT already. The Private funding price is fixed at $0. 0058 and it will be raised to $0. 0061 and this will be done under a tiered pricing strategy that will benefit early investors. Layer Brett is built on Ethereum Layer 2 blockchain technology,.

Tag: shiba

SHIB Price Prediction: Targeting $0.0000104 by December 2025 Despite Current Consolidation

The post SHIB Price Prediction: Targeting $0. 0000104 by December 2025 Despite Current Consolidation appeared com. Zach Anderson Nov 09, 2025 09: 07 Shiba Inu technical analysis reveals neutral momentum at RSI 46. 72, with analyst consensus targeting $0. 0000104-$0. 000019 range. Current consolidation phase may precede breakout. Shiba Inu (SHIB) finds itself at a critical juncture as November 2025 progresses, with technical indicators painting a mixed picture that demands careful analysis. Despite a recent 1. 79% daily decline, the meme coin’s underlying momentum suggests potential for measured upside in the coming weeks. SHIB Price Prediction Summary Based on comprehensive technical analysis and recent analyst forecasts, here are the key Shiba Inu price predictions: • SHIB short-term target (1 week): $0. 0000097 (+15% potential upside) • Shiba Inu medium-term forecast (1 month): $0. 0000104-$0. 000012 range• Key level to break for bullish continuation: $0. 0000104 • Critical support if bearish: $0. 00000832 Recent Shiba Inu Price Predictions from Analysts The latest SHIB price prediction landscape reveals interesting divergence among crypto analysts. CoinMarketCap AI leads the bullish camp with a medium-term target of $0. 0000104, citing Shibarium adoption and potential ETF considerations as key catalysts. This Shiba Inu forecast aligns with several other predictions clustering around the $0. 00001 level. However, the most optimistic SHIB price target comes from Analytics Insight, projecting $0. 0003-$0. 0004 for long-term holders based on anticipated token burns and sustained market sentiment. Conversely, DroomDroom presents the most conservative outlook at $0. 00000832, suggesting potential short-term weakness. The consensus among eight major forecasting platforms points toward cautious optimism, with most predictions falling between $0. 0000097 and $0. 000019 for the next 30-60 days. SHIB Technical Analysis: Setting Up for Consolidation Breakout Current Shiba Inu technical analysis reveals a cryptocurrency in transition. The RSI reading of 46. 72 positions SHIB in neutral territory, neither oversold nor overbought, which historically precedes significant directional moves. The MACD histogram showing 0. 0000 with bullish momentum suggests underlying strength.