BitMine Immersion Technologies’ executive chairman says ETH is beginning a bitcoin-style run as he highlights past drawdowns and patience.

Tag: institutional

Bitwise CEO Declares Bitcoin’s Four-Year Cycle Obsolete

The post Bitwise CEO Declares Bitcoin’s Four-Year Cycle Obsolete appeared com. Key Points: Bitwise CEO announces Bitcoin’s four-year cycle as outdated, highlighting post-ETF dynamics. New market structure reshapes crypto investment behavior. Bear market phase likely concluding, per on-chain and institutional data. On November 16, Bitwise CEO Hunter Horsley asserted on X that the traditional Bitcoin four-year cycle is obsolete due to new market dynamics post-Bitcoin ETF launch. This shift could disrupt Bitcoin’s market rhythm, as institutional flows redefine investment strategies and potentially stabilize previously volatile cycles. Impact of ETFs on Bitcoin’s Market Cycle He suggested a six-month bear market might be ending, aligning with expectations of renewed market structures and different participant behavior. Market reactions reflect the changing landscape, with institutional investors now playing a more prominent role in determining price movements. “What we’re talking about is the four-year cycle but the reality is, this pattern is based on a bygone era of cryptocurrency. Since the launch of the Bitcoin ETF and the appointment of a new management team, we have entered a new market structure: new participants, new dynamics, new reasons for people to buy and sell. I believe we have most likely already gone through a nearly six-month bear market and are about to emerge from it.” Hunter Horsley, CEO, Bitwise Asset Management Institutional Influence and Future Bitcoin Stability Did you know? Hunter Horsley’s statement on the obsolescence of Bitcoin’s four-year cycle points to the largest structural shift in crypto markets since the initial adoption of Bitcoin ETFs, potentially mitigating traditional price swings. According to CoinMarketCap, Bitcoin has a market cap of $1. 91 trillion, showing a moderate daily price change of 0. 30%. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 09: 07 UTC on November 16, 2025.

BullZilla Surges as Top Cryptos To Buy Before Christmas with 8 Game-Changing Picks For 2025

The post BullZilla Surges as Top Cryptos To Buy Before Christmas with 8 Game-Changing Picks For 2025 appeared com. Crypto Presales Discover BullZilla and seven more game-changing top cryptos to buy before Christmas with high ROI potential for 2025 investors. What if this Christmas isn’t just about gifts but about grabbing generational wealth? The crypto market is roaring back to life, setting the stage for a potential record-breaking bull run. According to CoinDesk and Messari, the global crypto market cap has soared beyond $2. 8 trillion, reflecting surging institutional and retail participation. With Bitcoin’s halving approaching and Ethereum’s Layer-2 expansion accelerating, investor optimism is rising across the board. Altcoins and structured presales are drawing attention for their explosive ROI potential, offering both innovation and accessibility. Analysts believe 2025 could deliver historic returns for early entrants, especially in presales that blend token utility, transparent economics, and strong community-driven momentum across decentralized ecosystems. Leading this pack is BullZilla (ZIL), a presale phenomenon turning viral excitement into a structured path to wealth creation. Now in Stage 10 (Castle Bravo), Phase 2, BullZilla trades at $0. 00025239, having already raised over $1 million with 31 billion tokens sold and a rapidly growing base of 3, 500+ holders. Its innovative HODL Furnace offers investors up to 70% APY, while the Progressive Price Engine ensures that every $100, 000 milestone triggers a price surge, with the next 2. 64% increase on the horizon. Combining deflationary tokenomics, transparent vesting, and community rewards, BullZilla isn’t just another meme project; it’s an ecosystem designed to empower early adopters chasing life-changing ROI before Christmas. BullZilla (ZIL): Frontlining the Top Cryptos to Buy Before Christmas BullZilla is redefining meme-coin investing by replacing luck with structure. Its ecosystem blends staking, referral bonuses, and scarcity mechanics that reward long-term believers. Now in Stage 10 (Castle Bravo) at $0. 00025239, BullZilla’s ROI potential stands at 1, 988. 59%, with early entrants from 10B enjoying possible 4, 289. 39% returns. The HODL Furnace fuels.

All the Reasons Analysts Say XRP Price Could Reach $5 Soon

The post All the Reasons Analysts Say XRP Price Could Reach $5 Soon appeared com. Several key metrics, including exchange supply and on-chain momentum, as well as network activity and regulatory breakthroughs, are looking up for the Ripple token, triggering renewed optimism across the XRP community. As supply dries up and technical momentum builds, analysts say the setup resembles the start of previous multi-week rallies that pushed XRP to new highs. 5 Reasons Why XRP Could Reach $5 in Q4 2025 The XRP token was trading for $2. 40 as of this writing, down by almost 5% in the last 24 hours. However, several metrics suggest that there is more upside potential, potentially reaching the $5 mark. Such a move would constitute a 108. 3% move above the current price. Sponsored Sponsored Ripple (XRP) Price Performance. 1. Exchange Balances Hit Record Lows Citing data from Glassnode, data shared by market analyst Steph is Crypto shows that more than 216 million XRP, valued at $556 million, were withdrawn from exchanges this week. “Confidence is back!” the analyst wrote on X (Twitter), highlighting a historic drawdown in available supply. XRP exchange balances. Conversely, moving tokens to exchanges often suggests intention to sell, with the resulting bearish sentiment impeding potential for a rally. Sponsored Sponsored 2. On-Chain Momentum Mirrors 75% Rally Setup Further, trader Onur pointed out that XRP’s Cumulative Volume Delta (CVD), a metric tracking buy-sell pressure, has just flipped bullish for the first time in months. “A textbook cup-and-handle setup is forming, with a clean technical breakout pointing toward $5,” he said. “Last time the spot taker CVD flipped this bullish, XRP rallied 75% in weeks.”.

Historic Moment Has Arrived: XRP Spot ETF Will Soon Begin Trading – Here’s the Date and Time

The post Historic Moment Has Arrived: XRP Spot ETF Will Soon Begin Trading Here’s the Date and Time appeared com. The cryptocurrency market has experienced a long-awaited development. According to a new filing with the U. S. Securities and Exchange Commission (SEC), the Canary XRP ETF, managed by Canary Capital Group LLC, has surpassed a critical threshold in its official listing process. According to cryptocurrency reporter Eleanor Terrett, the company has filed its Form 8-A with the SEC, which is required for the ETF to be listed. This filing is known as one of the final steps for a security to be traded on US exchanges. Terrett said in a statement: CanaryFunds has filed Form 8-A. The product officially becomes active once Nasdaq approves the listing on Thursday at 1: 30 AM UTC+3, 5: 30 PM ET. Once this happens, the final hurdle will be cleared, and the first XRP spot ETF will begin trading at market open on Thursday. The documents indicate that the Canary XRP ETF has been registered for listing on Nasdaq Stock Market LLC. The registration is made under the class “Beneficial Interest Common account now for exclusive news, analytics and on-chain data! Source:.

DBS and J.P. Morgan’s Kinexys develop interoperability framework for tokenized deposits

The post DBS and J. P. Morgan’s Kinexys develop interoperability framework for tokenized deposits appeared com. Today, Singapore’s DBS Bank and Kinexys, a J. P. Morgan company, have collaborated to create an interoperability framework that facilitates tokenized value transfers between their respective on-chain ecosystems. According to the press release, the framework seeks to establish a new industry standard for the real-time, international settlement of tokenized deposits in both public and permissioned blockchains. The framework, which is still under development, will enable transactions between clients of Kinexys Digital Payments and DBS Token Services on both public and permissioned blockchain networks. According to the framework, on the public base blockchain, a JP Morgan institutional client would use JP Morgan Deposit Tokens (JPMD) to pay a DBS client. Additionally, after receiving the JPMD tokens, the DBS client would have the option to convert them into DBS tokens or redeem them for fiat money. According to DBS, the goal is to build a framework that others can use. Notably, the framework is designed to work across different blockchain environments. DBS and Kinexys unite to boost interoperability framework Rachel Chew, Group Chief Operating Officer and Head of Digital Currencies, Global Transaction Services, DBS Bank, said that businesses can navigate global risks and seize new opportunities with the optionality, agility, and speed that instant 24/7 payments offer. Chew claimed that interoperability is still essential to minimizing fragmentation. She added that interoperability guarantees the safe cross-border transfer of the full value as the digital asset ecosystem expands. “Our collaboration with Kinexys by J. P. Morgan to develop an interoperability framework is therefore a significant milestone for cross-border money movement, with the potential to pave the way for future partnerships.” -Rachel Chew, Group Chief Operating Officer and Head of Digital Currencies, Global Transaction Services, DBS Bank. Naveen Mallela, global co-head of Kinexys, stated that collaborating with DBS on the project is a clear example of how.

Press Release: Board of Regents Names Dr. Alan LaFave as Next President of Northern State University

Board of Regents Names Dr. Alan LaFave as Next President of Northern State University PIERRE, S. D. The South Dakota Board of Regents is pleased to announce the appointment of Alan D. LaFave, D. M. A., as the next President of Northern State University (NSU) in Aberdeen, beginning this January. Dr. LaFave returns to his alma mater and [.].

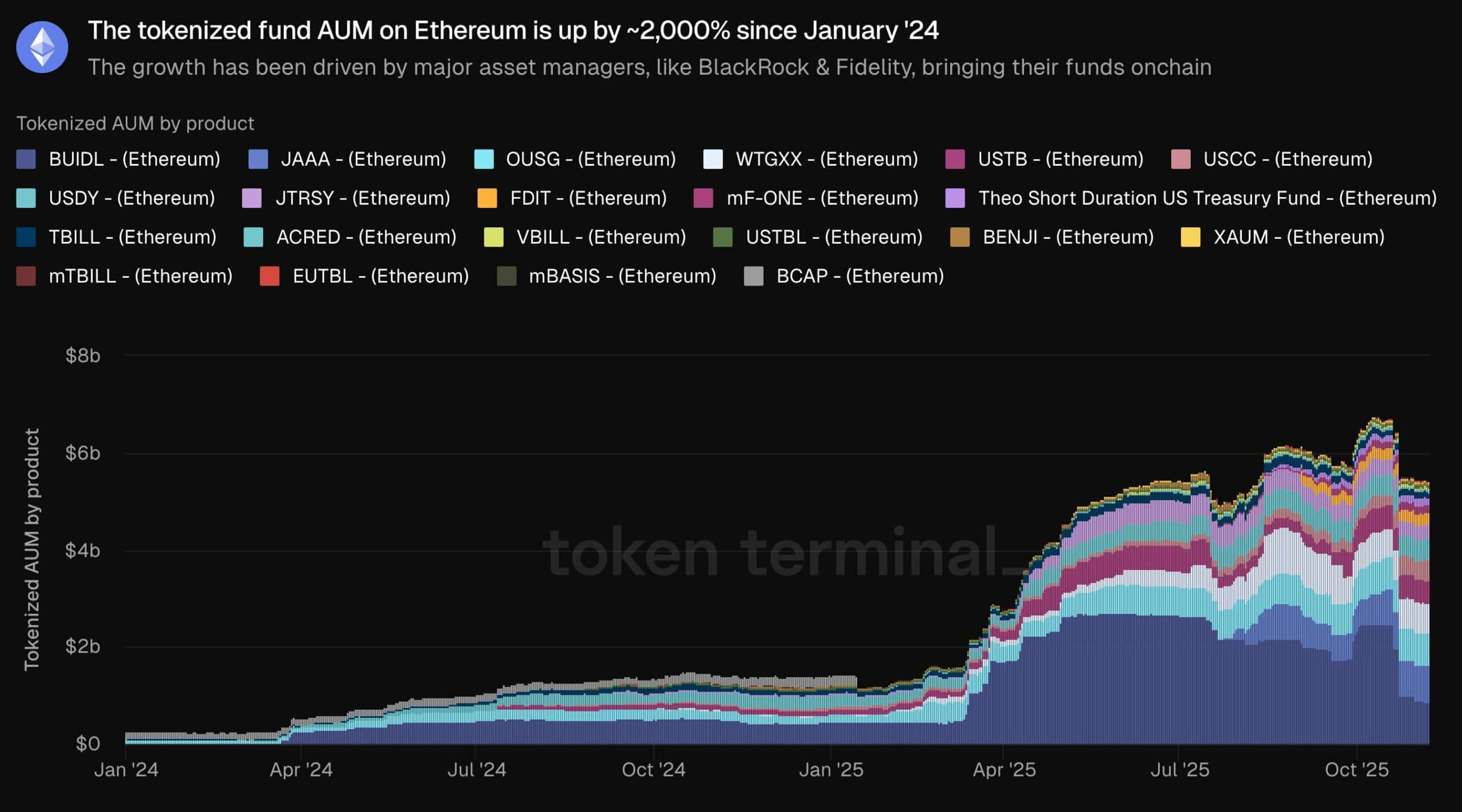

Ethereum On-Chain Surge via PYUSD and Tokenized Funds May Face Price Headwinds Below $3,500

com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Ethereum’s on-chain growth in 2025 is fueled by surging stablecoin activity and tokenized asset adoption. PayPal’s PYUSD stablecoin reached $18. 6 billion in transfer volume, while tokenized funds saw a 2, 000% increase since early 2024, driven by institutions like BlackRock and Fidelity. PayPal’s PYUSD stablecoin volume hits $18. 6 billion, boosting Ethereum’s payment infrastructure. Tokenized funds on Ethereum surge 2, 000% year-over-year, signaling mainstream financial integration. Despite on-chain momentum, ETH price hovers below $3,500 with neutral derivatives indicators. Ethereum on-chain growth in 2025 accelerates with PYUSD’s $18. 6B milestone and tokenized funds boom. Explore how these trends shape ETH’s future-stay ahead in crypto finance today. What is Driving Ethereum’s On-Chain Growth in 2025? Ethereum on-chain growth in 2025 is primarily propelled by the rapid expansion of stablecoin usage and real-world asset tokenization. Institutions are increasingly leveraging Ethereum’s network for efficient, secure transactions, with PayPal’s PYUSD stablecoin achieving $18. 6 billion in transfer volume. This shift marks a pivotal moment as traditional finance converges with blockchain technology. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior traders, research‑backed setups,.

Ripple IPO Plans Off Despite SEC Case Win And Record Growth

The post Ripple IPO Plans Off Despite SEC Case Wcom. Ripple, the US blockchain company behind the XRP cryptocurrency, will not pursue an initial public offering following the conclusion of its years-long legal battle with the Securities and Exchange Commission. Ripple president Monica Long said the company has no plans or timeline for an IPO, according to a Bloomberg report on Wednesday. “We’re in a fortunate position where we’ve been able to be very well capitalized and fund all of our organic growth, inorganic growth, strategic partnerships, anything we want to do,“ Long said. Ripple’s decision to forgo an IPO ends years of speculation, after multiple executives had hinted at one. The company was hit with a $1. 3 billion SEC lawsuit in late 2020. Ripple doesn’t report revenue As a private company, Ripple doesn’t publish full annual profit or revenue. According to estimations by the market intelligence platform CBI Insights, Ripple’s 2024 revenue was $1. 3 billion. Long declined to share 2024 revenue in the report but said the company doubled its customers, driven by Ripple USD (RLUSD) stablecoin adoption and greater regulatory clarity globally. Related: Ripple’s RLUSD enters top 10 USD stablecoins less than year after debut The raise follows Ripple’s “strongest year to date” and a $1 billion tender offer, valuing the company at $40 billion. “As Ripple continues its record year of growth, providing liquidity for shareholders and employees remains a priority,” Ripple said in the $500 million raise announcement, adding that it has repurchased more than 25% of its outstanding shares in recent years. Ripple CEO Brad Garlinghouse announced that the SEC was dropping its multi-year action against the company in March. He previously hinted at a.

Ripple News: Ripple Confirms No IPO Timeline After $500 Million Funding Round

The post Ripple News: Ripple Confirms No IPO Timeline After $500 Millicom. Ripple has “no plans or timeline” for an IPO, President Monica Long stated. This follows a $500 million funding round valuing it at $40 billion. Ripple President Monica Long made a significant announcement. At the Swell conference in New York, she stated the company has “no plans or timeline” for an IPO. This means no intention for the short term. As a result, Ripple will not be participating in other crypto companies going public. Ripple Dismisses Market Rumors of Imminent Public Listing Her comments come after a recent funding round of $500 million. This seed funding greatly boosted Ripple’s valuation. The company is currently valued at $40 billion. Therefore, this statement implies that Ripple will continue to remain private. Related Reading: Ripple News: Ripple Hits $40 Billion Valuation After $500 Million Strategic Funding Round | Live Bitcoin News Bloomberg talked to Monica Long, who only said: “We don’t have an IPO timeline.” She repeated “No plan, no timeline.” This clarity dispenses with the constant market speculation. According to a Bloomberg report, Ripple is not going to follow other digital asset companies. Many are looking for public listings. As a result, Long pointed out the company’s internal priorities. They are focusing on internal growth and building their ecosystem. This focus is more important than an IPO. Her comments rule out market speculation. These rumors indicated that Ripple would be going public soon. Thus, the company is taking its own path. Earlier this year, investors from around the world came in for Ripple’s latest round of funding. This private financing was a major driving force behind its valuation. It was the company’s initial public offering in six years. It was also its biggest capital injection since 2019. The US $500 million investment was participated in by well-known companies. The round was led.