American Century Growth Fund Q3 2025 Portfolio Review

Tag: expectations

World markets jump on stronger U.S. shutdown truce, softer dollar

The post World markets jump on stronger U. S. shutdown truce, softer dollar appeared com. Global market sentiment improved on Monday after U. S. Senate lawmakers late Sunday moved a procedural vote forward to advance legislation to end the ongoing government shutdown, according to CNBC. The vote came after weeks of stalled talks in Washington that had restricted access to federal economic data. The lack of data had made it harder for traders to evaluate interest rate expectations. The new progress immediately showed in U. S. stock futures, which had finished the prior week under pressure from concerns tied to high artificial intelligence stock valuations. S&P 500 futures surged by 0. 76%, Dow Jones futures added 112 points or 0. 24%, and Nasdaq-100 futures rallied by 1. 29% during early Monday trading. Last week had been rough for major indexes, with the Nasdaq Composite recording its worst weekly performance since April, crashing by 3%, while the S&P 500 declined by 1. 6%, and the Dow Jones Industrial Average fell by 1. 2%. Asia stocks are posting broad gains after selloff pressure eased Across Asia-Pacific, equities also moved higher on Monday. South Korea’s Kospi rose 3. 02% to 4, 073. 24. The Kosdaq gained 1. 32% to 888. 35. Major names advanced, with Samsung Electronics higher by 2. 76% and SK Hynix up 4. 48%. SK Inc, the holding company for one of the country’s largest chaebols, rallied by 9. 29%. GS Holdings, active in energy, retail, and construction, climbed 11. 79%. In Japan, the Nikkei 225 gained 1. 26% to 50, 911. 76, and the Topix index rose 0. 56% to 3, 317. 42. 10-year Japanese government bond yields touched 1. 7%, their highest level since October. Hong Kong’s Hang Seng added 1. 54%, and China’s CSI 300 increased 0. 17%. Australia’s S&P/ASX 200 moved up 0. 75% to 8, 835. 9. In India, the Nifty 50 gained 0. 54%, while the Sensex added 0. 52%. In Europe, the Stoxx 600 index rose 1% during the morning session. The FTSE in the United Kingdom increased.

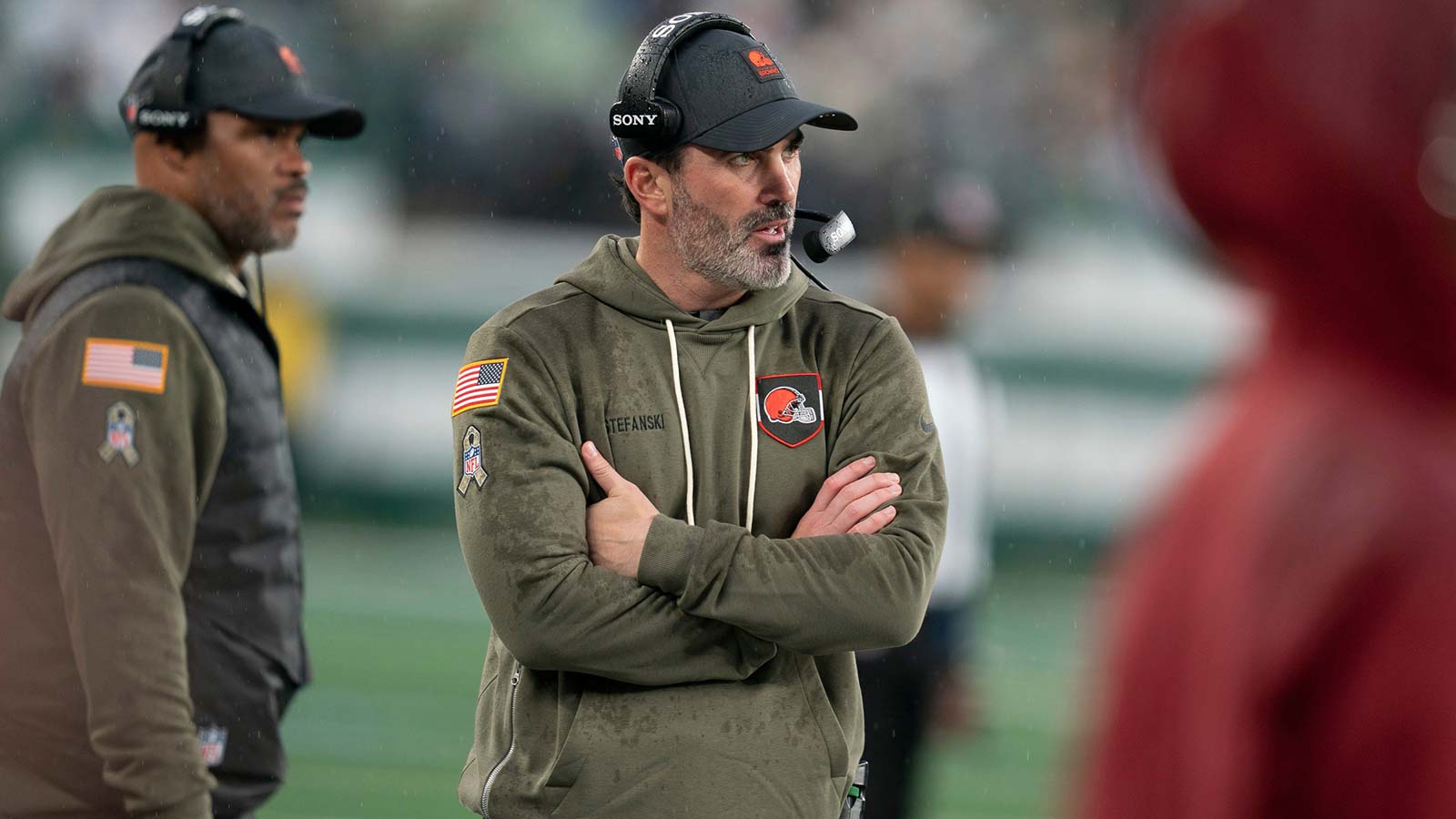

Browns’ loss to Jets snaps insane 225-game NFL streak

The Cleveland Browns’ Week 10 loss to the New York Jets was somehow even worse than it initially seemed. The Browns entered Week 10 with a 2-6 record and with their expectations already lowered to the floor. However, many fans expected them to beat the 1-7 Jets, who just traded away Sauce Gardner and Quinnen [.] The post Browns’ loss to Jets snaps insane 225-game NFL streak appeared first on ClutchPoints.

Crypto Markets Post Friday Recovery After Week of Heavy Losses

TLDR Bitcoin recovered above $103,000 on Friday after dropping to $99,000 earlier in the week, posting a 2% gain in 24 hours Altcoins showed stronger bounces with Ethereum, XRP, and Solana up 4-5%, while Dogecoin and Cardano gained 12% and 9% respectively University of Michigan Consumer Sentiment Survey fell to 50. 3 in November from 53. 6, [.] The post Crypto Markets Post Friday Recovery After Week of Heavy Losses appeared first on CoinCentral.

Marvel 1943: Rise of Hydra delayed ‘beyond early 2026’

Marvel 1943: Rise of Hydra delayed ‘beyond early 2026’

B2Gold Corp. (BTO:CA) Q3 2025 Earnings Call Transcript

B2Gold Corp. (BTO:CA) Q3 2025 Earnings Call Transcript

Snapchat (SNAP) Q3 2025 earnings results beat revenue estimates on smaller than expected loss

Snapchat (SNAP) Q3 2025 earnings results beat revenue estimates on smaller than expected loss

Unity (U) Q3 2025 earnings results beat EPS and revenue expectations

Unity (U) Q3 2025 earnings results beat EPS and revenue expectations

Qualcomm (QCOM) Q4 FY25 earnings results beat revenue expectations, EPS hit by $6 billion tax charge

Qualcomm (QCOM) Q4 FY25 earnings results beat revenue expectations, EPS hit by $6 billion tax charge

Bitcoin Plunges Below $100,000 As Market Turmoil Continues

The post Bitcoin Plunges Below $100,000 As Market Turmoil Continues appeared com. Nov 04, 2025 at 23: 06 // News The crypto market experienced a dramatic downturn on November 4, 2025, as Bitcoin (BTC) briefly retreated below the critical psychological threshold of $100,000 for the first time since June. The scale of the sell-off Bitcoin dipped as low as $99,982 before bouncing back slightly, marking a daily drop of over 5% and placing the asset on the cusp of bear market territory (a 20% drop from the record high of $126,272 set in early October). The sharp price drop triggered another massive liquidation event, with over $1. 37 billion in leveraged long positions being wiped out across exchanges, contributing to the selling pressure. Underlying causes Market analysts pointed to continued investor caution following the prior month’s severe “flash crash” that erased nearly $400 billion from the total market cap. Furthermore, a perceived hawkish stance from the U. S. Federal Reserve, cooling expectations for a December interest rate cut, was seen as reducing risk appetite across all momentum trades, including crypto, gold, and tech stocks. This market movement confirmed the fragility of investor sentiment and the high leverage still present in the system, even after previous major corrections. The total market capitalization of all tokens tracked by CoinGecko dropped to approximately $3. 45 trillion. The event highlighted that while institutional adoption is growing, the market remains highly sensitive to macro-economic data and liquidity concerns. Source:.