10 years ago, Kapil Sharma made a rocking debut in Hindi films with Kis Kisko Pyaar Karoon (2015). It surprised the trade and industry as it opened in double digits, at Rs. 10. 15 crores. As a result, expectations are tremendous for its second part, titled Kis Kisko Pyaar Karoon 2. Bollywood Hungama has learned that the trailer will be launched in 2 days from now. A source told Bollywood Hungama, “The theatrical trailer of Kis Kisko Pyaar Karoon 2 will be unveiled on Wednesday, November 26, at a grand event in Mumbai. It will be graced by lead actor Kapil Sharma, Manjot Singh and his four heroines, namely, Warina Hussain, Ayesha Khan, Tridha Choudhury and Parul Gulati. Director Anukalp Goswami and producers Ratan Jain, Ganesh Jain and Abbas-Mustan are also expected to be present.”The source further said, “The makers are happy with the way Kis Kisko Pyaar Karoon 2 has shaped up and are excited to launch the trailer in a big way. Hence, they have decided to go all out for the event. Moreover, Kapil’s presence is bound to add to the fun as he’s known for his quick-witted humour.”Kis Kisko Pyaar Karoon 2 releases in cinemas on December 12, 2025. The source said, “Star Studio18 has backed the film and they will also be releasing it in cinemas. The film is going to get a solo release and the team is already working to ensure that the comic caper gets the correct release nationwide, especially in the mass centres, where the first part did extremely well.”Kis Kisko Pyaar Karoon’s first part told the story of a man who reluctantly gets married thrice. How he manages his three wives, ensuring that they don’t find out the truth, while also dealing with his girlfriend, formed the crux of the film. The sequel is expected to be on the same lines and this time, the laughter quotient is expected to be more, according to the insiders. Also Read: Parul Gulati seeks blessings at Golden Temple ahead of the release of Kis Kisko Pyaar Karoon 2 with Kapil Sharma.

Tag: expectations

The Assassin’s Creed franchise exceeded Ubisoft’s H1 2025-26 expectations

Assassin’s Creed Shadows drove strong performance for the AC franchise in the first half of the fiscal year.

The Assassin’s Creed franchise exceeded Ubisoft’s H1 2025-26 expectations

Assassin’s Creed Shadows drove strong performance for the AC franchise in the first half of the fiscal year.

EUR/USD pressured as USD gains traction on uneven data and Fed divide

The post EUR/USD pressured as USD gains traction on uneven data and Fed divide appeared com. EUR/USD posts moderate losses during the North American session on Friday as the US Dollar (USD) holds firm after the release of mixed economic data and dovish comments by Federal Reserve (Fed) officials. The pair trades at 1. 1504, down 0. 20%, after hitting a two-week low of 1. 1491. Euro retreats 0. 20% as weak US sentiment contrasts with firmer PMIs, markets rise December cut odds Data in the US was mixed, yet the economy shows signs of resilience. The S&P Global Manufacturing and Services PMIs were mixed in November but revealed that business confidence had improved. Other data showed that American households turned pessimistic about the economic outlook, according to the University of Michigan (UoM) Consumer Sentiment for November. Sentiment hit its lowest level since 2009, as consumers remain frustrated about high prices and weakening incomes. After the data, the EUR/USD’s reaction was muted, as traders digested mixed comments from many Federal Reserve officials. Dovish comments from New York Fed President John Williams and Governor Stephen Miran boosted investor expectations for a 25-basis-point rate cut at the December meeting. Conversely, Boston Fed President Susan Collins and Dallas Fed President Lorie Logan argued for maintaining a restrictive policy stance, signaling support for keeping rates unchanged. Given the backdrop, market participants had priced in a 71% chance of a December rate cut, a sharp jump from around 31% earlier in the day. Daily market movers: Euro’s tumble despite Fed’s dovish tilt New York Fed President John Williams said policymakers could still cut rates in the “near-term,” a remark that lifted market odds for a December move. Echoing that tone, Fed Governor Stephen Miran said that Thursday’s Nonfarm Payrolls data supports a December rate cut, adding that if his vote were decisive, he “would vote for a 25-bps cut.” On the other side, Dallas Fed.

Bitwise XRP ETF Hits $107 Million Inflows on First Day

The Bitwise spot XRP ETF has recorded significant inflows and trading volume on its first day of launch, further igniting confidence in XRP-based investment products.

Silver dips as US Dollar strength, rate cut doubts weigh on gains

The post Silver dips as US Dollar strength, rate cut doubts weigh on gains appeared com. Silver (XAG/USD) trades around $50. 80 on Thursday at the time of writing, down 0. 70% on the day. The white metal is paring part of the earlier weekly advance, after prices briefly tested the $52. 00 area before being rejected as the US Dollar (USD) regained strength. The renewed firmness of the US Dollar is weighing across the commodities space, as investors reassess the likelihood of another Federal Reserve (Fed) rate cut in December. The Federal Open Market Committee (FOMC) Minutes released on Wednesday revealed significant resistance within the committee to further easing, reducing expectations for additional cuts and limiting the appeal of non-yielding precious metals. Silver is also affected by the broad market pause ahead of the delayed Nonfarm Payrolls (NFP) report for September due later in the day. The Bureau of Labor Statistics (BLS) confirmed that the October report will be published together with November’s data due to the government shutdown, reducing short-term macro visibility. Markets will therefore focus on the available indicators, including jobless claims, hourly earnings and participation, which could help shape rate expectations ahead of the December Fed meeting. Meanwhile, improved risk appetite following Nvidia’s strong earnings has triggered a modest rotation out of safe-haven assets, weighing on demand for Silver. Silver Technical Analysis: XAG/USD compresses between falling resistance and rising support Silver 4-hour chart. 80, down for the day by $0. 47 from the opening price. The 100-period Simple Moving Average (SMA) rises to $49. 85, and price remains above it, suggesting underlying support. The Relative Strength Index (RSI) stands at 47, neutral and pointing to fading momentum. A descending trend line from $54. 39 caps gains with resistance near $51. 77, while a rising line from $45. 56 underpins the price around $49. 74. A topside break of the descending barrier could.

Internet Computer bulls reclaim $5.5 – Why ICP may not revisit $5 this week

The post Internet Computer bulls reclaim $5. 5 Why ICP may not revisit $5 this week appeared com. Journalist Posted: November 19, 2025 Key Takeaways Why is ICP a potential buying opportunity? Internet Protocol has outperformed many altcoins over the past 24 hours, posting strong double-digit percentage gains. This relative strength shows that a rally to $9. 8 is likely. What is the invalidation for ICP bulls already in swing positions? The $5. 1-$5. 5 was a local demand zone that has been retested in recent hours. It was unlikely that the price would drop lower in the coming days. Internet Computer [ICP] rallied 17% on the 18th of November, and could climb even higher. The daily session was not yet closed at the time of writing. Also, the high daily trading volume of $858 million indicated heavy demand. However, Coinalyze data showed the Funding Rate was negative, even as prices climbed higher. This was a sign of a short squeeze. The market had been overly pessimistic during the retest of the $5. 5 local resistance. A continued price move higher would force these short positions to close, spurring prices higher. What was the importance of $5. 5, and why was the market convinced to take bearish positions? 3 was ripe for a bullish reversal. It also had confluence with the former resistance zone at the same level as in October. It could be that during the price bounce in recent hours, some market participants expected $4. 3 to be.

GBP/USD holds near 1.3160 as traders wait for NFP and UK CPI

The post GBP/USD holds near 1. 3160 as traders wait for NFP and UK CPI appeared com. The Pound Sterling is steady on Tuesday as traders shift worried about the economic outlook in the US and market participants eyeing crucial NVIDIA earnings for Q3, keeping US equity markets in the red. The GBP/USD trades at 1. 3156 virtually unchanged. Sterling trades steady despite softer US data and rising Fed cut expectations, with UK inflation and Autumn Budget in focus The US Department of Labor revealed that Initial Jobless Claims for the week ended October 18 were 232K, while continuing claims rose to 1. 957 million. GBP/USDs was muted on its release with traders eyeing Nonfarm Payrolls data on Thursday. Expectations that the Federal Reserve would cut rates at the December meeting stand at 55%, higher than last week’s below 50% chances, according to Prime Market Terminal data. Alongside this, traders are awaiting British inflation figures, which could potentially impact the Bank of England’s path on interest rates. Money markets are expecting a rate cut with odds standing at 83%. Recently BoE Chief Economist Huw Pill said measures related to inflation had not slowed as much as he would expect in the past. He said that “I think policymakers should be cautious about over-interpreting the latest news in data, because there is a lot of noise in the data flow, and partly because of some of the challenges our colleagues in the Office for National Statistics have faced.” Traders are also awaiting the release of the Autumn Budget in November 26. Chancellor Rachel Reeves is expected to raise tens of billions of pounds to meet her fiscal goals, according to analysts. GBP/USD Price Forecast: Technical outlook The GBP/USD daily chart shows the pair consolidating after forming back-to-back doji’s below the 20-day Simple Moving Average (SMA) at 1. 3185, acting as key resistance. A breach of the latter clears the path to.

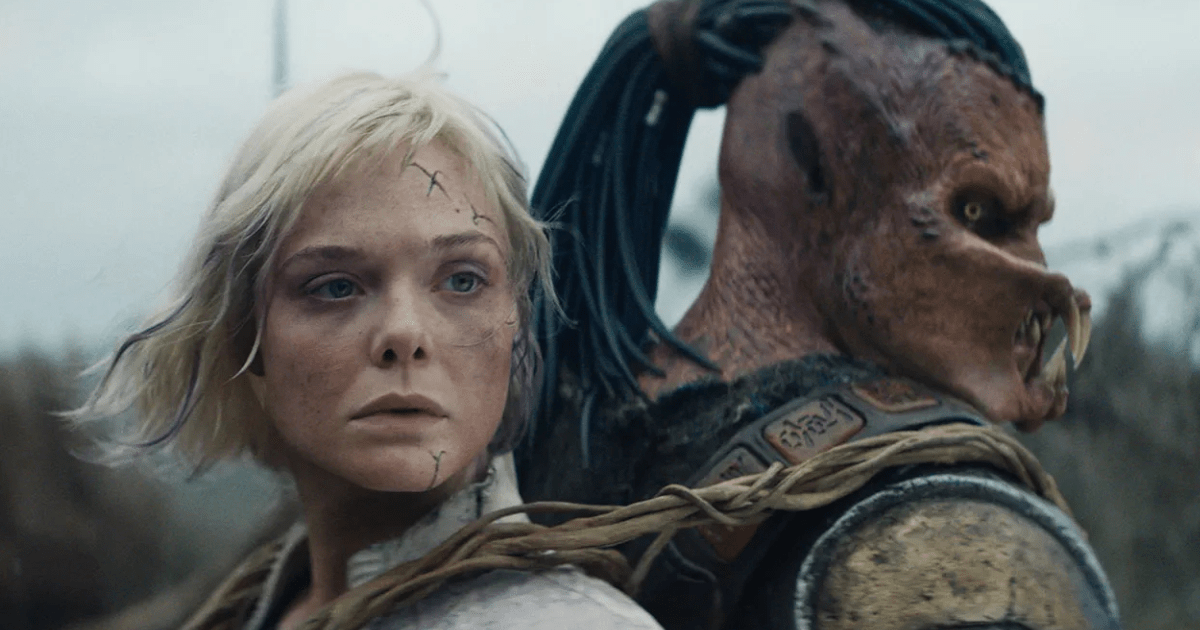

Predator: Badlands’ 2nd Weekend Box Office Succumbs to Competition

With Predator: Badlands entering its second weekend, its box office performance has become a key focus among industry observers. The film’s follow up numbers drew attention after its strong debut frame. Its sharp weekend decline also raised interest in how it stacks against other major titles now in release. The movie is being tracked closely [.] The post Predator: Badlands’ 2nd Weekend Box Office Succumbs to Competition appeared first on ComingSoon. net Movie Trailers, TV & Streaming News, and More.

Bitwise CEO Declares Bitcoin’s Four-Year Cycle Obsolete

The post Bitwise CEO Declares Bitcoin’s Four-Year Cycle Obsolete appeared com. Key Points: Bitwise CEO announces Bitcoin’s four-year cycle as outdated, highlighting post-ETF dynamics. New market structure reshapes crypto investment behavior. Bear market phase likely concluding, per on-chain and institutional data. On November 16, Bitwise CEO Hunter Horsley asserted on X that the traditional Bitcoin four-year cycle is obsolete due to new market dynamics post-Bitcoin ETF launch. This shift could disrupt Bitcoin’s market rhythm, as institutional flows redefine investment strategies and potentially stabilize previously volatile cycles. Impact of ETFs on Bitcoin’s Market Cycle He suggested a six-month bear market might be ending, aligning with expectations of renewed market structures and different participant behavior. Market reactions reflect the changing landscape, with institutional investors now playing a more prominent role in determining price movements. “What we’re talking about is the four-year cycle but the reality is, this pattern is based on a bygone era of cryptocurrency. Since the launch of the Bitcoin ETF and the appointment of a new management team, we have entered a new market structure: new participants, new dynamics, new reasons for people to buy and sell. I believe we have most likely already gone through a nearly six-month bear market and are about to emerge from it.” Hunter Horsley, CEO, Bitwise Asset Management Institutional Influence and Future Bitcoin Stability Did you know? Hunter Horsley’s statement on the obsolescence of Bitcoin’s four-year cycle points to the largest structural shift in crypto markets since the initial adoption of Bitcoin ETFs, potentially mitigating traditional price swings. According to CoinMarketCap, Bitcoin has a market cap of $1. 91 trillion, showing a moderate daily price change of 0. 30%. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 09: 07 UTC on November 16, 2025.