The post Strategic Arthur Hayes LDO Deposit Reveals Crypto Whale Movement Patterns appeared com. Cryptocurrency markets are buzzing with news that BitMEX founder Arthur Hayes made a significant Arthur Hayes LDO deposit to Wintermute, moving 320, 000 LDO tokens worth approximately $239,000. This transaction represents just one piece of a larger puzzle, as the prominent crypto figure has executed over $7. 4 million in token sales across multiple assets in recent days. What Does the Arthur Hayes LDO Deposit Mean for Markets? The Arthur Hayes LDO deposit to Wintermute raises important questions about market maker relationships and token strategy. Wintermute serves as a major liquidity provider in crypto markets, making this Arthur Hayes LDO deposit particularly noteworthy for several reasons: Market makers often facilitate large trades Institutional relationships can signal broader strategies Timing may coincide with market conditions Understanding the Broader Trading Pattern This Arthur Hayes LDO deposit forms part of a comprehensive trading strategy that has seen substantial activity across multiple tokens. According to Onchain Lens reports, the wallet address associated with Hayes has executed significant transactions involving: Ethereum (ETH) Ethena (ENA) Lido DAO (LDO) Aave (AAVE) Uniswap (UNI) Why Should Crypto Investors Monitor Whale Movements? The Arthur Hayes LDO deposit exemplifies why tracking major wallet activity provides valuable market intelligence. Large transactions often precede price movements and can indicate shifting institutional sentiment. However, it’s crucial to remember that individual trades don’t necessarily predict market direction. What Makes Lido DAO Tokens Significant? LDO tokens represent governance rights in Lido Finance, a leading liquid staking protocol. The Arthur Hayes LDO deposit comes at a time when liquid staking continues to gain traction across Ethereum and other proof-of-stake networks. This Arthur Hayes LDO deposit transaction highlights the ongoing institutional interest in DeFi governance tokens. Key Takeaways from Recent Whale Activity The pattern emerging from Hayes’ recent transactions suggests strategic portfolio rebalancing rather than outright market exit. The.

Tag: cryptocurrency

$1.15 Billion Robotics Startup Deal That Could Reshape Crypto

The post $1. 15 Billicom. In a groundbreaking move that could reshape the cryptocurrency landscape, Tether is reportedly considering a massive $1. 15 billion investment in German robotics startup Neura. This potential Tether investment represents one of the largest crypto-to-traditional-tech moves in recent history, signaling a bold expansion strategy from the world’s largest stablecoin issuer. Why Is This Tether Investment So Significant? The potential $1. 15 billion Tether investment in Neura marks a strategic pivot beyond traditional cryptocurrency domains. Tether, primarily known for its USDT stablecoin, has been actively diversifying its portfolio across multiple sectors. This particular investment would represent their largest single commitment to date in the robotics and artificial intelligence space. According to industry reports, discussions between Tether and Neura remain in early stages. However, the implications are substantial. If finalized, this Tether investment could catapult Neura’s valuation to between $9. 3 billion and $11. 6 billion, creating one of Europe’s most valuable robotics companies overnight. What Does This Mean for Tether’s Investment Strategy? Tether’s investment approach has evolved significantly over recent years. The company has already invested in 140 companies across various sectors including: Bitcoin mining operations Energy sector companies Financial technology firms Artificial intelligence startups This potential robotics investment demonstrates Tether’s commitment to diversifying beyond cryptocurrency. The move aligns with their broader strategy of building a comprehensive technology ecosystem rather than focusing solely on digital assets. How Could This Tether Investment Impact the Robotics Industry? The massive scale of this Tether investment could trigger significant changes in the robotics sector. Neura, as a German startup, would gain unprecedented resources to accelerate its research and development efforts. Moreover, the validation from a major cryptocurrency player could attract additional blockchain and crypto investors to the robotics space. This Tether investment also highlights the growing convergence between cryptocurrency wealth and cutting-edge technology development. The influx of crypto capital.

9 Trending Digital Golds: Next Crypto to Explode

The post 9 Trending Digital Golds: Next Crypto to Explode appeared com. Crypto Presales Explore 9 trending digital assets and why Apeing (PEING) could be the next crypto to explode, plus how to join the whitelist for early entry. Get ready to catch the wave with Apeing, the next crypto to explode! Designed for movers and shakers who jump in while others hesitate, Apeing (PEING) brings the thrill of bold action with a community that’s all about holding tight through market storms. With easy whitelist access and plans for real growth, Apeing offers a fresh, exciting chance to join a token built for those who don’t just watch the market, they own it. Leading the latest wave of crypto excitement, Apeing (PEING) takes center stage for early movers ready to act while others hesitate. Peanut the Squirrel draws in fans with its emotional story, and Pudgy Penguins combines NFTs with gamified experiences. Cheems mixes humor with deflationary mechanics, while Cheems Snek, Mog Coin, and Dogwifhat ride viral meme energy. SPX6900 thrives on community belief, and Fartcoin and Snek generate hype through pure cultural virality. Together, these coins are capturing degen imaginations everywhere. Apeing (PEING): Igniting the Crypto Wildfire Apeing (PEING) is a new meme cryptocurrency designed for investors who want to act fast and join a growing community. Unlike complex crypto, Apeing is easy to understand and participate in, making it accessible for both beginners and experienced traders. Its focus is on early involvement, holding, and community engagement, rather than complicated financial products or advanced technology. The token rewards those who move quickly and join the conversation, encouraging users to connect, share, and take part in fun, community-driven activities. With a vibrant and active community, Apeing blends humor, excitement, and high-energy participation, making it one of the most talked-about tokens in the current crypto scene. The Fast Track: Your Guide to the.

Significant Difference Between Bitcoin Investors and Ethereum Investors Emerged This Week – Here’s What It Is

The post Significant Difference Between Bitcoin Investors and Ethereum Investors Emerged This Week Here’s What It Is appeared com. A new report from blockchain analysis firm Glassnode has revealed that Ethereum investors are less willing to hold onto their coins than Bitcoin holders. While BTC is still held by the crypto market’s “real diamond hands” thanks to its low volatility, ETH is moved and spent at a much higher rate, according to the report. Glassnode stated that it made these findings using data collected before the cryptocurrency crash earlier this week. The company argued that Bitcoin acts as a “digital savings asset” while Ethereum, due to its broad range of uses, qualifies as “digital oil.” The report claimed that BTC is significantly less mobile and is being held by investors for long-term safekeeping: “Bitcoin is behaving as a digital savings asset, as designed; coins are widely hoarded, turnover is low, and supply is increasingly directed to long-term storage rather than exchanges.” On the Ethereum side, the picture is quite different. ETH is much more actively used due to smart contracts, DeFi protocols, tokenization, and gas fees: “Ethereum’s behavior reflects its nature as a smart contract platform with high transaction volume. There’s a large base of native staking, and the investor component has been further strengthened by the introduction of ETFs.” Glassnode noted that smart contracts, in particular, have significantly increased ETH usage. ETH is spent as gas fees across a wide range of use cases, from DeFi transactions to stablecoin transfers to decentralized exchange token swaps. One of the report’s notable findings was the long-term coin movement. According to the data: “Long-term ETH holders are mobilizing their coins 3x faster than BTC holders.” Although ETH is not as passive an asset as Bitcoin, Glassnode noted that the store of value aspect of Ethereum should not be completely ignored: “One in four ETH in circulation is locked in native staking.

Bitcoin To Eclipse Gold, Eric Trump Says—Calling BTC The ‘Greatest Asset’ Ever

The post Bitcoin To Eclipse Gold, Eric Trump Says-Calling BTC The ‘Greatest Asset’ Ever appeared com. They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit.

Cardano’s Charles Hoskinson Calls for ‘Gigachad Bullrun’

Cardano founder Charles Hoskinson has issued a hot take containing a brutal truth to the community while calling for a “gigachad bullrun.”.

BTC Price Prediction: Bitcoin Eyes $125,000 Target by December 2025 Despite Short-Term Correction Risk

The post BTC Price Prediction: Bitcoin Eyes $125,000 Target by December 2025 Despite Short-Term Correcticom. Ted Hisokawa Nov 15, 2025 14: 53 Bitcoin technical analysis suggests potential correction to $94,000 before rallying toward $125,000-$134,000 range by year-end, with RSI oversold presenting buying opportunity. Bitcoin continues to navigate a complex technical landscape as we approach the final quarter of 2025. With the cryptocurrency trading at $96,305 after a recent pullback from its 52-week high of $124,658, our comprehensive BTC price prediction analysis reveals a mixed but ultimately bullish outlook for the world’s largest cryptocurrency. BTC Price Prediction Summary • BTC short-term target (1 week): $94,000-$101,833 (-2. 4% to +5. 7%) • Bitcoin medium-term forecast (1 month): $115,000-$125,000 range • Key level to break for bullish continuation: $116,400 (immediate resistance) • Critical support if bearish: $94,012 (strong support coinciding with lower Bollinger Band) Recent Bitcoin Price Predictions from Analysts The latest Bitcoin forecast from market analysts presents a fascinating dichotomy. Finbold’s AI prediction agent suggests a conservative BTC price prediction of $101,833 by November 30, representing only a modest 5. 7% upside from current levels. This contrasts sharply with Aurpaytech’s more aggressive Bitcoin forecast calling for $125,000-$134,000 by mid-November, based on historical November performance averaging 42. 5% gains since 2013. Bitrue’s analysis aligns more closely with our technical assessment, predicting a short-term correction before a longer-term rally extending into 2026. This divergence in analyst opinions creates an interesting setup where contrarian positioning could prove profitable for traders who can accurately time the market’s next major move. BTC Technical Analysis: Setting Up for Corrective Bounce Our Bitcoin technical analysis reveals several key indicators pointing toward a potential short-term correction followed by a stronger rally. The RSI at 34. 11 has moved into oversold territory, while the MACD histogram at -782. 25 confirms bearish momentum remains intact in the near term. Perhaps most telling is Bitcoin’s position relative.

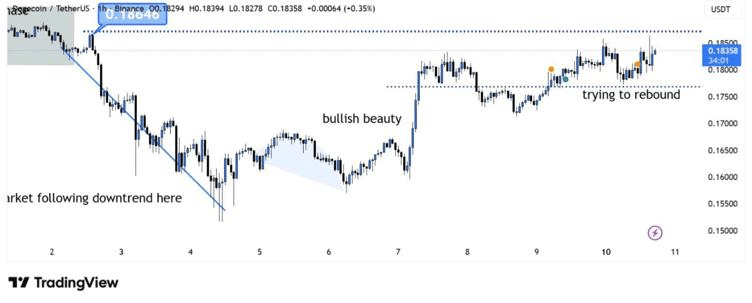

Chainlink LINK Tests Crucial Rising Trendline Support in Steady Price Range

The post Chainlink LINK Tests Crucial Rising Trendline Support com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Chainlink (LINK) is currently testing a crucial rising support trendline that has held during every decline since mid-2023, trading near $13. 97 within a stable range of $13. 71 to $14. 44. Analysts monitor this fifth contact point for potential reversal signals amid steady market activity. LINK approaches a long-term rising trendline that supported recoveries from peaks at $32, $25, and $21 since mid-2023. Price action remains contained in a controlled range, showing orderly trading with active liquidity. Technical indicators like RSI and MACD are nearing levels observed before previous price reversals, per market data from Coingecko. Discover Chainlink LINK’s latest price analysis as it tests key support. Stay informed on crypto trends and potential recovery signals for informed trading decisions. What is Chainlink LINK’s Current Support Level and Price Movement? Chainlink LINK support trendline is under close watch as the cryptocurrency returns to a rising base that has consistently provided support since mid-2023. Currently trading near $13. 97, LINK’s price has formed a fifth contact with this trendline after pullbacks from higher levels around $18. Market participants observe stable range-bound movement between.

3 Cryptos Under $5 That Will Drive 3500% Portfolio Growth

The post 3 Cryptos Under $5 That Will Drive 3500% Portfolio Growth appeared com. As investors search for extraordinary gains in the crypto space, a number of sub-$5 cryptocurrencies are emerging as top performers to change the dynamics of investment. Dogecoin (DOGE) is still proving to be a resilient performer, with strong community backing and crucial levels well above $0. 20, while a number are holding strong around their support level, including Ripple (XRP), which is now looking to rebound towards $3. 00. Among the established cryptocurrencies, a fresh face has managed to make a rapid appearance, that being Mutuum Finance (MUTM). Being solely in Presale Stage 6, MUTM has already managed to sell out 90% of this presale round, all at a low price of just $0. 035, now sitting well over the initial target set, reaching a strong total so far of over $18. 8 million at this early stage of presale, all well before its market entry as a fully fledged cryptocurrency. Investors are labeling MUTM as one of the best cryptos to buy for its early-stage growth and utility. Dogecoin (DOGE) Exhibits Signs of Fresh Bullish Trends Dogecoin (DOGE) has transitioned from a strong downtrend to a strong upward move, indicating a potential takeover by the bulls. Currently, Dogecoin price is sustaining around an important resistance level, fighting to make a comeback, and a successful breakout may bring even better gains. On the other hand, a failed breakout could bring a small dip before moving towards the next leg. Although Dogecoin is performing well as a trading asset, investors are now focusing their attention on Mutuum Finance (MUTM). MUTM presale is gaining traction due to its novel DeFi solution, as the current presale stage is almost fully sold out, making it a must-watch in the top cryptocurrencies list for 2025. XRP Awaits ETF Approval The anticipation around the upcoming Canary Capital XRP ETF, slated.

A Major Exchange Responds to Claims That Cryptocurrencies Were Secretly Stolen from Users’ Wallets

The post A Major Exchange Responds to Claims That Cryptocurrencies Were Secretly Stolen from Users’ Wallets appeared com. OKX CEO Star Xu made an important statement after a user accused the platform of the theft of 50 ETH. Xu announced that a 10 BTC reward will be given to anyone who can prove with definitive and verifiable evidence that a “backdoor” exists in OKX Wallet. Xu argued that security and transparency are the core principles of the OKX ecosystem, telling OKX Wallet users: “The OKX Wallet team will reward anyone who provides definitive evidence proving the existence of a backdoor in OKX Wallet with 10 BTC. We expect a joint audit by OKX Wallet users worldwide. Security and transparency are our priority; we welcome community review.” The issue has particularly gained traction among the Chinese-speaking cryptocurrency community. Chinese users claim that OKX’s wallet app contains a backdoor mechanism that hackers are using to steal users’ assets. The 10 BTC reward is equivalent to approximately $950,000 at the time of writing. *This is not investment advice. account now for exclusive news, analytics and on-chain data! Source:.