The post Blackrock Opens 2026 With 774K Bitcoin as Strategy Locks up 674K BTC in a Supply Squeeze appeared com. Blackrock and Strategy entered 2026 controlling a massive share of bitcoin supply, highlighting accelerating institutional concentration as regulated ETFs and public companies tighten their grip on the world’s largest cryptocurrency. Blackrock Starts 2026 Holding 774K Bitcoin While Strategy Pushes Holdings to 674K Strategy Inc (Nasdaq: MSTR), and Blackrock’s Ishares Bitcoin Trust (IBIT) exchange-traded fund (ETF) [.] Source:.

Tag: cryptocurrency

Interpol Targets Crypto Fraud in Global Scam Compound Networks

The post Interpol Targets Crypto Fraud com. Interpol has officially recognized crypto-related fraud in scam compounds as a major transnational criminal threat, involving human trafficking and billions in illicit crypto flows. This resolution urges global law enforcement to enhance coordination and disrupt these adaptive networks affecting over 60 countries. Scam compounds traffic victims for online fraud including cryptocurrency scams, using advanced tech to evade detection. These operations have expanded from Southeast Asia to regions like Russia, Colombia, and East Africa since early 2023. S. sanctions targeting $4 billion in laundering by 2024. Interpol targets crypto scam compounds: Discover how global trafficking networks fuel billions in fraud and what international efforts mean for crypto security. Stay informed on evolving threats. What is Interpol’s Recognition of Crypto Scam Compounds? Interpol’s recognition of crypto scam compounds marks a pivotal step in addressing transnational crime, as outlined in a resolution passed at the organization’s General Assembly in Marrakech. This designation highlights networks that exploit human trafficking to run large-scale online fraud, including cryptocurrency scams, impacting victims across more than 60 countries. By focusing on the financial flows through digital assets, Interpol aims to foster tighter global coordination among law enforcement agencies to dismantle these operations. How Do Crypto Scam Compounds Operate and Evolve? Criminal groups behind crypto scam compounds recruit victims through deceptive job offers, luring them to remote facilities where they are coerced into executing scams like investment fraud, romance schemes, and cryptocurrency cons. These compounds, first prominently identified in Southeast Asia-particularly in Myanmar, Cambodia, and Laos-employ sophisticated technologies to mask activities and deceive targets worldwide. According to Interpol’s reports, the networks’ highly adaptive nature allows them to shift operations rapidly, incorporating tools for voice phishing and other illicit schemes. Since January.

Digitap ($TAP) Presale Gains Attention Ahead of Black Friday

The post Digitap Ever since Digitap announced its massive Black Friday offer, investors have been piling into what could end up being the potential altcoin to buy during the current bear cycle. Even as Other Major Coins Recover, Ethereum’s Struggles Continue Many crypto enthusiasts now believe the crypto bear market is ending soon and are actively seeking top cryptocurrencies to buy. This can be seen by a slight recovery among most major coins. Ethereum, however, seems to have been hit harder than many of its competitors. Over the last month, Ethereum’s price has dropped by over 26%. Bitcoin has only dropped around 22%, and most other major coins are in the 20-25% range. According to data from TradingView, Ethereum’s 20-day simple moving average is currently at 3, 146, while its exponential moving average for the same period is 3, 132. Both of these indicate a ‘sell’ rating for investors. Furthermore, out of 9 oscillators that TradingView tracks on Ethereum, 7 of them are currently ‘neutral’ and 2 are ‘sell’. While the outlook for Ethereum has undoubtedly improved over the last week or so, the technical data indicates that investors are still bearish on Ethereum compared to other major coins. Could Digitap Eclipse Ethereum in 2025? Ethereum launched its network in 2015. It was meant to be the original utility token. Unlike Bitcoin and other tokens that acted as digital currencies, Ethereum was described as being much more versatile. Its ecosystem could be used to power decentralized apps, launch other projects, and allow cryptocurrencies to act in a manner much similar to.

Bitcoin (BTC) Price: Trades at $87,500 as Fed Rate Cut Odds Jump to 80%

The post Bitcoin (BTC) Price: Trades at $87,500 as Fed Rate Cut Odds Jump to 80% appeared com. TLDR Bitcoin trades around $87,500 on Wednesday after dropping to seven-month lows near $80,000 last week Market odds for a December Federal Reserve interest rate cut jumped to 80% from 42% in one week Speculation grows that Kevin Hassett could replace current Fed chair and support aggressive rate cuts CFTC announces new CEO Innovation Council to provide guidance on digital asset regulation and stablecoins Most altcoins including Ethereum and XRP remain subdued with Bitcoin still rangebound despite modest recovery Bitcoin traded at $87,536 on Wednesday morning, showing little movement after last week’s sharp decline to near $80,000. The world’s largest cryptocurrency has recovered modestly but remains in a tight trading range around $88,000. The market has seen a major shift in expectations for Federal Reserve policy. The odds of a December interest rate cut climbed to 80% from just 42% one week ago. This change followed comments from Federal Reserve officials who signaled support for lowering borrowing costs. San Francisco Fed president Mary Daly told The Wall Street Journal she supports another rate cut. She expressed concern about the labor market. “It’s vulnerable enough now that the risk is it’ll have a nonlinear change,” Daly said. New York Fed President John Williams also indicated room for policy adjustment. He stated there is space for further movement in the federal funds rate target range. The cryptocurrency fell from its October peak above $125,000 to current levels in just over a month. This represents a drawdown of nearly 40%. Bitcoin Price on CoinGecko Softer U. S. economic data has helped revive hopes for easier monetary policy. Lower interest rates typically benefit risk assets like cryptocurrencies. Political Changes Could Impact Fed Policy Reports suggest Kevin Hassett could succeed the current Federal Reserve chair. Hassett is a close adviser to Donald Trump. Market watchers view.

BNB Price Prediction: Targeting $950-$1,000 Recovery Within 30 Days as Technical Indicators Signal Oversold Bounce

BNB price prediction suggests a 10-17% upside to $950-$1,000 range within 30 days as oversold RSI and strong support confluence create buying opportunity near $860 levels. (Read More).

XRP Jumps 9% as Franklin Templeton and Grayscale Launch Spot ETFs

The post XRP Jumps 9% as Franklcom. XRP jumped more than 9% to $2. 27 after Franklin Templeton and Grayscale launched their spot XRP ETF on Monday. The $1. 69 trillion asset manager joined Bitwise, Grayscale, and Canary Capital in offering regulated XRP investment products, calling XRP “foundational” for global settlement infrastructure. This wave of ETF launches marks a turning point for XRP. After regulatory uncertainty faded with Ripple’s SEC settlement earlier in 2025, institutional interest is surging. Sponsored Wave of Institutional ETF Launches Signals Market Maturity Franklin Templeton debuted the Franklin XRP ETF (XRPZ) on NYSE Arca, offering regulated XRP exposure through a grantor trust. The fund tracks the CME CF XRP-Dollar Reference Rate and uses Coinbase Custody as custodian, with BNY Mellon as administrator. According to Franklin Templeton’s announcement, the ETF allows investors to follow XRP’s performance transparently, without buying the cryptocurrency directly. “XRPZ offers investors a convenient and regulated way to access a digital asset that plays a critical role in the global settlement infrastructure,” stated David Mann, director of ETF products and capital markets at Franklin Templeton. Grayscale has also launched its XRP Trust ETF (GXRP) with a zero-fee introductory period, highlighting XRP’s strong market position. Introducing Grayscale XRP Trust ETF (Ticker: XRP), now trading with 0% fees¹ from Grayscale, the world’s largest crypto-focused asset manager². Gain exposure to RP, the world’s 3rd largest digital asset³, driving innovation in global payments. Available in your brokerage. pic. twitter. com/rAzGrm0M6P Grayscale (@Grayscale) November 24, 2025 Bitwise, which launched its XRP ETF a week earlier, reported $100 million in initial inflows. The clustering of ETF launches signals that asset managers were prepared for regulatory clarity, which arrived from the SEC in 2025. Sponsored Regulatory Resolution Paves Way for Wall Street Entry Ripple’s $125 million settlement with the Securities and Exchange Commission in May 2025 ended years of uncertainty. SEC.

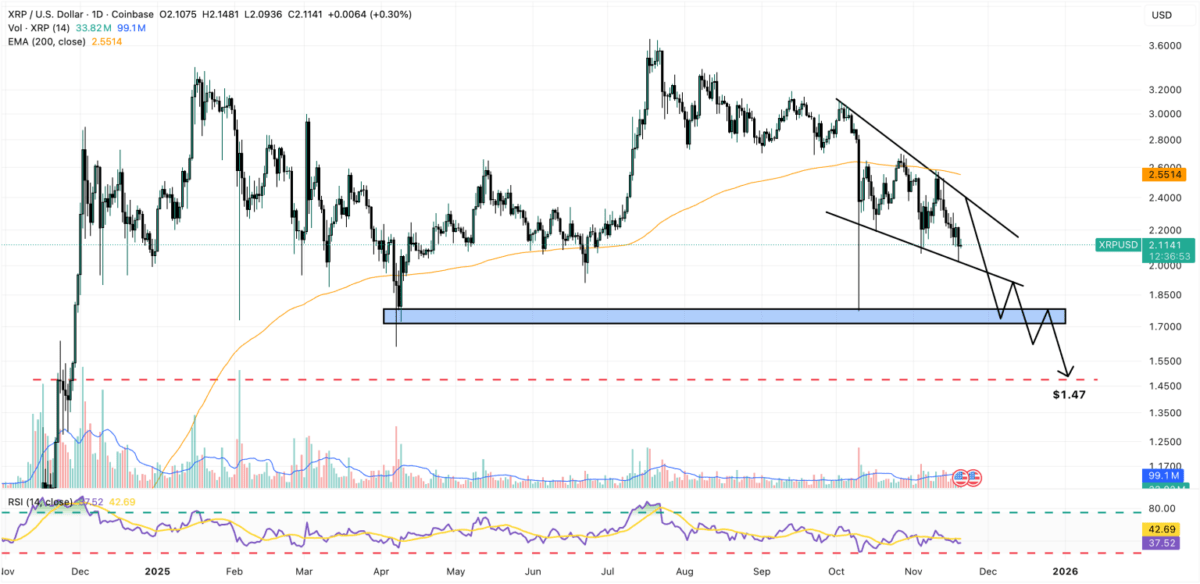

Top Crypto to Buy Now as Ripple (XRP) Struggles Mount

The post Top Crypto to Buy Now as Ripple XRP is Experiencing Greater Selling Pressure XRP`s situation is becoming more and more measurable. Currently, the token is testing a trend line support level. If this line is breached, it could lead the token to a new level of rapid decline. The market is displaying a 27% growth in trading volume over the past 24 hours, representing almost 5% of its circulating market cap. This volume growth is generally a sign of increased selling pressure as opposed to increased buying of the asset. The decline of this open interest leads to the conclusion that market participants are closing their contracts and leaving the active trading of the asset, and that they see limited upward potential in the short term. In the highly unusual situation that a support level holds, the token could trade higher in short time as a result of positive technical market action. However, the overall structure remains weak, as this flat price action is unlikely to lead to a sustained technical recovery. This continuing market condition is likely to lead to many market participants.

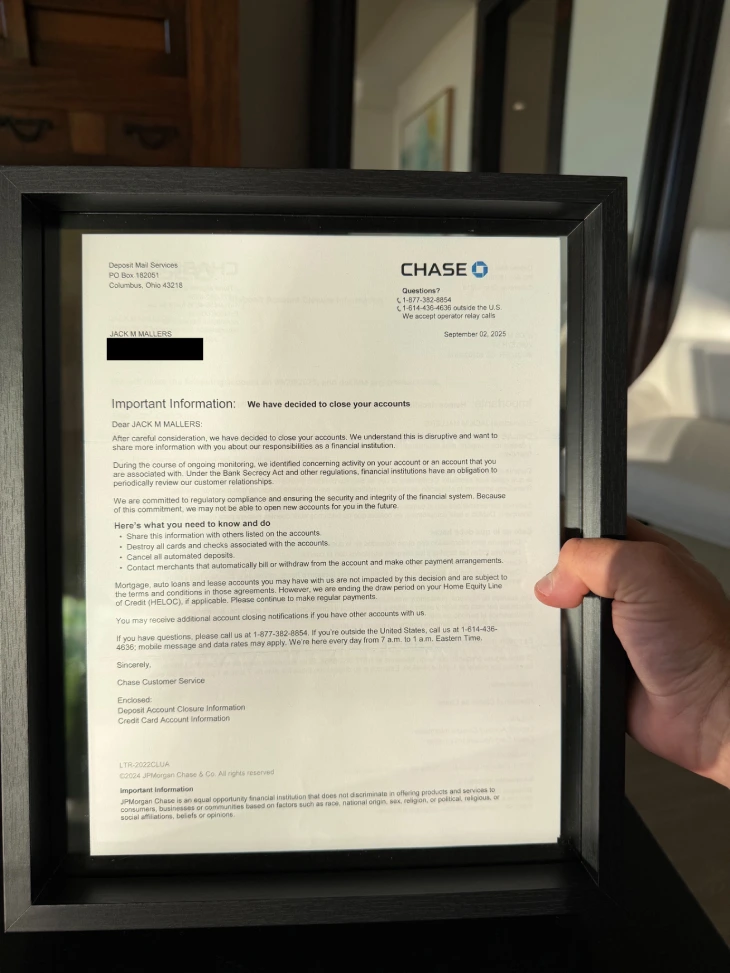

Senator Lummis Slams JPMorgan for Debanking Strike CEO

Key Highlights Senator Cynthia Lummis has slammed JPMorgan for undermining confidence in traditional banks and sending the digital.

Alarming Bitcoin ETFs Exodus: $4.34B Flees In Just 4 Weeks

The post Alarming Bitcoin ETFs Exodus: $4. 34B Flees In Just 4 Weeks appeared com. Have you been tracking the dramatic shifts in cryptocurrency investments? The latest data reveals a startling trend: US spot Bitcoin ETFs have recorded their fourth consecutive week of net outflows, with a staggering $4. 34 billion exiting these funds. This persistent withdrawal pattern raises crucial questions about investor sentiment and market direction. Why Are Bitcoin ETFs Bleeding Billions? The outflow numbers tell a compelling story. According to data from SoSoValue, last week alone saw $1. 22 billion leave Bitcoin ETFs. This marks the fourth straight week of negative flows, creating a cumulative outflow that’s shaking investor confidence. The consistent pattern suggests deeper market concerns beyond temporary fluctuations. Several factors could be driving this trend: Market volatility concerns affecting risk appetite Regulatory uncertainty impacting institutional decisions Profit-taking behavior after previous gains Macroeconomic pressures influencing overall investment strategy BlackRock’s IBIT Takes Major Hit: What Does It Mean? The situation becomes more concerning when we examine specific funds. BlackRock’s IBIT experienced $1. 09 billion in net outflows last week alone. This represents the second-largest weekly outflow in the fund’s history, signaling significant institutional repositioning. This massive withdrawal from one of the most prominent Bitcoin ETFs indicates that even established players aren’t immune to current market pressures. The scale of these outflows suggests institutional investors might be reassessing their cryptocurrency exposure amid changing market conditions. How Do These Outflows Impact Bitcoin’s Future? While four weeks of consecutive outflows might seem alarming, it’s essential to consider the broader context. Bitcoin ETFs have experienced both massive inflows and outflows throughout their history, reflecting the cryptocurrency market’s dynamic nature. However, the current trend does highlight several important considerations: Market maturity indicators How institutional investors respond to volatility Price correlation patterns between ETF flows and Bitcoin value Long-term adoption signals despite short-term fluctuations Regulatory development impacts on investor behavior What.

Bitcoin Exchange Inflow Hits $2 Billion As Profit-Taking Phase Lingers

The post Bitcoin Exchange Inflow Hits $2 Billion As Profit-Taking Phase Lingers appeared com. After days of intense bearish action, the price of Bitcoin appears to be entering a calmer state, as it recovers above the $86,000 level. The latest on-chain data shows that several investors tried to take some profit in the past week, providing a basis for the premier cryptocurrency registering a double-digit loss. Bitcoin Exchange Inflow Spikes As Price Faces Downward Pressure In a recent post on the social media platform X, crypto analyst Ali Martinez revealed that significant Bitcoin amounts were sent to centralized exchanges in the past week. Data from Santiment shows that about $20, 000 BTC (worth nearly $2 billion) has been moved to these exchanges in the past seven days. The relevant indicator in this on-chain observation is the Exchange Inflow metric, which tracks the volume of an asset (in this case, Bitcoin) that flows to centralized exchanges within a specified period. This metric is often important because one of the prominent exchanges’ service offerings is selling. Hence, an increase in the Exchange Inflow metric suggests the potential offloading of an asset by investors. The resulting increased supply of this cryptocurrency in the open market often adds downward pressure on the coin’s price, especially if there is no corresponding increase in demand. In a separate post on X, CryptoQuant’s head of research, Julio Moreno, shared a data piece supporting the recent spike in exchange inflows. According to data highlighted by the crypto researcher, the Bitcoin exchange inflows stood at about 81, 000 BTC (the highest level seen since mid-July) on Friday, November 21. Ultimately, this recent spike in exchange inflows explains the volatility experienced by the price of Bitcoin on Friday. The flagship cryptocurrency succumbed to significant bearish pressure, seeing its price fall to just above $80,000 as the weekend approached. As of this writing, the price of BTC.