Unprecedented early support consolidation gives Stefanik presumptive GOP nomination for New York governor, leaving rivals to petition onto ballot instead.

Tag: consolidation

XRP Price Eyes $2.26 as Support Holds Strong Above $2.03 Zone

TLDR XRP price surged above $2. 12 after briefly dipping to $2. 03, a key support level. Analyst CasiTrades suggests that the $2. 03 level could mark the final low of wave 2 of the correction. XRP price could move to $2. 26, supported by the RSI trendline and recent price action. There is a scenario where XRP price [.] The post XRP Price Eyes $2. 26 as Support Holds Strong Above $2. 03 Zone appeared first on CoinCentral.

Symmetrical Triangle Squeeze Sets Up Breakout As Flows Stabilize

The post Symmetrical Triangle Squeeze Sets Up Breakout As Flows Stabilize appeared com. Hyperliquid price today trades near $39. 05, moving deeper into a six week symmetrical triangle as volatility tightens. Spot flows stabilize, with a small net inflow marking the first shift after weeks of aggressive outflows. $38. 90 support and $39. 80 resistance define the breakout zone, with a decisive move expected as the triangle apex nears. Hyperliquid price today trades near $39. 05, sitting inside a narrowing symmetrical triangle that has compressed volatility for nearly six weeks. The token continues to trade below the 20 and 50 day EMAs, creating a cautious backdrop as spot flows show uneven participation across exchanges. Price continues to form higher lows along the rising support line near $38. 90, but every rally has been capped by the descending trendline that has held since September. The EMA structure reflects hesitation. The 20 day EMA sits near $39. 80, while the 50 day EMA is positioned at $41. 51. Both remain above current price and flattening, which suggests a neutral to slightly bearish trend. The 100 day EMA at $42. 12 forms the next barrier if buyers attempt a breakout. Related: Zcash Price Prediction: ZEC Retains Bullish Bias While Cypherpunk Boosts Holdings The Supertrend line on the daily chart sits near $35. 77, marking the broader support zone that buyers have defended through several shakeouts. As long as Hyperliquid stays above this level, the higher time frame structure remains constructive. Price is approaching the triangle vertex, which typically precedes a decisive move. Traders expect a breakout or breakdown within the next few sessions as compression reaches its limit.

STRK Holds Breakout Zone As Buyers React To $3M Spot Inflows

The post STRK Holds Breakout Zone As Buyers React To $3M Spot Inflows appeared com. Starknet trades near $0. 216 as the breakout from the nine-month $0. 12-$0. 19 range faces its first major retest. Coinglass data shows $3. 06M in inflows, the strongest accumulation spike in months, signaling renewed demand after the breakout. $0. 20 remains the critical support, with a break above $0. 235-$0. 245 needed to confirm continuation toward $0. 27 and $0. 30. Starknet price today trades near $0. 216 after a clean breakout above the multi-month consolidation range that held the market between $0. 12 and $0. 19 for almost nine months. The move places immediate pressure on buyers to maintain control as the token pulls back toward the top of the broken range while spot flows show one of the strongest positive prints of the quarter. 19 resistance that capped every rally from March through October. The candle structure turned positive once price reclaimed the 20 and 50 EMAs at $0. 163 and $0. 144, followed by a push above the 100 and 200 EMAs near $0. 139 and $0. 164. The first rejection near $0. 24 triggered a controlled pullback. Price is now retesting the breakout level at $0. 20 to $0. 195. This zone acted as the upper boundary of the consolidation range and now represents the immediate support buyers must defend. Supertrend has flipped bullish at $0. 117, confirming momentum remains with buyers as long as the market stays above the previous demand band. Starknet spent nearly nine months trading inside a narrow horizontal channel. Breaking out of that structure often leads to extended directional movement if the retest holds. Starknet recorded a positive $3. 06 million net inflow on November 19,.

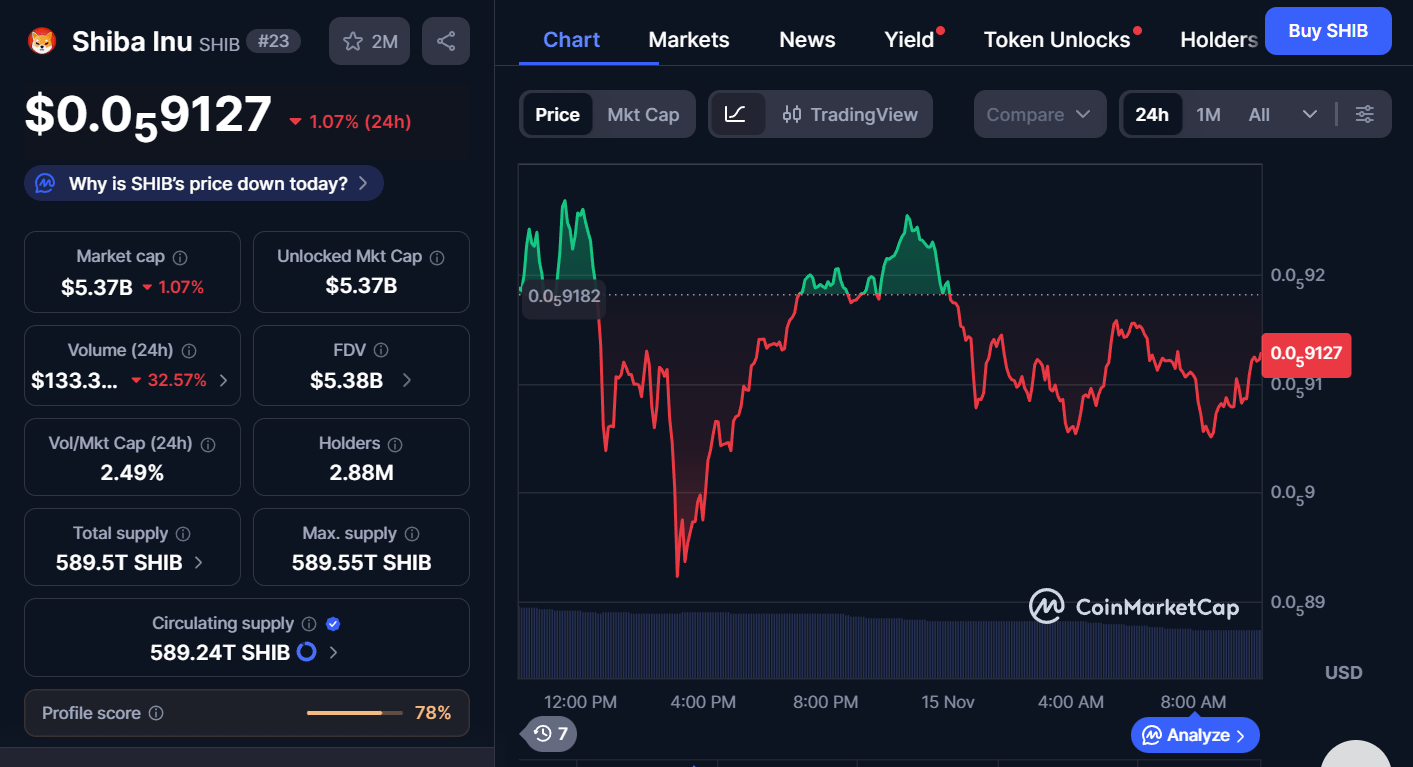

Latest Shiba Inu News: New Meme Coin Presale Goes Viral – Set To Rival SHIB

The post Latest Shiba Inu News: New Meme Coin Presale Goes Viral Set To Rival SHIB appeared com. Shiba Inu news just got a serious twist as Layer Brett bursts onto the scene with a viral pre-launch and its own Ethereum Layer 2 plans. While SHIB trades like a giant, LBRETT is setting up as the quicker rival, with faster transactions, big staking yields and a public testnet coming for holders hunting fresh upside in this high-volatility meme market cycle. Shiba inu cools off as price dips and trading interest fades Based on the most recent statistics, Shiba Inu (SHIB) is trading at 0. 000059127, which implies that it has gone down by 1. 07 in the past 24 hours. Nevertheless, SHIB has a large market cap of 5. 37 billion and a strong base of holders amounting to 2. 88 million holders. Moreover, the volume of trading has dropped by more than 32%, which is an indicator of less market activity and possibly a lack of conviction by investors. 00005912 and $0. 00005982. The short-run sentiment of SHIB is bearish as evidenced by the steady downwards highs that are signs of selling pressure. In this uncertain situation, many investors are looking for better options in the meme coin industry and Layer Brett keeps coming up as a strong rival for Shiba Inu for its current market standing. How Layer Brett’s is giving competition to Shiba Inu SHIB has a high overall reach into the meme coin market, but LBRETT is rapidly gaining momentum through a private funding event that has raised more than 4. 4 million USDT already. The Private funding price is fixed at $0. 0058 and it will be raised to $0. 0061 and this will be done under a tiered pricing strategy that will benefit early investors. Layer Brett is built on Ethereum Layer 2 blockchain technology,.

LDO Price Prediction: Targeting $1.03 by December 2025 Amid Mixed Technical Signals

LDO price prediction shows potential recovery to $1. 03+ within 4-6 weeks, despite current bearish pressure. Technical analysis reveals key $0. 82 resistance level critical for bullish continuation. (Read More).

Bitcoin liquidity pattern signals ‘pivotal moment’ with $124K BTC target

Increasing stablecoin supply mirrors past liquidity patterns that preceded significant Bitcoin rallies. Will BTC price return to $124,000 soon?.

Filecoin Shows Bullish Breakout Potential with Rising Volume and Whale Accumulation

The post Filecocom. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Filecoin (FIL) exhibits strong bullish breakout potential in November 2025, driven by a descending wedge pattern on the weekly chart, rising trading volume, and over 32% whale accumulation. This signals institutional interest and possible price targets up to $71. 46 if resistance breaks. Filecoin’s weekly descending wedge pattern indicates a potential breakout above key resistance, marking the start of a new bullish cycle for investors. The short-term rally from $2. 00 to $4. 00 highlights robust buying pressure, with current consolidation pointing to sustained upward momentum. Whale holdings have surged by more than 32%, while exchange supply dropped 15%, backed by trading volumes exceeding $1. 4 billion as per CoinGecko data. Filecoin FIL bullish breakout: Analyze rising volume, whale accumulation, and technical patterns signaling major gains. Discover investment insights for November 2025 now. What is the Bullish Breakout Potential for Filecoin (FIL)? Filecoin (FIL) is displaying clear signs of a bullish breakout, primarily through its weekly descending wedge pattern that has been forming since early 2021. This technical formation suggests a reversal from downward pressure, with a recent bullish candle pushing toward resistance.

What Are BTC’s Next Key Support Levels if $100K Falls?

The post What Are BTC’s Next Key Support Levels if $100K Falls? appeared com. Home » BTC ‘; } function loadTrinityPlayer(targetWrapper, theme, extras=””) { cleanupPlayer(targetWrapper); // Always clean first ✅ targetWrapper. classList. add(‘played’); // Create script const scriptEl = document. createElement(“script”); scriptEl. setAttribute(“fetchpriority”, “high”); scriptEl. setAttribute(“charset”, “UTF-8”); const scriptURL = new URL(`{theme}${extras}`); scriptURL. searchParams. set(“pageURL”, window. location. href); scriptEl. src = scriptURL. toString; // Insert player const placeholder = targetWrapper. querySelector(“. add-before-this”); placeholder. parentNode. insertBefore(scriptEl, placeholder. nextSibling); } function getTheme { return document. body. classList. contains(“dark”) ? “dark” : “light”; } // Initial Load for Desktop if (window. innerWidth > 768) { const desktopBtn = document. getElementById(“desktopPlayBtn”); if (desktopBtn) { desktopBtn. addEventListener(“click”, function { const desktopWrapper = document. querySelector(“. desktop-player-wrapper. trinity-player-iframe-wrapper”); if (desktopWrapper) loadTrinityPlayer(desktopWrapper, getTheme,’&autoplay=1′); }); } } // Mobile Button Click const mobileBtn = document. getElementById(“mobilePlayBtn”); if (mobileBtn) { mobileBtn. addEventListener(“click”, function { const mobileWrapper = document. querySelector(“. mobile-player-wrapper. trinity-player-iframe-wrapper”); if (mobileWrapper) loadTrinityPlayer(mobileWrapper, getTheme,’&autoplay=1′); }); } function reInitButton(container, html){ container. innerHTML = ” + html; } // Theme switcher const destroyButton = document. getElementById(“checkbox”); if (destroyButton) { destroyButton. addEventListener(“click”, => { setTimeout( => { const theme = getTheme; if (window. innerWidth > 768) { const desktopWrapper = document. querySelector(“. desktop-player-wrapper. trinity-player-iframe-wrapper”); if(desktopWrapper. classList. contains(‘played’)){ loadTrinityPlayer(desktopWrapper, theme,’&autoplay=1′); }else{ reInitButton(desktopWrapper,’Listen‘) const desktopBtn = document. getElementById(“desktopPlayBtn”); if (desktopBtn) { desktopBtn. addEventListener(“click”, function { const desktopWrapper = document. querySelector(“. desktop-player-wrapper. trinity-player-iframe-wrapper”); if (desktopWrapper) loadTrinityPlayer(desktopWrapper, theme,’&autoplay=1’); }); } } } else { const mobileWrapper = document. querySelector(“. mobile-player-wrapper. trinity-player-iframe-wrapper”); if(mobileWrapper. classList. contains(‘played’)){ loadTrinityPlayer(mobileWrapper, theme,’&autoplay=1′); }else{ const mobileBtn = document. getElementById(“mobilePlayBtn”); if (mobileBtn) { mobileBtn. addEventListener(“click”, function { const mobileWrapper = document. querySelector(“. mobile-player-wrapper. trinity-player-iframe-wrapper”); if (mobileWrapper) loadTrinityPlayer(mobileWrapper, theme,’&autoplay=1′); }); } } } }, 100); }); } }); Summarize with AI Summarize with AI Bitcoin has recently fallen below the crucial $100K support level, indicating a notable bearish move. If buyers couldn’t hold this critical level, another cascade toward the $95K range will occur. Technical Analysis By Shayan The Daily Chart On the daily timeframe, BTC remains locked between the $100K-$102K demand block and the $114K resistance cluster, with both the 100-day and.

VeChain Price Market Technicals Hint at 5x Upside

The post VeChain Price Market Technicals Hint at 5x Upside appeared com. VET price could hit the $0. 1 target once the ongoing consolidation phase fades. VeChain’s price mirrors historical patterns seen in 2020 and 2021 following major breakouts. Vechain (VET) has a positive outlook, as its technical indicators hint at a potential 5x rally ahead. $0. 1 VET Target Spotlighted CryptoPulse sees the price stability of VET as a function of accumulation around $0. 016. To the analyst, large investors are purchasing VET, storing energy for a breakout. Per the analysis, VeChain has a track record of long periods of sideways price action, usually followed by strong breakouts. CryptoPulse described this playbook as a “Calm before the storm.” The analyst is targeting the next VET breakout price at $0. 10, approximately a 5x increase from the current level. As of writing, the VET token was priced at $0. 01622, up 2. 99% over the past 24 hours. The trading volume stands at $28. 4 million, while the market cap surged to $1. 39 billion. If market momentum returns, VET could witness a major rally, drawing on VeChain’s focus on real-world utility and partnerships. As detailed in our last news piece, VeChain partnered with Keyrock, a global crypto investment firm founded in Brussels. Through the partnership, Keyrock has become a validator on the VeChainThor network. This means they are operating nodes that take part in the process of verifying and adding transactions to the blockchain. Furthermore, VeChain has continued to strengthen its position as a leading enterprise blockchain. It offers solutions for supply chain management, logistics, and carbon tracking, while on-chain metrics illustrate an increase.