Travis Kelce’s fiancée Taylor Swift is seen without makeup in several parts of the new teaser for “The End of an Era.

Category: general

Arias scores 24, hits game-wining 3-pointer as Jacksonville holds off VMI 69-67

LEXINGTON, Va. (AP) Chris Arias scored 24 points off the bench and hit a game-winning 3-pointer with 1. 4 seconds remaining to secure a 69-67 win for Jacksonville over VMI on Saturday. Jacksonville led 66-57 with 4: 07 remaining, before going scoreless until Arias rose up over two defenders to take lead. Arias added six rebounds.

3 Cryptos Under $5 That Will Drive 3500% Portfolio Growth

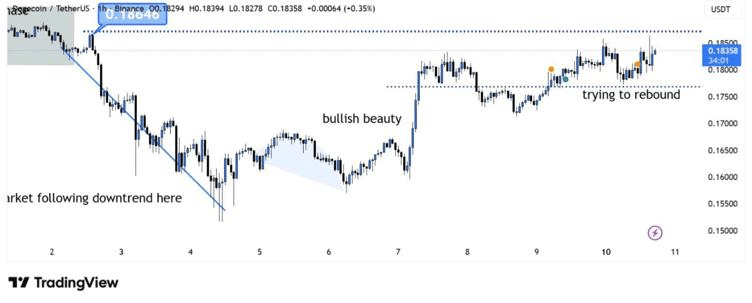

The post 3 Cryptos Under $5 That Will Drive 3500% Portfolio Growth appeared com. As investors search for extraordinary gains in the crypto space, a number of sub-$5 cryptocurrencies are emerging as top performers to change the dynamics of investment. Dogecoin (DOGE) is still proving to be a resilient performer, with strong community backing and crucial levels well above $0. 20, while a number are holding strong around their support level, including Ripple (XRP), which is now looking to rebound towards $3. 00. Among the established cryptocurrencies, a fresh face has managed to make a rapid appearance, that being Mutuum Finance (MUTM). Being solely in Presale Stage 6, MUTM has already managed to sell out 90% of this presale round, all at a low price of just $0. 035, now sitting well over the initial target set, reaching a strong total so far of over $18. 8 million at this early stage of presale, all well before its market entry as a fully fledged cryptocurrency. Investors are labeling MUTM as one of the best cryptos to buy for its early-stage growth and utility. Dogecoin (DOGE) Exhibits Signs of Fresh Bullish Trends Dogecoin (DOGE) has transitioned from a strong downtrend to a strong upward move, indicating a potential takeover by the bulls. Currently, Dogecoin price is sustaining around an important resistance level, fighting to make a comeback, and a successful breakout may bring even better gains. On the other hand, a failed breakout could bring a small dip before moving towards the next leg. Although Dogecoin is performing well as a trading asset, investors are now focusing their attention on Mutuum Finance (MUTM). MUTM presale is gaining traction due to its novel DeFi solution, as the current presale stage is almost fully sold out, making it a must-watch in the top cryptocurrencies list for 2025. XRP Awaits ETF Approval The anticipation around the upcoming Canary Capital XRP ETF, slated.

BullZilla Surges as Top Cryptos To Buy Before Christmas with 8 Game-Changing Picks For 2025

The post BullZilla Surges as Top Cryptos To Buy Before Christmas with 8 Game-Changing Picks For 2025 appeared com. Crypto Presales Discover BullZilla and seven more game-changing top cryptos to buy before Christmas with high ROI potential for 2025 investors. What if this Christmas isn’t just about gifts but about grabbing generational wealth? The crypto market is roaring back to life, setting the stage for a potential record-breaking bull run. According to CoinDesk and Messari, the global crypto market cap has soared beyond $2. 8 trillion, reflecting surging institutional and retail participation. With Bitcoin’s halving approaching and Ethereum’s Layer-2 expansion accelerating, investor optimism is rising across the board. Altcoins and structured presales are drawing attention for their explosive ROI potential, offering both innovation and accessibility. Analysts believe 2025 could deliver historic returns for early entrants, especially in presales that blend token utility, transparent economics, and strong community-driven momentum across decentralized ecosystems. Leading this pack is BullZilla (ZIL), a presale phenomenon turning viral excitement into a structured path to wealth creation. Now in Stage 10 (Castle Bravo), Phase 2, BullZilla trades at $0. 00025239, having already raised over $1 million with 31 billion tokens sold and a rapidly growing base of 3, 500+ holders. Its innovative HODL Furnace offers investors up to 70% APY, while the Progressive Price Engine ensures that every $100, 000 milestone triggers a price surge, with the next 2. 64% increase on the horizon. Combining deflationary tokenomics, transparent vesting, and community rewards, BullZilla isn’t just another meme project; it’s an ecosystem designed to empower early adopters chasing life-changing ROI before Christmas. BullZilla (ZIL): Frontlining the Top Cryptos to Buy Before Christmas BullZilla is redefining meme-coin investing by replacing luck with structure. Its ecosystem blends staking, referral bonuses, and scarcity mechanics that reward long-term believers. Now in Stage 10 (Castle Bravo) at $0. 00025239, BullZilla’s ROI potential stands at 1, 988. 59%, with early entrants from 10B enjoying possible 4, 289. 39% returns. The HODL Furnace fuels.

Jeremiyah Love and No. 9 Notre Dame overwhelm No. 23 Pittsburgh in 37-15 victory

PITTSBURGH (AP) Jeremiyah Love ran for 147 yards and a score, Malachi Fields hauled in a pair of touchdown passes and No. 9 Notre Dame breezed past No. 23 Pittsburgh 37-15 on Saturday. The Fighting Irish (8-2) have won eight straight games by an average of 26 points since their 0-2 start. Notre Dame.

If Quantum Computing Breaks Through, What Happens to Satoshi’s Bitcoin?

The post If Quantum Computing Breaks Through, What Happens to Satoshi’s Bitcoin? appeared com. Why Satoshi’s wallet is a prime quantum target Satoshi’s 1. 1-million-BTC wallet is increasingly viewed as a potential quantum vulnerability as researchers assess how advancing computing power could affect early Bitcoin addresses. Satoshi Nakamoto’s estimated 1. 1 million Bitcoin (BTC) is often described as the crypto world’s ultimate “lost treasure.” It sits on the blockchain like a dormant volcano, a digital ghost ship that has not seen an onchain transaction since its creation. This massive stash, worth approximately $67 billion-$124 billion at current market rates, has become a legend. But for a growing number of cryptographers and physicists, it is also viewed as a multibillion-dollar security risk. The threat is not a hacker, a server breach or a lost password; it is the emergence of an entirely new form of computation: quantum computing. As quantum machines move from theoretical research labs to powerful working prototypes, they pose a potential threat to existing cryptographic systems. This includes the encryption that protects Satoshi’s coins, the wider Bitcoin network and parts of the global financial infrastructure. This is not a distant “what if.” The race to build both a quantum computer and a quantum-resistant defense is one of the most critical and well-funded technological efforts of our time. Here is what you need to know. Why Satoshi’s early wallets are easy quantum targets Most modern Bitcoin wallets hide the public key until a transaction occurs. Satoshi’s legacy pay-to-public-key (P2PK) addresses do not, and their public keys are permanently exposed onchain. To understand the threat, it is important to recognize that not all Bitcoin addresses are created equal. The vulnerability lies in the type of address Satoshi used in 2009 and 2010. Most Bitcoin today is held in pay-to-public-key-hash (P2PKH) addresses, which start with “1,” or in newer SegWit addresses that begin with “bc1.” In these.

Earth Has Tilted 31.5 Inches. That Shouldn’t Happen. (More Climate Change BS)

Water has power. So much power, in fact, that pumping Earth’s groundwater can change the planet’s tilt and rotation. It can also impact sea-level rise and other consequences of climate change. Pumping groundwater appears to have a greater consequence than ever previously thought. But now-thanks to a study published in the journal Geophysical Research Letters-we can see that, in less than two decades, Earth has tilted 31. 5 inches as a result of pumping groundwater. This equates to . 24 inches of sea level rise. “Earth’s rotational pole actually changes a lot,” Ki-Weon Seo, a geophysicist at Seoul National University and study.

Apple is ramping up succession plans for CEO Tim Cook and may tap this hardware exec to take over, report says

John Ternus, Apple’s senior VP of hardware engineering, could take control of the company as soon as next year, sources told the Financial Times.

Annapolis Mall Rolls Out Full Holiday Lineup With Santa, The Grinch, And Community Giving

The Annapolis Mall is inviting families from across the region to celebrate the holidays with a full season of events, from immersive Santa photos and Grinch-themed activities to live performances […] The post Annapolis Mall Rolls Out Full Holiday Lineup With Santa, The Grinch, And Community Giving appeared first on Eye On Annapolis.

“Make an edit of Cameron Green in purple” – Aakash Chopra’s big statement on Aussie all-rounder ahead of IPL 2026 Auction

Former batter Aakash Chopra made a massive statement on Australian all-rounder Cameron Green ahead of the IPL 2026 auction. He hinted that Green could be seen donning the KKR jersey next season.