Waymo is drawing ire in San Francisco after the owner of a beloved bodega cat said the feline was run over and killed by the company’s robotaxi.

Category: general

Will Tyson Foerster Score a Goal vs. the Calgary Flames on November 2?

When the Philadelphia Flyers play the Calgary Flames on Sunday, is Tyson Foerster going to light the lamp? Stats and trends to help you make the right bet are available in this article, so take a look before the puck drops at 7:00 PM ET. Tyson Foerster Anytime Goal Odds vs. the Flames Anytime Goal Odds: +225 (Bet $10 to win $22.50 if he scores a goal) Foerster Goals Betting Stats Foerster has eclipsed his points prop bet in each game he’s played with a set points prop (one total opportunity). In 11 games played this season, Foerster has recorded eight points, with a single multi-point effort. Foerster has scored in four of 11 games this season, with multiple goals in one of those games. Foerster has five goals on the season, and has taken 20 shots, converting 25.0% of them. This is his first game of the season against the Flames. His numbers on the power play are three goals, from nine shots. Foerster Recent Performance Date Opponent Home/Away Result Points Goals Time On Ice 11/1/2025 Maple Leafs Home L 5-2 1 1 18:17 10/30/2025 Predators Home W 4-1 0 0 17:05 10/28/2025 Penguins Home W 3-2 SO 0 0 20:20 10/25/2025 Islanders Home W 4-3 SO 0 0 22:44 10/23/2025 Senators Away L 2-1 1 1 17:07 10/20/2025 Kraken Home W 5-2 2 2 17:36 10/18/2025 Wild Home W 2-1 OT 1 0 20:14 10/16/2025 Jets Home L 5-2 0 0 16:09 10/13/2025 Panthers Home W 5-2 1 1 16:56 10/11/2025 Hurricanes Away L 4-3 OT 1 0 17:37 Philadelphia Flyers vs. Calgary Flames Game Info Game Day: Sunday, November 2, 2025 Game Time: 7:00 PM ET TV Channel: NHL Network Watch the NHL on Fubo!

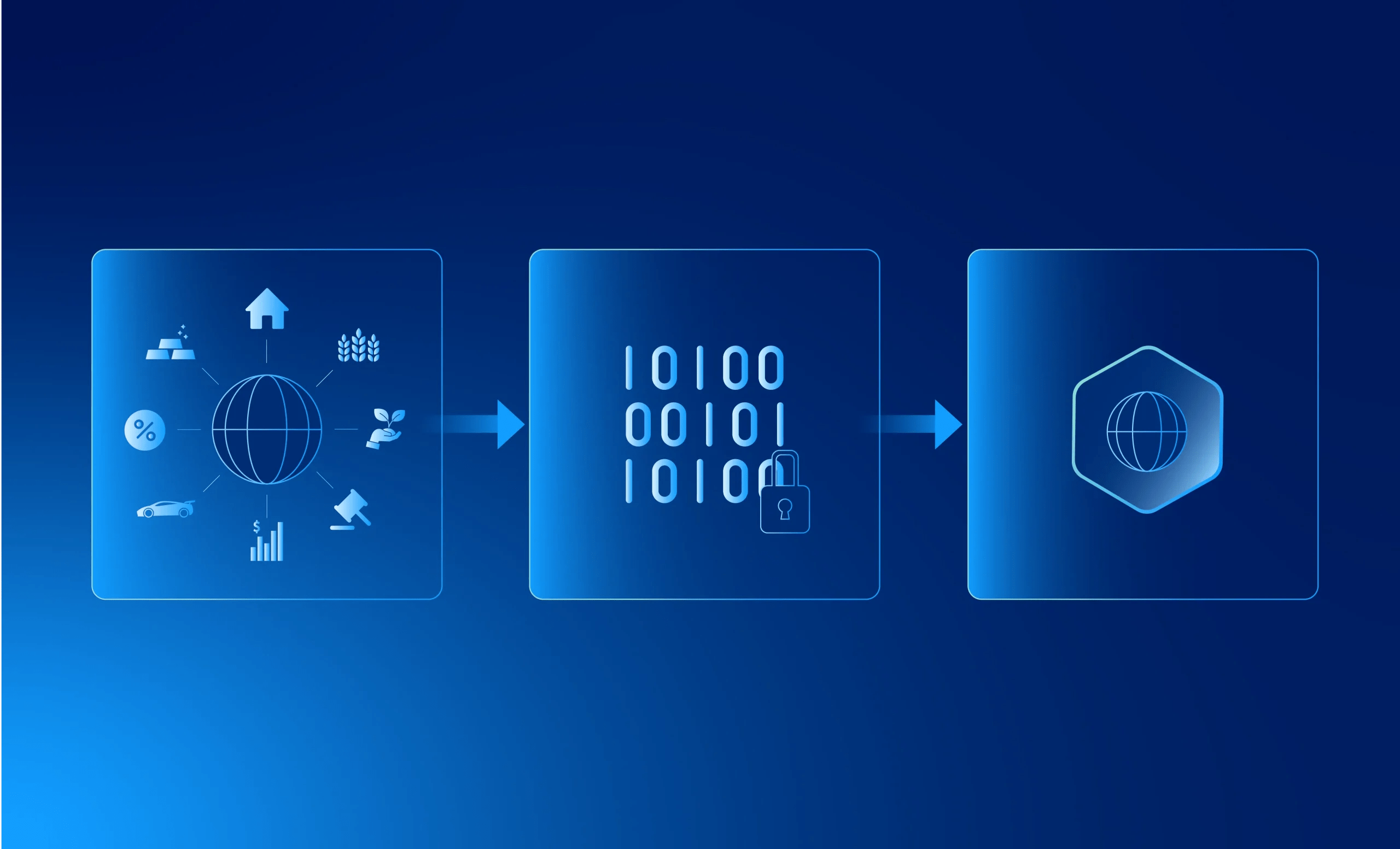

Here’s Why Tokenized Bank Deposits Don’t Stand a Chance Against Stablecoins

The post Here’s Why Tokenized Bank Deposits Don’t Stand a Chance Against Stablecoins appeared com. BlockchainFintech Traditional banks are finally experimenting with blockchain. Yet their latest innovation, tokenized deposits, may be arriving years too late. Financial institutions envision a future where everyday checking balances live on a distributed ledger. But for Omid Malekan, adjunct professor at Columbia Business School, the concept is little more than a digital illusion one destined to be eclipsed by stablecoins. The Great Banking Copycat Moment In the last decade, crypto projects built what banks never could: instantly transferable digital dollars that actually work. Now, banks want in but without giving up control. Their idea is to take customer deposits and issue them as blockchain-based tokens, effectively “on-chain bank balances.” Malekan dismisses the model as self-defeating. Tokenized deposits, he argues, are the blockchain equivalent of a private intranet in an era of global internet connectivity secure, limited, and ultimately obsolete. These instruments would be usable only among customers of the same institution, fenced in by compliance layers like KYC and transaction permissioning. “What use is a token that can’t travel?” he wrote, describing them as digital checking accounts that stop at the bank’s front door. Stablecoins Already Solved the Problem While banks are still building walled gardens, stablecoins have spent years integrating into open networks that now underpin DeFi, cross-border payments, and on-chain commerce. They are interoperable, composable, and transferable without middlemen. Most importantly, they rely on transparent, full-reserve backing not fractional banking to ensure stability. That structure, Malekan argues, makes them safer from a risk perspective. Stablecoin issuers must hold equivalent assets in cash or short-term treasuries, giving them a liquidity profile banks can’t match. Tokenized deposits, by contrast, remain exposed to the same lending risk that defines the traditional system. Why Yields Will Decide Everything The real blow, however, could come from returns. As.

What to know about saturated fat as RFK Jr. touts whole milk and beef tallow

RFK Jr. has come out in support of saturated fats, saying he plans to encourage higher intake in future U. S. dietary guidelines. Here’s what the science says about it.

Comforting touches LA Times Crossword Clue

That should be all the information you need to solve for the Comforting touches crossword clue! Be sure to check more clues on our Crossword Answers. The post Comforting touches LA Times Crossword Clue appeared first on Try Hard Guides.

Prince Andrew’s Controversial Crypto Engagement at Buckingham Palace

The post Prince Andrew’s Controversial Crypto Engagement at Buckingham Palace appeared com. Alvin Lang Nov 02, 2025 08: 37 Prince Andrew is under scrutiny for hosting crypto businessmen at Buckingham Palace linked to a failed £1. 4M deal with Sarah Ferguson, prompting concerns over royal privileges. Prince Andrew finds himself embroiled in controversy once again, following revelations that he hosted a private visit to Buckingham Palace for cryptocurrency businessmen. The visit, connected to a failed £1. 4 million deal involving his ex-wife Sarah Ferguson, has raised significant questions about his use of royal privileges for private business dealings, according to a BBC investigation. Prince Andrew Welcomed Crypto Executives Linked to £1. 4M Deal at Palace Event The businessmen, Jay Bloom and Michael Evers, co-founders of the Arizona-based Pegasus Group Holdings, were given access to the palace in June 2019. This occurred while Queen Elizabeth II was present, intensifying scrutiny over Andrew’s actions. The duo attended Andrew’s Pitch@Palace business event and later dined with Ferguson and their daughter, Princess Beatrice. Pegasus Group Holdings had promised to establish a large-scale Bitcoin mining operation powered by solar energy in Arizona. However, the project quickly unraveled, resulting in significant financial losses for investors. Court documents revealed that the company purchased only a fraction of the planned equipment, producing minimal Bitcoin. Sarah Ferguson, who served as a brand ambassador for Pegasus, reportedly received over £200, 000. Her contract promised an additional £1. 2 million bonus and shares, with luxuries such as first-class travel and five-star accommodations included, yet she bore no responsibility for the project’s technical aspects. The incident has reignited concerns regarding the financial entanglements of Prince Andrew and Ferguson, and the intersection of their royal status with private ventures. Buckingham Palace has since confirmed that steps are being taken to strip Andrew of his remaining titles and his residence at Windsor. UK Crypto.

Bitcoin Bollinger Bands Demand Record Volatility After 3.7% October Dip

The post Bitcoin Bollinger Bands Demand Record Volatility After 3. 7% October Dip appeared com. Key points: Bitcoin seals its worst October performance since 2018 as traders flip cautious on the outlook. ETF outflows return as derivatives traders hedge risk despite macro tailwinds. Bollinger Bands data suggests that BTC price volatility is due to make a sweeping comeback. Bitcoin (BTC) traded around $110,000 on Saturday as traders stayed bearish after “Uptober” failed to deliver. BTC/USD one-hour chart. This began with sell pressure a frequent phenomenon throughout the week involving both US exchanges and the spot Bitcoin exchange-traded funds (ETFs). Onchain analytics platform Glassnode said that ETF outflows highlight “rising sell pressure from TradFi investors and renewed weakness in institutional demand.” Data from UK-based investment company Farside Investors put Friday’s tally at $191 million, which followed $488 million in outflows for Thursday. US spot Bitcoin ETF netflows (screenshot). The Fed delivered the expected rate cut, but the hawkish tone for December has cooled optimism,” it told X followers. “The initial rally faded as traders moved back into cautious mode, a shift clearly reflected in BTC’s options market.” Traders likewise remained cautious, with crypto investor and entrepreneur Ted Pillows calling the current setup on Bitcoin “time-based capitulation.” “BTC time-based capitulation is happening now. But for this, Bitcoin needs to consolidate above $100,000,” he warned Friday. “A weekly close below this level will confirm the downtrend.” BTC/USDT two-day chart.

Dear Abby: I want to have a good time but Bob the creep is at the bar

Dear Abby: I want to have a good time but Bob the creep is at the bar

The Deep State Stalls on Trump Ban of Dangerous ‘Gain-Of-Function’ Research [WATCH]

The Deep State Stalls on Trump Ban of Dangerous ‘Gain-Of-Function’ Research [WATCH]

ETFs, Treasuries, and Regulated Networks Push XRP Into a New Phase

The post ETFs, Treasuries, and Regulated Networks Push XRP Into a New Phase appeared com. Altcoins The XRP ecosystem is rapidly evolving into one of the most active institutional playgrounds in digital finance. From tokenized capital market infrastructure on the XRP Ledger (XRPL) to ETF filings and billion-dollar treasury acquisitions, the network is transitioning from litigation recovery to full-scale financial integration. Axiology, led by CEO Marius Jurgilas, is building what it calls a “regulated blockchain backbone” for capital markets using the XRP Ledger. Speaking during RippleX’s Onchain Economy series, Jurgilas outlined his goal to merge issuance, settlement, and trading within a single compliant ecosystem one that eliminates redundant intermediaries and streamlines direct links between issuers and investors. How is regulated blockchain infrastructure reshaping capital markets? In the latest episode of Onchain Economy, @MariusJurgilas of @AxiologyTSS joins to discuss their work building institutional-grade digital asset infrastructure on the XRPL. They’re making finance more. pic. twitter. com/GApeEsnFjR RippleX (@RippleXDev) October 31, 2025 He explained that today’s system still relies on layers of brokers, custodians, and clearing agents, even for something as simple as purchasing a government bond. Axiology’s XRPL-based framework aims to remove that friction entirely, while ensuring full compliance with existing regulations. Jurgilas emphasized that “the real challenge isn’t technology, but institutional education.” Many financial institutions, he said, still view blockchain through a lens of complexity rather than efficiency, underscoring the need for broader understanding of its transparency and control advantages. He also drew attention to a striking imbalance in Europe: small and medium-sized enterprises face a $5 trillion funding gap while $15 trillion sits idle in deposits. A regulated, blockchain-enabled capital market could, in his view, unlock that trapped liquidity and reshape the funding landscape for EU businesses. Teucrium Files for First Flare ETF as FXRP Activity Surges Meanwhile, another Ripple-linked ecosystem is gaining momentum. Teucrium Trading LLC, known for its leveraged XRP ETF, has.

![The Deep State Stalls on Trump Ban of Dangerous ‘Gain-Of-Function’ Research [WATCH]](https://trostisar.com/wp-content/uploads/2025/11/2025.11.02-08.06-lifezette-690711144d970.jpg)