Donald Trump’s attack on members of Congress who served in the military for advising those currently serving not to follow illegal orders could have a ripple effect that blows up on him, an expert warned Tuesday. During an appearance on MS NOW, longtime Washington D. C. observer John Heilemann suggested the president may face a reckoning now that Defense Secretary Pete Hegseth is going after Sen. Mark Kelly (D-AZ), a popular former Navy pilot and astronaut. Speaking with the hosts on “Morning Joe,” Heileman made the case that it is only a matter of time before retired and active duty military personnel turn on the president, whose popularity is already slipping. Admitting that he was stunned that Hegseth is focusing on Kelly, he added that it could be the straw that broke the camel’s back within the military ranks.“The question for me is, when do we get to the point where active duty senior military officials start to speak up, because they have kept quiet?” he told the panel. “When Trump gave speeches at Fort Bragg and West Point, a lot of them were upset about it because they were so partisan and political.”“They have kept quiet in the face of the discussions of sending in the military to a place like Chicago and Los Angeles and other places, but I think there’s a moment that’s coming, and I think a lot of people in the military recognize this, where not just retired, but where current active duty senior military who are clearly, quietly troubled by everything that’s going on with this, are going to face a moment of truth where they’re either going to have to speak up, or they’re going to have to end up obeying orders that are at least questionably legal and possibly blatantly illegal.”“That’s going to be a big moment in this country. We haven’t seen anything like that from active duty military speaking out publicly, really, in our lifetimes,” he reminded the panel. YouTube youtu. be.

Tag: subsequently

Likely to trade in a range between 0.5650 and 0.5690 – UOB Group

The post Likely to trade in a range between 0. 5650 and 0. 5690 UOB Group appeared com. New Zealand Dollar (NZD) is likely to trade in a range between 0. 5650 and 0. 5690. In the longer run, no change in view; NZD is likely to trade in a range between 0. 5605 and 0. 5695, UOB Group’s FX analysts Quek Ser Leang and Peter Chia note. NZD is likely to trade in a range 24-HOUR VIEW: “Last Friday, we expected NZD to ‘range-trade between 0. 5630 and 0. 5680’. The subsequent price movements did not turn out as expected. NZD rose to a high of 0. 5691 before settling at 0. 5680 (+0. 47%). Despite rising to a high of 0. 5691, there is no clear increase in upward momentum. Today, we continue to expect range-trading, most likely between 0. 5650 and 0. 5690.” 1-3 WEEKS VIEW: “Last Tuesday (11 Nov, spot at 0. 5645), we highlighted that NZD ‘is likely to trade in a range between 0. 5605 and 0. 5695’. We reiterated our stance last Friday (14 Nov, spot at 0. 5655), stating that “there is no change in our view.” NZD subsequently rose close to 0. 5695 (high was 0. 5691). The slight increase in upward momentum is not enough to indicate a continued advance. In other words, we continue to hold the same view.” Source:.

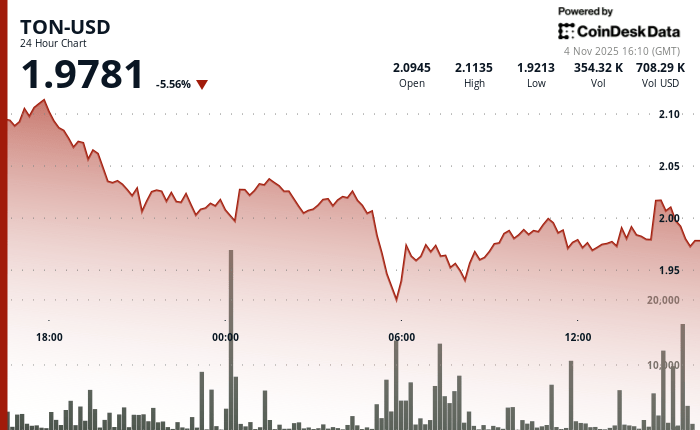

Toncoin Falls Below $2 as Broader Market Conditions Weigh on Price

The post Toncoin Falls Below $2 as Broader Market Conditions Weigh com. TON$1. 9361 fell sharply over the last 24-hour period, breaking below the key $2 level amid a broader crypto market downturn that saw the CoinDesk 20 (CD20) index retreat 2. 57%. The token dropped 5. 5% to $1. 97, with volume surging 89% above daily averages. Traders pushed TON through several support zones before it found footing near $1. 92, according to CoinDesk Research’s technical analysis data model. The price action came during a broader downturn in crypto markets. Bitcoin BTC$101, 825. 28 dropped below $102, 800, its lowest level since June, as over $1. 4 billion in long positions were liquidated across the market, according to CoinGlass, intensifying downward pressure. The drop triggered a spike in intraday volatility, with the price swinging across an 11. 8% range. TON subsequently showed signs of stabilizing with the price pushed back toward $1. 99 on elevated volume. That V-shaped recovery, while modest, suggests interest may still be intact, though the token has since slumped to $1. 97. Traders are now watching the $2 level closely. A sustained move back above that line could shift momentum, but pressure remains high with scrutiny on major TON holders. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. Source:.

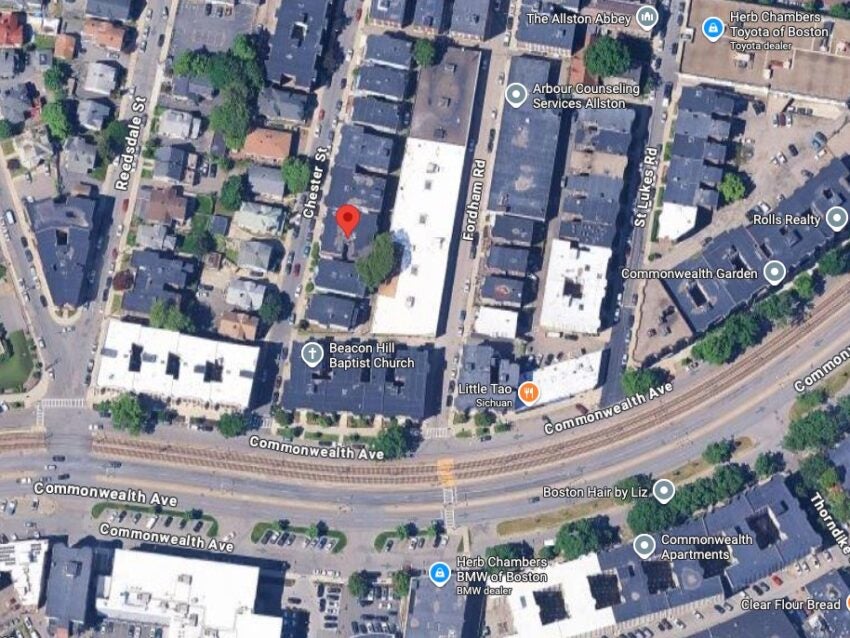

An Allston resident was closing her bedroom window. ‘It suddenly reopened and a hand reached inside,’ police say.

A Brighton man was subsequently arrested. The post An Allston resident was closing her bedroom window. ‘It suddenly reopened and a hand reached inside,’ police say. appeared first on Boston. com.