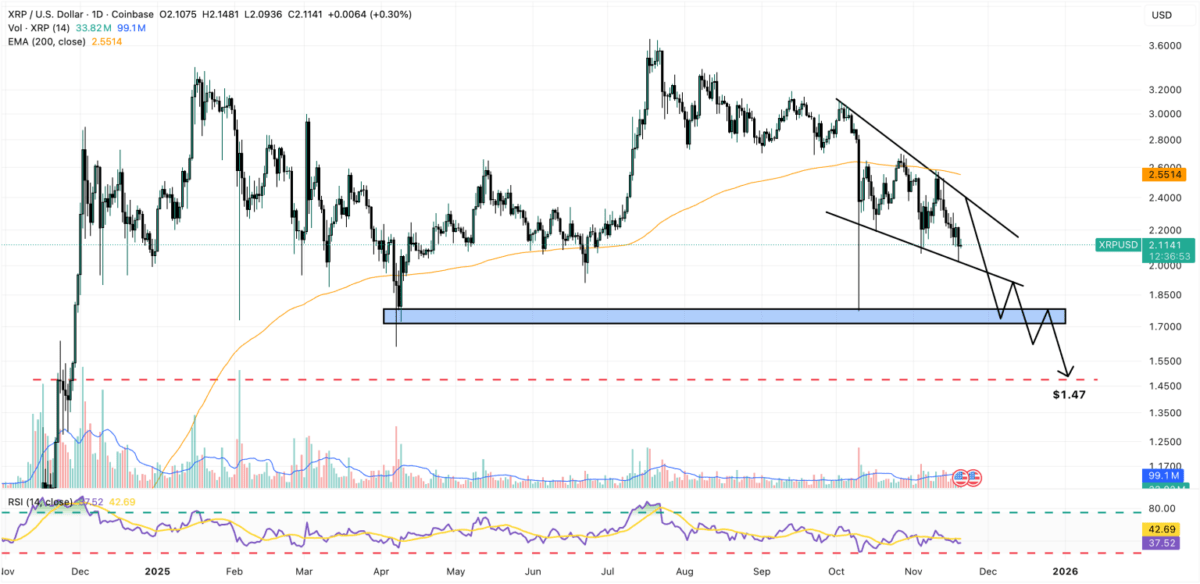

The post Top Crypto to Buy Now as Ripple XRP is Experiencing Greater Selling Pressure XRP`s situation is becoming more and more measurable. Currently, the token is testing a trend line support level. If this line is breached, it could lead the token to a new level of rapid decline. The market is displaying a 27% growth in trading volume over the past 24 hours, representing almost 5% of its circulating market cap. This volume growth is generally a sign of increased selling pressure as opposed to increased buying of the asset. The decline of this open interest leads to the conclusion that market participants are closing their contracts and leaving the active trading of the asset, and that they see limited upward potential in the short term. In the highly unusual situation that a support level holds, the token could trade higher in short time as a result of positive technical market action. However, the overall structure remains weak, as this flat price action is unlikely to lead to a sustained technical recovery. This continuing market condition is likely to lead to many market participants.

Tag: ripple

Financial Ambitions Grow, XRP Price Outlook Turns Cautiously Bullish

The post Financial Ambitions Grow, XRP Price Outlook Turns Cautiously Bullish appeared com. AltcoinsFintech At a time when the lines between traditional finance and digital assets are fading, Ripple Labs is positioning itself as a central bridge between the two. Key Takeaways: Ripple is evolving into a financial infrastructure giant through multi-billion-dollar acquisitions. Institutional crypto adoption grows under a more supportive U. S. regulatory stance. XRP trades near $2. 46 with short-term sell signals but a potential path toward $2. 70. The Clarity Act’s delay and government shutdown continue to stall regulatory progress. At the Swell 2025 conference in New York, CEO Brad Garlinghouse unveiled Ripple’s evolving mission: transforming from a blockchain innovator into a global financial infrastructure company. In recent months, Ripple has intensified efforts to merge institutional-grade finance with blockchain technology, focusing on scalable solutions for banks, funds, and corporations seeking to modernize cross-border payments and liquidity systems. Ripple’s Expanding Financial Empire The company’s acquisition trail this year underscores that ambition. Ripple acquired Hidden Road, a prime brokerage firm, for about $1. 3 billion, followed by GTreasury, a corporate liquidity management platform, for over $1 billion. These moves culminated in the launch of Ripple Prime, a brokerage for over-the-counter spot trading of digital assets, alongside a $500 million fundraising round that lifted its market valuation to roughly $40 billion. Ripple Labs is conquering crypto. Now the XRP-linked firm wants to take on traditional finance CNBC (@CNBC) November 10, 2025 Garlinghouse said Ripple’s goal is not to compete with banks but to embed blockchain directly into financial infrastructure. “We’re investing in the next generation of finance,” he explained, emphasizing that the company’s latest acquisitions are part of a broader plan to bring crypto-enabled efficiency to traditional markets. Institutional Momentum and Regulatory Shifts Ripple’s expansion comes amid a friendlier environment for digital assets in the United States, where President Donald Trump’s administration has taken a.

Hodler’s Digest, Nov. 2 – 8 – Cointelegraph Magazine

The post Hodler’s Digest, Nov. 2 8 Cointelegraph Magazine appeared com. Top Stories of The Week Ripple rejects IPO plans despite SEC case victory: Here’s why Ripple, the US blockchain company behind the XRP cryptocurrency, will not pursue an initial public offering following the conclusion of its years-long legal battle with the US Securities and Exchange Commission. Ripple president Monica Long said the company has no plans or timeline for an IPO, according to a Bloomberg report on Wednesday. “We’re in a fortunate position where we’ve been able to be very well capitalized and fund all of our organic growth, inorganic growth, strategic partnerships, anything we want to do,“ Long said. Ripple’s decision to forgo an IPO ends years of speculation, after multiple executives had hinted at one. The company was hit with a $1. 3 billion SEC lawsuit in late 2020. Bitcoin bull run hasn’t started yet: Jan3’s Samson Mow Samson Mow, the CEO and founder of Bitcoin technology infrastructure company Jan3, argues the Bitcoin bull run is yet to begin, as Bitcoin fell to just under $100, 000 earlier this week. “The Bitcoin bull run hasn’t started yet. We’re just marginally outperforming inflation at this price range,” he said on Wednesday. Bitcoin and the broader cryptocurrency market continued to slump this week, with analysts attributing the decline to trade tensions between the US and China, as well as other macroeconomic factors. Bitcoin selling intensified on Tuesday, and CoinGecko data shows the price dipped to $99,607 on Wednesday. However, Mow, in a series of bullish X posts, predicted the market still has plenty of upside on the horizon as Bitcoin continues to outperform the US inflation rate of 3%. FBI can’t be blamed for wiping hard drive with $345M BTC, say judges A man convicted of identity theft, who claims his hard drive with over 3, 400 Bitcoin was seized and wiped by.

Ripple Unveils Full U.S. Spot Prime Brokerage Access for Institutional Crypto Trading

Key Takeaways: Ripple activates spot prime brokerage services in the U. S., letting institutions execute OTC spot trades on major digital assets, including XRP and RLUSD. The rollout follows Ripple integrating The post Ripple Unveils Full U. S. Spot Prime Brokerage Access for Institutional Crypto Trading appeared first on CryptoNinjas.

Ripple IPO Plans Off Despite SEC Case Win And Record Growth

The post Ripple IPO Plans Off Despite SEC Case Wcom. Ripple, the US blockchain company behind the XRP cryptocurrency, will not pursue an initial public offering following the conclusion of its years-long legal battle with the Securities and Exchange Commission. Ripple president Monica Long said the company has no plans or timeline for an IPO, according to a Bloomberg report on Wednesday. “We’re in a fortunate position where we’ve been able to be very well capitalized and fund all of our organic growth, inorganic growth, strategic partnerships, anything we want to do,“ Long said. Ripple’s decision to forgo an IPO ends years of speculation, after multiple executives had hinted at one. The company was hit with a $1. 3 billion SEC lawsuit in late 2020. Ripple doesn’t report revenue As a private company, Ripple doesn’t publish full annual profit or revenue. According to estimations by the market intelligence platform CBI Insights, Ripple’s 2024 revenue was $1. 3 billion. Long declined to share 2024 revenue in the report but said the company doubled its customers, driven by Ripple USD (RLUSD) stablecoin adoption and greater regulatory clarity globally. Related: Ripple’s RLUSD enters top 10 USD stablecoins less than year after debut The raise follows Ripple’s “strongest year to date” and a $1 billion tender offer, valuing the company at $40 billion. “As Ripple continues its record year of growth, providing liquidity for shareholders and employees remains a priority,” Ripple said in the $500 million raise announcement, adding that it has repurchased more than 25% of its outstanding shares in recent years. Ripple CEO Brad Garlinghouse announced that the SEC was dropping its multi-year action against the company in March. He previously hinted at a.

Ripple News: Ripple Confirms No IPO Timeline After $500 Million Funding Round

The post Ripple News: Ripple Confirms No IPO Timeline After $500 Millicom. Ripple has “no plans or timeline” for an IPO, President Monica Long stated. This follows a $500 million funding round valuing it at $40 billion. Ripple President Monica Long made a significant announcement. At the Swell conference in New York, she stated the company has “no plans or timeline” for an IPO. This means no intention for the short term. As a result, Ripple will not be participating in other crypto companies going public. Ripple Dismisses Market Rumors of Imminent Public Listing Her comments come after a recent funding round of $500 million. This seed funding greatly boosted Ripple’s valuation. The company is currently valued at $40 billion. Therefore, this statement implies that Ripple will continue to remain private. Related Reading: Ripple News: Ripple Hits $40 Billion Valuation After $500 Million Strategic Funding Round | Live Bitcoin News Bloomberg talked to Monica Long, who only said: “We don’t have an IPO timeline.” She repeated “No plan, no timeline.” This clarity dispenses with the constant market speculation. According to a Bloomberg report, Ripple is not going to follow other digital asset companies. Many are looking for public listings. As a result, Long pointed out the company’s internal priorities. They are focusing on internal growth and building their ecosystem. This focus is more important than an IPO. Her comments rule out market speculation. These rumors indicated that Ripple would be going public soon. Thus, the company is taking its own path. Earlier this year, investors from around the world came in for Ripple’s latest round of funding. This private financing was a major driving force behind its valuation. It was the company’s initial public offering in six years. It was also its biggest capital injection since 2019. The US $500 million investment was participated in by well-known companies. The round was led.

Ripple RLUSD Stablecoin Crosses $1 Billion Valuation

In a remarkable turn of events, the supply of RLUSD, Ripple’s stablecoin, has surpassed the $1 billion valuation mark. Market-tracking platforms such as Ripple Stablecoin Tracker on X and CryptoQuant confirm this milestone. Visit Website.

Crypto Whales Join AlphaPepe as the Best Crypto to Buy Now, Surpassing Litecoin and XRP

While established assets like Litecoin (LTC) and Ripple’s XRP continue to hold their ground, high-value investors are rotating into newer [.] The post Crypto Whales Join AlphaPepe as the Best Crypto to Buy Now, Surpassing Litecoin and XRP appeared first on Coindoo.

Ripple’s Evernorth Expands XRP Portfolio to $1B as Nasdaq Listing Looms

TLDR Evernorth now holds over 388 million XRP worth more than $1B, powered by Ripple. Chris Larsen transferred 50 million XRP to Evernorth, boosting its treasury. Evernorth plans to go public on Nasdaq through a SPAC merger by Q1 2026. XRP price has surged 10% in a week amid increased institutional interest. Ripple-backed Evernorth has [.] The post Ripple’s Evernorth Expands XRP Portfolio to $1B as Nasdaq Listing Looms appeared first on CoinCentral.

Here’s Why Ripple is Buying $1B in XRP Instead of Just Using Its Escrow

Nietzbux, an XRP community pundit, has shared his theory on why Ripple has decided to lead efforts to buy XRP instead of using its escrow balance. For context, Bloomberg recently reported that Ripple was looking to lead a fundraising effort in an attempt to raise up to $1 billion for the purchase of XRP tokens. Visit Website.