The post Google denies claims of using Gmail data to tracom. Key Takeaways Google firmly denied using Gmail content (emails and attachments) to train its AI models, including Gemini AI. Viral claims that Google changed privacy policies for AI development purposes are inaccurate, according to the company. Google denied claims that it uses Gmail data to train its AI models, following viral reports suggesting the tech giant had changed its privacy policies to access user emails and attachments for AI development purposes. The company clarified that Gmail’s existing smart features, such as spell checking and smart replies, use data for personalization but remain separate from AI model training. “We do not use Gmail content to train our Gemini AI,” Google stated, emphasizing that no policy changes have occurred regarding AI training data. Recent discussions emerged after some users reported being unexpectedly re-enrolled in Gmail’s smart features, which analyze user data to provide conveniences like attachment scanning and automated responses. Gmail’s smart features have long utilized user data for personalization purposes, but Google maintains these functions operate independently from its AI model development. The company highlighted that users retain privacy controls over data usage through their account settings. The clarification comes as privacy concerns grow around major tech companies’ data collection practices for AI development, with users increasingly scrutinizing opt-out options for various data usage features. Source:.

Tag: key

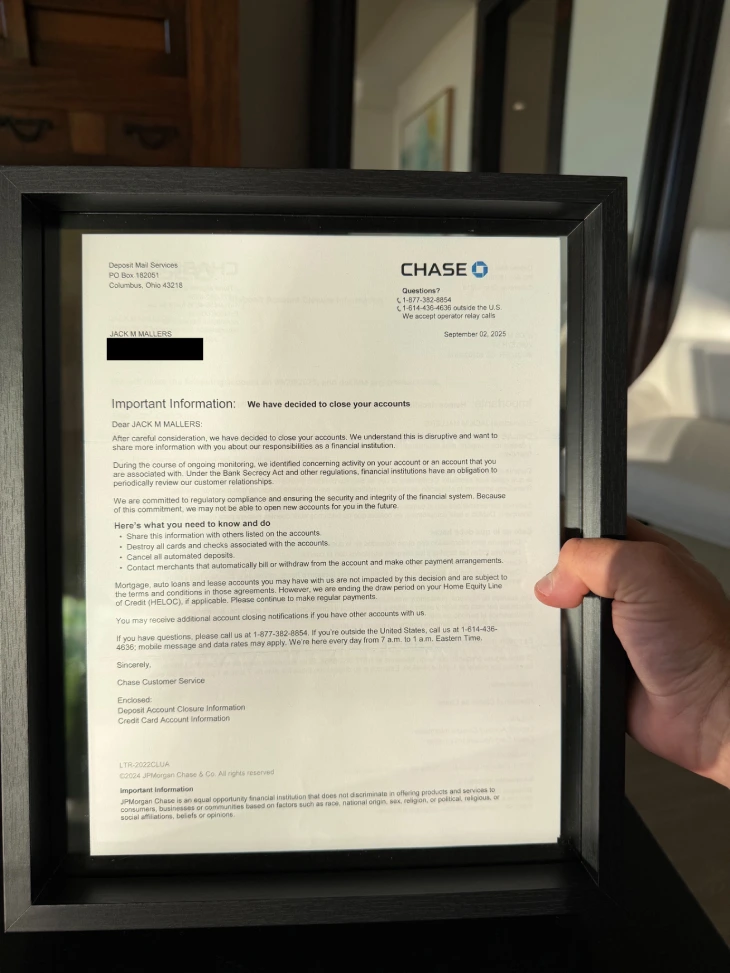

Senator Lummis Slams JPMorgan for Debanking Strike CEO

Key Highlights Senator Cynthia Lummis has slammed JPMorgan for undermining confidence in traditional banks and sending the digital.

Internet Computer bulls reclaim $5.5 – Why ICP may not revisit $5 this week

The post Internet Computer bulls reclaim $5. 5 Why ICP may not revisit $5 this week appeared com. Journalist Posted: November 19, 2025 Key Takeaways Why is ICP a potential buying opportunity? Internet Protocol has outperformed many altcoins over the past 24 hours, posting strong double-digit percentage gains. This relative strength shows that a rally to $9. 8 is likely. What is the invalidation for ICP bulls already in swing positions? The $5. 1-$5. 5 was a local demand zone that has been retested in recent hours. It was unlikely that the price would drop lower in the coming days. Internet Computer [ICP] rallied 17% on the 18th of November, and could climb even higher. The daily session was not yet closed at the time of writing. Also, the high daily trading volume of $858 million indicated heavy demand. However, Coinalyze data showed the Funding Rate was negative, even as prices climbed higher. This was a sign of a short squeeze. The market had been overly pessimistic during the retest of the $5. 5 local resistance. A continued price move higher would force these short positions to close, spurring prices higher. What was the importance of $5. 5, and why was the market convinced to take bearish positions? 3 was ripe for a bullish reversal. It also had confluence with the former resistance zone at the same level as in October. It could be that during the price bounce in recent hours, some market participants expected $4. 3 to be.

Ethereum bounces off $3K despite ETF bleed: Are ETH bulls stepping into a trap?

The post Ethereum bounces off $3K despite ETF bleed: Are ETH bulls stepping into a trap? appeared com. Key Takeaways Is Ethereum rebound flow-backed? Market positioning signals that Ethereum traders are leaning long, but ETF outflows and capitulating whales keep the risk of a bull trap alive. Does the $3k level mark a bottom? Technically, ETH’s V-shaped recoveries are absent, and the pattern mirrors mid-November’s breakdown, leaving $3k exposed. Is it still too early to call Ethereum’s [ETH] $3k level a confirmed bottom? On one hand, ETH has managed a 3. 5% bounce off $3k despite the broader market sitting in extreme fear. And yet, smart money continues to capitulate (realizing losses) while ETH ETFs keep bleeding capital. In this context, is Ethereum’s rebound a “bull trap”? Capital, leverage, and market share pivot toward Ethereum Ethereum’s rebound is being driven by a clear shift in market positioning. Notably, its resilience shows up as Bitcoin dominance [BTC. D] gets rejected at the 60% level. Meanwhile, ETH dominance [ETH. D] has pushed back above the 12% market-share mark with three consecutive green inflows. Essentially, traders are rotating into alts as BTC becomes the riskier trade. As a result, the ETH/BTC ratio has jumped roughly 3% in under 72 hours off the 0. 032 floor, reinforcing the idea of a classic strategic rotation at play. In Derivatives, positioning has been clearly tilted to one side, with the ETH/USDT perpetuals on Binance showing a 70%+ long skew across multiple timeframes. Simply put, Ethereum traders are leaning hard into the upside. Backing this, ETH’s Open Interest (OI) has climbed by $2 billion in under 72 hours, while BTC’s has jumped by $280 million. That’s 7× slower than ETH’s pace, highlighting the sharp rotation of leverage toward Ethereum. Taken together, ETH’s 3. 5% rebound is riding on solid rotational flows and a clear speculative liquidity.

Tether explores €1bn investment in German AI robotics firm Neura

The post Tether explores €1bn investment com. Key Takeaways Tether is exploring a €1 billion investment in Neura Robotics, a German AI robotics company. The partnership aims to boost Neura Robotics as it develops cognitive humanoid robots for practical applications. Tether, the stablecoin issuer, is considering a €1 billion funding deal with Neura Robotics, a German AI robotics company, marking a significant expansion into the artificial intelligence and robotics sectors. The potential investment would support Neura Robotics as it prepares to debut a humanoid robot emphasizing cognitive capabilities for real-world applications. Tether has been building a diverse investment portfolio by targeting opportunities in AI and robotics sectors, moving beyond its core stablecoin business. The funding discussions come as the humanoid robotics field features increasing competition, with startups actively seeking investors for innovative robot development. Source:.

Why Sharplink’s 4,364 ETH transfer is a reality check for Ethereum investors

The post Why Sharplink’s 4, 364 ETH transfer is a reality check for Ethereum investors appeared com. Key Takeaways Why is a Sharplink-driven ETH sell-off plausible? The recent media frenzy exposed market sensitivity. As SBET’s stock drop tightens its capital-raising channel, the company may need to sell ETH. How are investors feeling about Ethereum DATs? SBET’s unrealized losses, BitMine’s $2. 1 billion paper losses, highlight growing pressure and softening confidence in Ethereum DATs. Q4 is shaping up to be a hard reality check for Ethereum [ETH] DATs. After a 71. 26% Q3 rally, Sharplink Gaming [SBET] has already unwound about 40% of those gains, and we’re not even halfway through the quarter. So anyone who chased the late-Q3 breakout is now deep underwater. Notably, SBET isn’t the only one feeling the squeeze. The largest ETH DAT, BitMine [BMNR], has accumulated roughly 442, 000 ETH since the mid-October drawdown. But now, according to CryptoQuant data, that position is sitting on $2. 1 billion dollars in unrealized losses. To recap, Arkham Intelligence flagged a wallet tied to Sharplink that moved 4, 364 ETH into OKX, triggering a headline cycle. But a few hours later, SBET’s CIO clarified that the address wasn’t affiliated with the company. Still, the market’s outsized reaction stood out. Essentially, Sharplink’s model runs on an equity-fueled ETH accumulation loop. However, with SBET’s Q4 turning bearish, did this flare-up “expose” a real soft patch in investor confidence, backing up CryptoQuant’s thesis? Sharplink ETH stack faces a reality check amid rising losses On paper, conviction in SBET is hanging by a thread. At its Q3 peak, unrealized gains ballooned to roughly 920 million dollars as Sharplink’s stock pushed toward 40 and its market cap hit about 4 billion. Now, though, that valuation has slid to around 2. 3 billion. CryptoQuant backs this up. SBET’s unrealized losses spiked to 320 million.

Decoding ICP’s 35% rally: Has the AI-driven boom just begun?

The post Decoding ICP’s 35% rally: Has the AI-driven boom just begun? appeared com. Key Takeaways What’s fueling ICP’s recent 35% rally? The launch of its AI platform Caffeine and rising investor interest are driving the surge. Could ICP continue its upward momentum? Strong capital inflows, bullish sentiment, and minimal downside liquidity suggest potential for further gains. Internet Computer [ICP] has become the latest buzz in the crypto market, driven largely by developments within its ecosystem, particularly the public launch of its artificial intelligence (AI) platform, Caffeine. As a result, ICP has recorded a significant 35% rally in recent days, pushing the asset close to the double-digit zone. Interest and investor sentiment turn bullish Google Trends data shows a sharp increase in search interest for ICP, with the “Interest Over Time” metric reaching a peak score of 100, indicating the token’s highest level of popularity to date. Historically, such spikes in search interest have aligned with major price movements, often in the upward direction. At press time, 84% of 113, 900 investors expressed a bullish outlook on ICP, indicating expectations of a continued rally. Data reviewed by AMBCrypto also shows a correlation between retail search interest, sentiment votes, and capital inflows into the market. Capital flow backs the rally In the past day, ICP recorded a strong capital inflow, particularly in the derivatives market. Open interest rose by $85 million to reach $261 million, as of writing, signaling renewed investor engagement. This surge was accompanied by a 92% rise in token trading volume to roughly $1. 27 billion, bringing total trading capital to $2. 45 billion. The Long-to-Short Ratio has stayed above 1, confirming that buying volume outweighs selling activity. Rising capital inflow and trading volume could further strengthen ICP’s upward momentum, potentially pushing.

Gemini launches XRP perpetual contracts for EU users with up to 100X leverage

The post Gemini launches XRP perpetual contracts for EU users with up to 100X leverage appeared com. Key Takeaways Gemini has launched XRP perpetual contracts for European Union users. The contracts support up to 100x leverage, allowing traders to amplify positions. Gemini, a cryptocurrency exchange, today launched XRP perpetual contracts for EU users with leverage up to 100x. The new product allows traders in the European Union to take long or short positions on XRP without expiry dates. The perpetual contracts enable directional exposure to XRP price movements through Gemini’s offshore exchange platform. Users can access enhanced risk management tools as part of the offering. Gemini continues expanding its perpetual contract trading options for international users, adding various crypto assets to its leveraged products suite for markets outside the US. Source:.

Bitcoin endures second-worst day in 2025

The post Bitcoin endures second-worst day in 2025 appeared com. Key Takeaways Bitcoin endured its second-worst trading day of 2025, reflecting heightened market volatility. The sharp declines were triggered by macroeconomic pressures and technical indicators. Bitcoin, the largest digital asset by market cap, experienced its second-worst trading day of 2025 today as sharp declines continued to pressure the broader cryptocurrency market. Recent sharp declines in Bitcoin’s value have been influenced by macro pressures and technical signals triggering broader cryptocurrency drops. The digital asset recently finished a historically strong month in the red due to unexpected drawbacks, marking a shift from typical seasonal performance. Bitcoin has shown traces of post-crash recovery patterns following a major wipeout event in early October, though today’s performance suggests continued volatility in the market. Source:.

Crypto market sees over $250M in long positions liquidated within an hour

The post Crypto market sees over $250M in long positions liquidated within an hour appeared com. Key Takeaways Over $250 million worth of long positions were liquidated in the crypto market within a single hour due to a sharp downturn. The total liquidations reached $1 billion over the past 24 hours. The crypto market experienced over $250 million in long position liquidations within a single hour today, as leveraged bets on asset price increases faced sudden margin calls during a sharp downturn. Bitcoin nearly fell below $100, 000, marking its lowest since June 23. Currently trading at $101, 247, Bitcoin has decreased about 5% in the past day, bringing its market cap to $2 trillion. The broader crypto market also declined by 4. 5% to $3. 4 trillion. Major tokens like Ethereum, XRP, BNB, Solana, and Dogecoin experienced similar downturns. Over $1 billion in futures positions were liquidated in the last 24 hours due to the market pullback. Source:.