The post AI News: Nvidia’s Earnings Strength Collides With Tough Market Expectations appeared com. Sovereign adoption and quantum computing clarity could spark Bitcoin’s next major move, says ProCap CIO Jeff Park Sovereign adoption has become a major talking point for Bitcoin. Jeff Park from ProCap said it could trigger a massive upswing in price if a developed country chose to add Bitcoin to its national balance sheet. Park described this as a rare event that could change market sentiment within hours. Genuine sovereign buying could reshape price action Park said a real move from one large country could push Bitcoin near $150,000 overnight. That level would mark a large jump from recent prices tracked by CoinMarketCap. Strong buying from a government could create a fast change in trader behavior. Park said such an event would show that Bitcoin has reached a new stage in global finance. He said the announcement must describe clear and deliberate buying. It cannot be a symbolic gesture or a trial program. JEFF PARK : THE REAL BITCOIN SUPER-CATALYST IS SOVEREIGN ADOPTION ProCap CIO Jeff Park a former Morgan Stanley portfolio manager and seasoned macro investor says the real upside trigger isn’t ETFs, halving, or rate cuts. It’s sovereign Bitcoin adoption! If a major. pic. twitter. com/4JdipXCcyQ CryptosRus (@CryptosR_Us) November 22, 2025 He said the market listened to claims of national buying for nearly a year in the past. Several sources repeated the idea without evidence and that period created mistrust among investors and reduced excitement when similar claims appeared again. Park said a confirmed purchase would break that pattern and create strong demand at once. Several analysts in the crypto space have said countries may act sooner than expected. Samson Mow said adoption follows a slow, then a fast phase and believes the slow phase may be ending. Park on the other hand, did not predict.

Tag: coinmarketcap

Meme Coins Hit Hard by Bitcoin Price Dip Below $90K: Weekly Round-Up

TLDR: Bitcoin fell below $90K, marking its largest correction since 2017 and a six-month low hitting meme coins hard. Meme coin market cap dropped 12% to $44. 3B, with volumes down 7% to $5. 5B. Grayscale aims to list DOGE ETF on NYSE, pending SEC approval in 20 days. Pump. fun created 15, 000+ tokens in 24 hours, far [.] The post Meme Coins Hit Hard by Bitcoin Price Dip Below $90K: Weekly Round-Up appeared first on Blockonomi.

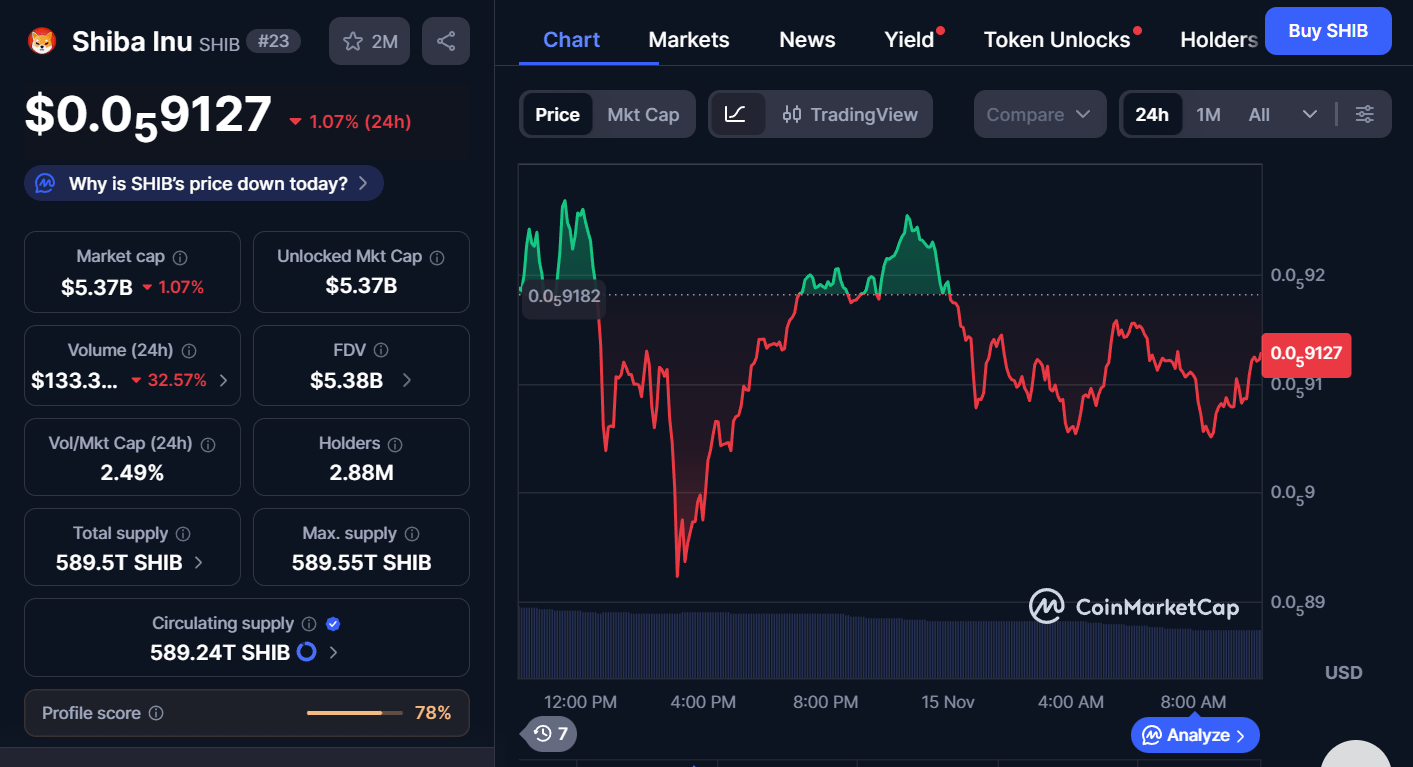

Latest Shiba Inu News: New Meme Coin Presale Goes Viral – Set To Rival SHIB

The post Latest Shiba Inu News: New Meme Coin Presale Goes Viral Set To Rival SHIB appeared com. Shiba Inu news just got a serious twist as Layer Brett bursts onto the scene with a viral pre-launch and its own Ethereum Layer 2 plans. While SHIB trades like a giant, LBRETT is setting up as the quicker rival, with faster transactions, big staking yields and a public testnet coming for holders hunting fresh upside in this high-volatility meme market cycle. Shiba inu cools off as price dips and trading interest fades Based on the most recent statistics, Shiba Inu (SHIB) is trading at 0. 000059127, which implies that it has gone down by 1. 07 in the past 24 hours. Nevertheless, SHIB has a large market cap of 5. 37 billion and a strong base of holders amounting to 2. 88 million holders. Moreover, the volume of trading has dropped by more than 32%, which is an indicator of less market activity and possibly a lack of conviction by investors. 00005912 and $0. 00005982. The short-run sentiment of SHIB is bearish as evidenced by the steady downwards highs that are signs of selling pressure. In this uncertain situation, many investors are looking for better options in the meme coin industry and Layer Brett keeps coming up as a strong rival for Shiba Inu for its current market standing. How Layer Brett’s is giving competition to Shiba Inu SHIB has a high overall reach into the meme coin market, but LBRETT is rapidly gaining momentum through a private funding event that has raised more than 4. 4 million USDT already. The Private funding price is fixed at $0. 0058 and it will be raised to $0. 0061 and this will be done under a tiered pricing strategy that will benefit early investors. Layer Brett is built on Ethereum Layer 2 blockchain technology,.

Bitwise CEO Declares Bitcoin’s Four-Year Cycle Obsolete

The post Bitwise CEO Declares Bitcoin’s Four-Year Cycle Obsolete appeared com. Key Points: Bitwise CEO announces Bitcoin’s four-year cycle as outdated, highlighting post-ETF dynamics. New market structure reshapes crypto investment behavior. Bear market phase likely concluding, per on-chain and institutional data. On November 16, Bitwise CEO Hunter Horsley asserted on X that the traditional Bitcoin four-year cycle is obsolete due to new market dynamics post-Bitcoin ETF launch. This shift could disrupt Bitcoin’s market rhythm, as institutional flows redefine investment strategies and potentially stabilize previously volatile cycles. Impact of ETFs on Bitcoin’s Market Cycle He suggested a six-month bear market might be ending, aligning with expectations of renewed market structures and different participant behavior. Market reactions reflect the changing landscape, with institutional investors now playing a more prominent role in determining price movements. “What we’re talking about is the four-year cycle but the reality is, this pattern is based on a bygone era of cryptocurrency. Since the launch of the Bitcoin ETF and the appointment of a new management team, we have entered a new market structure: new participants, new dynamics, new reasons for people to buy and sell. I believe we have most likely already gone through a nearly six-month bear market and are about to emerge from it.” Hunter Horsley, CEO, Bitwise Asset Management Institutional Influence and Future Bitcoin Stability Did you know? Hunter Horsley’s statement on the obsolescence of Bitcoin’s four-year cycle points to the largest structural shift in crypto markets since the initial adoption of Bitcoin ETFs, potentially mitigating traditional price swings. According to CoinMarketCap, Bitcoin has a market cap of $1. 91 trillion, showing a moderate daily price change of 0. 30%. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 09: 07 UTC on November 16, 2025.

11,000,000 DOGE Committed to Futures in 24 Hours as Futures Activity Prints Bullish Signal

The post 11, 000, 000 DOGE Committed to Futures in 24 Hours as Futures Activity Prints Bullish Signal appeared com. Dogecoin has remained in the spotlight despite the unstable market conditions that have seen the prices of leading cryptocurrencies consistently remain in the red zone. The meme coin has just printed an over 4% increase in its open interest volume over the last day, according to data from CoinGlass. Dogecoin open interest hits November high The data shows that Dogecoin’s futures traders have committed a massive 2. 16 billion DOGE to its derivatives market, signaling renewed interest across the ecosystem. This surge in the Dogecoin futures activity marks the highest open interest the leading meme token has recorded so far in November, signaling a resurgence in speculative appetite on Dogecoin. While Dogecoin’s open interest as of Nov. 14 was around 2. 05 billion DOGE, it appears that an additional 11 million DOGE tokens have been committed to its futures contracts in the last 24 hours. You Might Also Like While Dogecoin has only seen its price show weakness amid a broad market correction at the time, it appears that traders have increasingly committed more tokens in the derivatives market in preparation for a potential breakout. Although Dogecoin was trading positively during the early hours of the day, it has suddenly flipped to the other side of the market. As of writing time, Dogecoin is trading at $0. 1618, showing a decent price decline of 0. 44% over the last day, according to data from CoinMarketCap. Notably, the upsurge in open interest, which appears to have been triggered by the decent price resurgence witnessed earlier today, implies that traders are increasingly opening new.

Chris Burniske Signals Strategic Caution Amid Crypto Weakness

The post Chris Burniske Signals Strategic Cauticom. Key Points: Strategic portfolio caution advised by Chris Burniske amid crypto market challenges. Main assets Bitcoin and Ethereum face structural weaknesses. Investors urged towards defensive allocations amid potential asset correction. Chris Burniske, former Ark Invest crypto lead, warns of lasting impacts from October’s crypto market drop, urging cautious portfolio management amid structural weaknesses in Bitcoin and Ethereum. Burniske’s commentary signals broader systemic risks and advises a defensive strategy, emphasizing investment caution as core crypto assets continue to experience vulnerability in the market. Main Content Chris Burniske, the former crypto lead at Ark Invest and a current partner at Placeholder VC, highlighted ongoing structural challenges within the cryptocurrency market. Despite the market turmoil, BTC and ETH remain in a higher valuation range. Burniske emphasized the need for defensive portfolio strategies, as the potential for a broad asset correction looms. He noted that despite chart weaknesses, BTC and ETH are still in a historical high. “This bull market is different, and the next bear market will also be different. I am not all-in or all-out. Will consider re-entering if BTC falls to $75,000 or lower. Defensive measures are prudent as macro fragility persists.” -Chris Burniske, Partner, Placeholder VC Crypto Prices Drop as Defensive Shifts Gain Traction Did you know? The 2000 and 2008 asset crashes featured gold surges before a sharp decline, echoing Chris Burniske’s warnings against chasing inflated asset values. According to CoinMarketCap, Bitcoin (BTC) currently trades at $97,815. 43, showing a 4. 09% daily loss and a significant 17. 02% decline over 90 days. The cryptocurrency’s market cap stands at $1. 95 trillion with a 59. 43% market dominance. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 05: 07 UTC on November 14, 2025. Defensive portfolio adjustments and risk assessments may become.

Paradigm Stakes $700 Million in HYPE, Shaking Up Crypto Governance

The post Paradigm Stakes $700 Million in HYPE, Shaking Up Crypto Governance appeared com. Key Points: Paradigm stakes $581M in HYPE, expands control to 5. 73% of circulation. SWPE drops to 1. 90 amidst strategic staking moves. Potential volatility anticipated from upcoming HYPE token unlocks in November. Paradigm staked 14. 7 million HYPE tokens, valued at $581 million, and moved 3. 02 million tokens to Hyperevm on November 12, highlighting significant asset transfers within crypto markets. Paradigm’s actions underscore their market influence, impacting Hyperliquid’s governance and driving the SWPE ratio to a historic low, signaling potential shifts in market dynamics. Paradigm’s Strategy Sparks Market Analysis and Potential Volatility This action has significant implications, primarily by decreasing the SWPE to a record low of 1. 90. Anchorage and Figment, as institutional-grade providers, facilitate this centralized staking effort, underscoring the strategic efforts to solidify voting dynamics. Financial analysts and industry experts, though not publicly commenting, are likely observing these developments closely. Arthur Hayes’s Maelstrom office has classified this as a potentially volatile shift, warning of upcoming market turbulence aligned with scheduled HYPE unlocks in late November. Industry chatter is buzzing around how these strategic maneuvers will influence governance and market sentiment. “The monthly supply surplus [from team unlocks] may not be fully absorbed, thereby increasing selling pressure.” Lukas Ruppert, Researcher, Maelstrom Historical Context, Price Data, and Expert Insights Did you know? Paradigm’s staking activity in HYPE marks one of the largest concentrated positions within a decentralized finance project, previously unheard of in such magnitude, setting precedence for future investment and governance strategies. Hyperliquid (HYPE) is witnessing dynamic shifts with a price at $39. 50, reflecting a 1. 71% dip over the last 24 hours and 3. 12% over the week. The market cap stands at $13. 30 billion, marking 0. 38% dominance. The 24-hour trading volume experienced a 12. 44%.

SHIB Price Prediction: Targeting $0.0000104 by December 2025 Despite Current Consolidation

The post SHIB Price Prediction: Targeting $0. 0000104 by December 2025 Despite Current Consolidation appeared com. Zach Anderson Nov 09, 2025 09: 07 Shiba Inu technical analysis reveals neutral momentum at RSI 46. 72, with analyst consensus targeting $0. 0000104-$0. 000019 range. Current consolidation phase may precede breakout. Shiba Inu (SHIB) finds itself at a critical juncture as November 2025 progresses, with technical indicators painting a mixed picture that demands careful analysis. Despite a recent 1. 79% daily decline, the meme coin’s underlying momentum suggests potential for measured upside in the coming weeks. SHIB Price Prediction Summary Based on comprehensive technical analysis and recent analyst forecasts, here are the key Shiba Inu price predictions: • SHIB short-term target (1 week): $0. 0000097 (+15% potential upside) • Shiba Inu medium-term forecast (1 month): $0. 0000104-$0. 000012 range• Key level to break for bullish continuation: $0. 0000104 • Critical support if bearish: $0. 00000832 Recent Shiba Inu Price Predictions from Analysts The latest SHIB price prediction landscape reveals interesting divergence among crypto analysts. CoinMarketCap AI leads the bullish camp with a medium-term target of $0. 0000104, citing Shibarium adoption and potential ETF considerations as key catalysts. This Shiba Inu forecast aligns with several other predictions clustering around the $0. 00001 level. However, the most optimistic SHIB price target comes from Analytics Insight, projecting $0. 0003-$0. 0004 for long-term holders based on anticipated token burns and sustained market sentiment. Conversely, DroomDroom presents the most conservative outlook at $0. 00000832, suggesting potential short-term weakness. The consensus among eight major forecasting platforms points toward cautious optimism, with most predictions falling between $0. 0000097 and $0. 000019 for the next 30-60 days. SHIB Technical Analysis: Setting Up for Consolidation Breakout Current Shiba Inu technical analysis reveals a cryptocurrency in transition. The RSI reading of 46. 72 positions SHIB in neutral territory, neither oversold nor overbought, which historically precedes significant directional moves. The MACD histogram showing 0. 0000 with bullish momentum suggests underlying strength.

Decoding ICP’s 35% rally: Has the AI-driven boom just begun?

The post Decoding ICP’s 35% rally: Has the AI-driven boom just begun? appeared com. Key Takeaways What’s fueling ICP’s recent 35% rally? The launch of its AI platform Caffeine and rising investor interest are driving the surge. Could ICP continue its upward momentum? Strong capital inflows, bullish sentiment, and minimal downside liquidity suggest potential for further gains. Internet Computer [ICP] has become the latest buzz in the crypto market, driven largely by developments within its ecosystem, particularly the public launch of its artificial intelligence (AI) platform, Caffeine. As a result, ICP has recorded a significant 35% rally in recent days, pushing the asset close to the double-digit zone. Interest and investor sentiment turn bullish Google Trends data shows a sharp increase in search interest for ICP, with the “Interest Over Time” metric reaching a peak score of 100, indicating the token’s highest level of popularity to date. Historically, such spikes in search interest have aligned with major price movements, often in the upward direction. At press time, 84% of 113, 900 investors expressed a bullish outlook on ICP, indicating expectations of a continued rally. Data reviewed by AMBCrypto also shows a correlation between retail search interest, sentiment votes, and capital inflows into the market. Capital flow backs the rally In the past day, ICP recorded a strong capital inflow, particularly in the derivatives market. Open interest rose by $85 million to reach $261 million, as of writing, signaling renewed investor engagement. This surge was accompanied by a 92% rise in token trading volume to roughly $1. 27 billion, bringing total trading capital to $2. 45 billion. The Long-to-Short Ratio has stayed above 1, confirming that buying volume outweighs selling activity. Rising capital inflow and trading volume could further strengthen ICP’s upward momentum, potentially pushing.

Bitcoin Falls Below $104,000—Here’s Why

The post Bitcoin Falls Below $104,000-Here’s Why appeared com. Topline Bitcoin prices dropped below $104,000 on Tuesday, headlining a broader decline for the crypto market over the last month as investors appeared to pull away from riskier assets while the Federal Reserve cautiously approaches interest rate cuts. The leading cryptocurrency has pared back historical gains in recent weeks. Getty Images Key Facts The price of bitcoin decreased 3. 78% over the last day to around $103,970, matching a low reached last month and nearing levels not seen since June, when the cryptocurrency last priced under $100,000. Bitcoin (down 10. 3%) has led a broader decline for crypto prices over the last seven days: Ethereum prices have dropped 16%, XRP fell 15. 2%, BNB is down 17. 5%, Solana has fallen 20. 5% and the meme token dogecoin has cut 20. 1%. Bitcoin topped out at a new record high above $126,000 on Oct. 6, before prices declined nearly 11% in the lead-up to the Federal Reserve’s decision to cut interest rates by a further quarter-point last week, though Fed Chair Jerome Powell suggested an additional reduction to rates isn’t guaranteed in December. Higher cryptocurrency prices tend to coincide with the Fed opting for lower interest rates, as the price of bitcoin surged during the pandemic as rates fell, rising from $5,000 in March 2020 to around $69,000 by November 2021, and when the Fed opted for rate hikes in 2018, the value of bitcoin fell from around $20,000 to roughly $3,000. Fed Governor Lisa Cook said Monday she was undecided on a rate cut for December, and it’s unclear whether other central bank officials would favor holding interest rates at their current range, other than Kansas City Fed President Jeffrey Schmid, who voted last week to not lower rates at all. Surprising Fact Bitcoin prices decreased 3. 7% in October, the worst performance by the cryptocurrency.