Zscaler Stock Overview

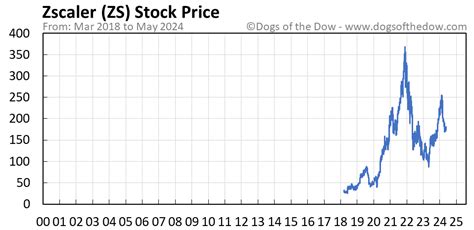

Zscaler, a leading player in the cloud security space, has garnered attention from investors and analysts alike. Over the past few months, the ZS stock has shown a notable upward trend influenced by increased demand for cybersecurity solutions amid rising digital transformation initiatives. This growth is underpinned by Zscaler’s innovative technology that enables secure access to applications and data for enterprises. As organizations continue to prioritize their security posture, Zscaler’s services have become critical, which may further impact its market valuation positively. Investors keen on understanding the comprehensive landscape of ZS stock can explore detailed insights on Zscaler’s official websiteor check analysis from finance experts at The Motley Fool. Moreover, several trends reflect shifting market dynamics in cybersecurity that could influence Zscaler’s stock trajectory in the coming quarters. For additional context surrounding investment strategies in tech stocks, visit this resourceand this article.

Latest Zscaler Market Trends

In recent months, Zscaler (ZS) has experienced notable fluctuations driven by various market dynamics. One primary factor influencing its stock price is the growing emphasis on cybersecurity, as organizations increasingly recognize the importance of safeguarding their digital assets. This trend has led to an uptick in demand for Zscaler’s services, contributing to positive adjustability in its stock performance.

Moreover, as illustrated in the table below, analysts have been closely monitoring key financial metrics that reveal underlying trends in Zscaler’s market position.

| Metrics | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|

| Revenue Growth | 25% | 30% | 28% |

| EPS (Earnings per Share) | $0.56 | $0.65 | $0.62 |

| Market Sentiment | Bullish | Bullish | Neutral |

Investors are encouraged to track the latest developments and expert analyses available on platforms like CNBCand Robinhood, as these resources provide insights into stock performance and market projections. With increasing adoption of cloud-based security solutions, Zscaler’s position appears to be strengthening within the evolving tech landscape, reflecting a promising outlook for stakeholders.

Factors Driving ZS Stock Value

Several key factors influence the valuation of Zscaler stock (ZS). One major driver is the increasing demand for secure cloud solutions as businesses shift towards digital transformation. As companies adopt more cloud technologies, Zscaler’s services become essential for ensuring cybersecurity, leading to potential growth in user subscriptions and revenue. Additionally, market trends such as heightened regulatory compliance requirements bolster the need for Zscaler’s offerings, positioning the company favorably within competitive markets.

Financial performance indicators, such as revenue growth and profit margins, also play a critical role. Investors closely monitor quarterly earnings reports and forecasts to gauge the company’s scalability and operational efficiency. Furthermore, investor sentiment can be influenced by broader economic conditions, including interest rate fluctuations and tech sector performance. To stay informed about ongoing developments in Zscaler’s stock value, you may refer to sources like MarketWatchand Seeking Alphafor comprehensive analyses.

Zscaler’s Investment Potential

Investing in Zscaler Inc. (ZS) offers a unique opportunity for those interested in the cloud security sector. As businesses increasingly shift towards digital operations, the demand for robust cybersecurity solutions has surged, benefiting Zscaler significantly. Its innovative platform allows companies to securely connect users to applications with minimal latency, a critical feature in today’s remote work environment. Additionally, Zscaler’s strong revenue growth, driven by an expanding customer base and high retention rates, positions it favorably against competitors. Moreover, the company’s ongoing advancements in technology and strategic partnerships enhance its market relevance and growth prospects. Investors should consider these elements carefully when evaluating Zscaler’s long-term potential in the evolving tech landscape.

Key Insights for ZS Investors

Investors in Zscaler stock (ZS) should closely monitor the evolving landscape of cybersecurity as it plays a crucial role in determining the company’s growth potential. As more organizations transition to cloud-based services, Zscaler’s innovative approach to secure data access and protection positions it favorably within the market. Recent financial reports have indicated steady revenue growth, driven primarily by an increase in customer adoption of its leading zero-trust security platform. Additionally, factors such as changing regulatory requirements and heightened awareness of cyber threats are amplifying the need for robust security solutions. Therefore, utilizing reputable resources like Yahoo Financeand Zscaler’s official sitecan provide further clarity regarding market dynamics and specific financial metrics that may impact investment decisions. Understanding these insights is essential for making informed strategies around ZS stock, especially as technological advancements continue to reshape the cybersecurity sector.

Forecasting Zscaler Stock Moves

Forecasting the movements of Zscaler’s stock (ZS) involves a careful analysis of various market indicators and company performance metrics. Investors should consider the high volatility typically associated with tech stocks and how external factors, such as competitive developments and regulatory changes, could impact Zscaler’s growth trajectory. Recent performance trends indicate a promising upward momentum, but analysts caution that investor sentiment can shift rapidly. As one industry expert noted, "Market fluctuations can catch even seasoned investors off guard."

To enhance investment decision-making, it is advisable to regularly monitor Zscaler’s quarterly earnings reports and follow major news related to cloud security trends. Additionally, leveraging resources such as Nasdaq ZS Stock Activityor Morningstar ZS Quotecan provide valuable insights into market expectations and stock evaluations. Staying informed about these dynamics may yield a clearer picture of potential future movements in Zscaler’s stock price.

Understanding Zscaler’s Performance

Zscaler’s performance in the stock market can be attributed to several critical elements that investors must carefully examine. One significant factor is the company’s ongoing expansion into new markets and industries, which has broadened its customer base and strengthened its revenue streams. Additionally, the demand for cybersecurity solutions continues to rise, thanks in part to the increasing frequency of cyber threats and the shift toward remote work environments. Zscaler has positioned itself well in this landscape by offering innovative and scalable cloud-based security solutions. Furthermore, company leadership’s strategic decisions and robust financial management practices have bolstered investor confidence, making Zscaler a compelling option for many in the stock market. Overall, these factors create a foundation for evaluating how well Zscaler can maintain its growth trajectory amid changing market conditions.