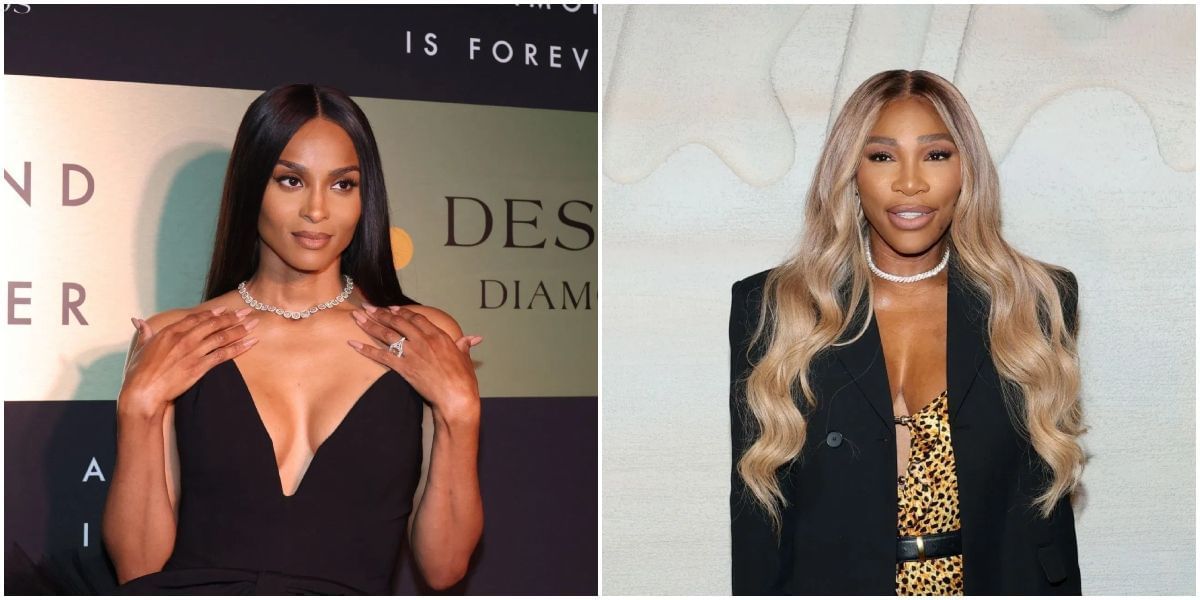

Serena Williams recently expressed her support for pop star Ciara by opening up about embracing her stretch marks. She shared that these marks serve as a reminder of the incredible journey she has been on.

Rather than feeling self-conscious, Serena emphasized feeling proud of her stretch marks, viewing them as symbols of strength and perseverance. Her message encourages others to celebrate their own bodies and the stories they tell.

https://www.sportskeeda.com/tennis/news-like-stretch-marks-kids-serena-williams-takes-ciara-s-breath-away-poignant-analogy-rejection-success