American citizens were on board a stolen speedboat that entered Cuban waters, and at least one American was one of four people killed by Cuba’s coast guard after the occupants of the boat allegedly opened fire on the Cuban military, the White House confirmed to CBS News. Cristian Benavides has more.

State Police sergeant charged with assaulting driver during traffic stop

The sergeant is facing assault charges after an alleged excessive use of force incident last month, prosecutors said. The post State Police sergeant charged with assaulting driver during traffic stop appeared first on Boston. com.

How Iran’s nuclear program has evolved

Iran and the U. S. are set to continue nuclear talks this week in Geneva as President Trump weighs a potential military action in Iran. “The Daily Report” breaks down Iran’s nuclear program. Mona Yacoubian, director and senior adviser of the Middle East program at the Center for Strategic and International Studies, joins CBS News to discuss.

College students react to Trump’s 2026 State of the Union address

President Trump delivered the longest State of the Union address in history on Tuesday night. CBS News correspondent Lana Zak watched the speech with college students and got their reactions in real time.

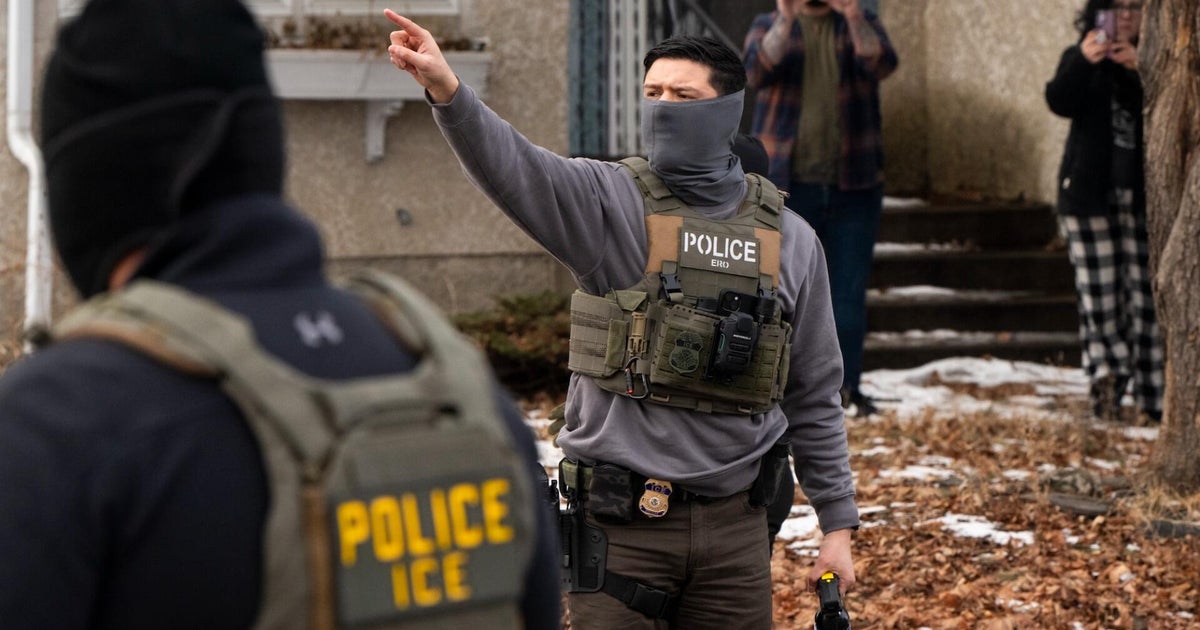

Americans polled on Trump’s immigration policies, tariffs

As President Trump prepares to talk about tariffs, immigration and the economy in his State of the Union address, CBS News’ Anthony Salvanto breaks down polling about the second Trump term.

Judge blocks DOJ from searching Washington Post reporter’s phone and laptop

A federal magistrate judge has blocked the DOJ from searching through a Washington Post reporter’s devices after they were seized by the FBI last month, instead ruling that the court would conduct a search.

Bain Capital: “12 Is The New 5” PE Faces Higher Hurdles

Private equity deal making hit a rough patch last year, however, Bain Capital reports that 2026 looks “promising.” Importance Rank: 1 read more.

GOP Rep. Tony Gonzales faces pressure from party over affair allegations

The Texas Republican is facing calls from fellow House Republicans to resign, following allegations of an affair with a staffer who later died by suicide.

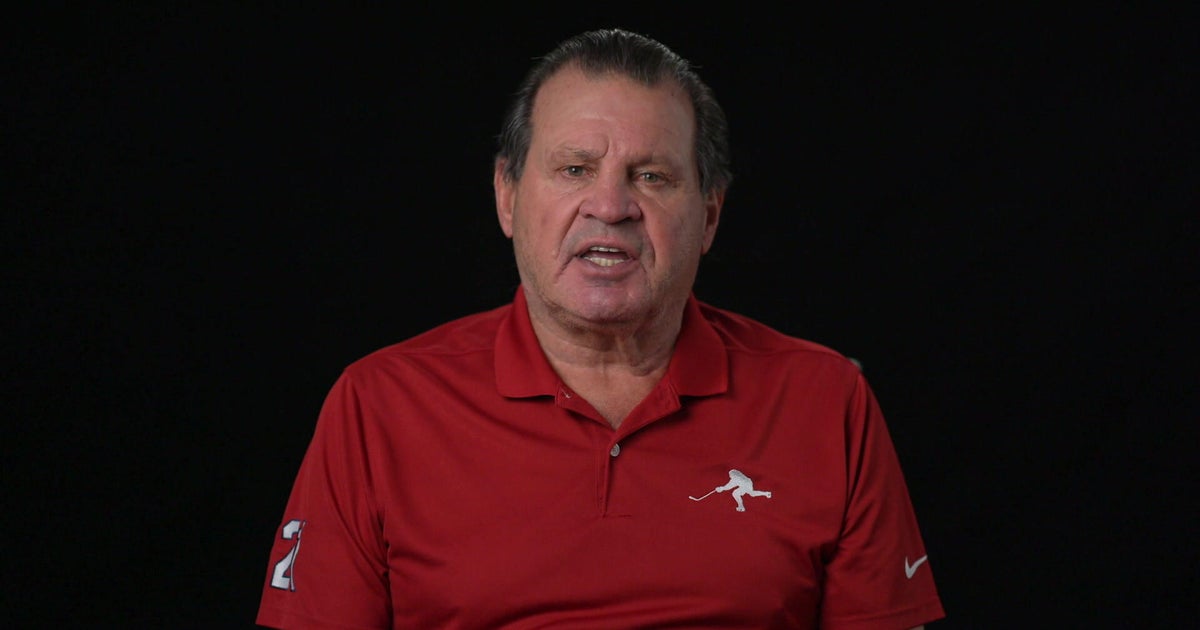

Mike Eruzione reflects on “Miracle on Ice” Olympic hockey game | 60 Minutes

Mike Eruzione, captain of the 1980 U. S. Olympic hockey team, led a squad of amateurs against the Soviet Union-and scored the game-winning goal. He reflects on the lessons of that “Miracle on Ice.”.

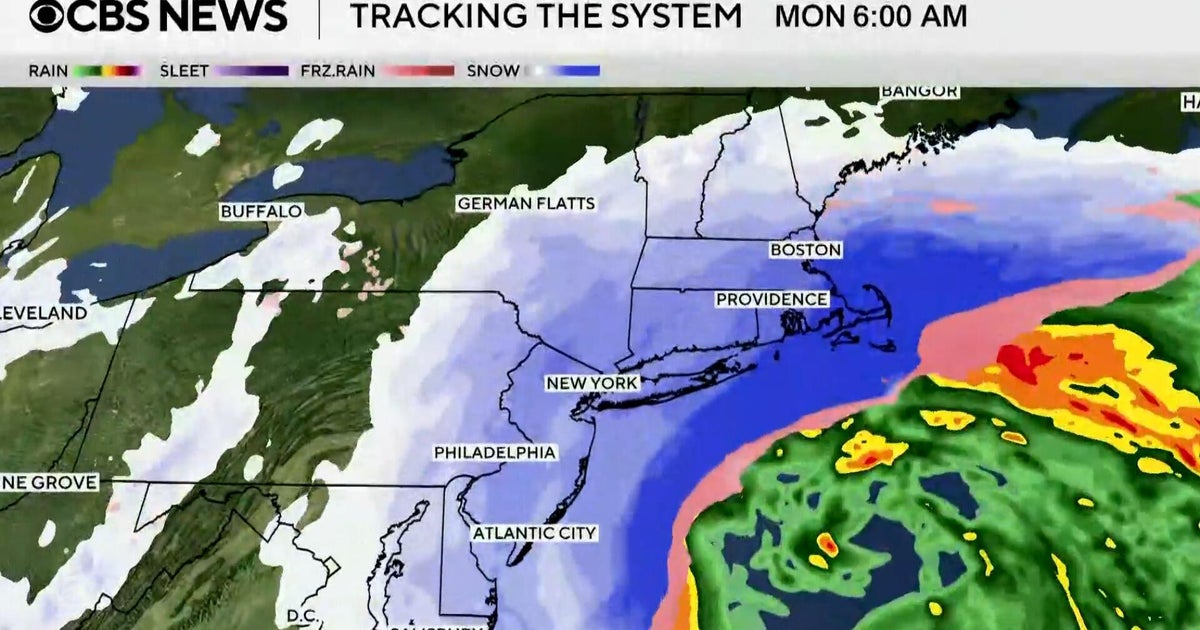

Massive snowstorm hits East Coast: What to know

A massive winter storm has begun to impact the East Coast, with heavy snow, brutal wind and dangerous flooding expected for several states. Shanelle Kaul, Andrew Kozak and Jason Allen have the latest.